3.2 Financial Institutions & Big changes in their Market Data requirements

We have seen expansion in market data usage on an enterprise level, into application based services across all sections of the business, while at the same time terminal numbers on the desk fall.

So why are terminal numbers declining? There are multiple reasons but the key one is the overall decline in size of dealing rooms, for instance:

- Business Insider reports on Wall Street 10,000 front line jobs have disappeared since 2010.

- Direct Market Access (DMA) and growth in electronic trading has removed the need for more traditional voice based trading which in turn removes the needs for the voices, and therefore headcount.

- This is true for both the institutional as well as the retail markets.

- Overall trading revenues in 2016 were disappointing and January 2017 traditionally a good month for equities has performed barely as well as December 2016.

- The saturation point for businesses and people willing to pay high terminal fees has been passed.

These are two prominent examples of the effects.

- The woes of UBS’ Connecticut Dealing Room seating 1,400, the World’s largest have been widely reported.

- Goldman Sachs has cut one of its three trading floors in Manhattan.

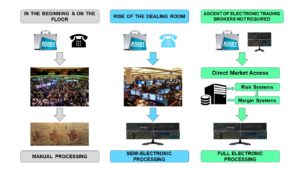

The chart below represents the shift in interaction from the investor through to the exchange from the 1970s to today.

In the beginning processes and communication was manual, then in the 1980s came the big dealing rooms as brokers/dealers moved off the trading floors. This came with the growth in providing terminals to this new breed of dealers needed instant access to price information, i.e. by electronic means, which was followed by broker dealing systems giving instant access to the exchange. Though they still primarily communicated by voice to their investing clients.

It did not take long for the spread of networked data and electronic processes to extend into the post trade departments.

Given the broker placed orders electronically to the exchange already, the logical progression is to eliminate the middle man, and allow the Investor to place orders directly via their brokers systems without human input.

The collateral feature of this evolution was to shift growth in market data usage firstly to datafeeds in specific parts of the business such as the dealing room, then across the entire dealing process encompassing applications and systems.

The result less need for terminals on the desk, more need for market data to be delivered on an enterprise basis for application driven usage.

Also as commission fees and margins fall, the pressures on the costs of participation in financial markets rise, and market data is one of the largest.

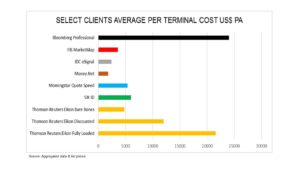

For instance, a Bloomberg Professional terminal costs US$24,000 PA for the basic service, and before additional fees such as exchange levies, third party services and other ancillaries. This means a major bank with say 5,000 terminals is going to be paying no less than US$120,000,000 PA and as each terminal comes with a two-year contract it means the subscriber is locked into double that sum over the agreement period. According to client data, additional exchange fees and third party services can add up to 40% more in dollar cost.

Thomson Reuters Eikon often does not come much cheaper at up to US$21,600 PA though many institutions pay less than US$12,000 per terminal per annum on average based on volume discounts.

In comparison Money.Net has a starting subscription of US$1,800 PA.

These trends are/will impact Bloomberg disproportionately as its business is far more reliant upon terminal revenues than its competitors. While figures are not exact up to 75% of annual income, i.e. US$7 Billion in 2016 comes from the Bloomberg Professional terminal according to Burton-Taylor. As seen it is expensive, and crucially its network connectivity via messaging and its catalogue of prime mover users are not nearly as exclusive as it was previously. Symphony has joined a long list of (failed) challengers in the chat space.

But Bloomberg, like Thomson Reuters, has one crucial and fundamental strength that has not been duplicated by anyone else, and that is their sheer universe of data accessible in one place, and in particular Over-The-Counter (OTC) Markets data. However, unlike Thomson Reuters, Bloomberg inexplicably sees its B-Pipe datafeed business as some sort of unwanted orphan.

According to Morgan Stanley in their series of 2016 Reports they came to the following conclusions regarding what they predict to be the future of the terminal business.

- Structural changes could reduce terminal spend by up to US$3 Billion up to 2020.

- Bloomberg will be hit hardest but Thomson Reuters and FactSet will also suffer along with other terminal providers.

- The catalyst for change is cost-cutting pressures along potentially with a mass adoption of Symphony.

Though Business Insider in their article on that Morgan Stanley Report described the almost emotional attachment of users to their Bloomberg Terminals, and that moving Bloomberg off the desk will continue to be a challenge, as virtually every market data manager and consultant will testify to.

Summary

- Market data growth has been driven by the explosion of trading systems linked to enterprise applications, which has also had the effect of eliminating a sizeable amount of human interaction.

- This has shifted where market data vendors generate revenue from terminals to feeds.

- It has also allowed new entrants into the market such as Activ Financial, Quant House, and Xignite to provide datafeed based services.

- However, owing to the low cost of entry for exchange based price data, and associated low margins, it is hard to deliver a profit in a very competitive market place based on datafeed only solutions, with limited OTC coverage.

- Bloomberg and Thomson Reuters biggest assets are their universe of data which provides far more extensive OTC coverage than their competitors, and obtaining a critical mass in OTC coverage is very expensive.

Financial institutions do not like spending money on market data, and many are on a mission to cut costs. Therefore, market data vendors are driven to ensure their services are extremely ‘sticky’ and as hard as possible to remove, a goal Thomson Reuters TREP has so far managed.