Exchange Market Data Business Failures

Exchanges market data businesses are setting themselves to fail, because they keep trying to fix past problems, instead of focusing on future opportunities, of which there are many.

This is a hard call to make when:

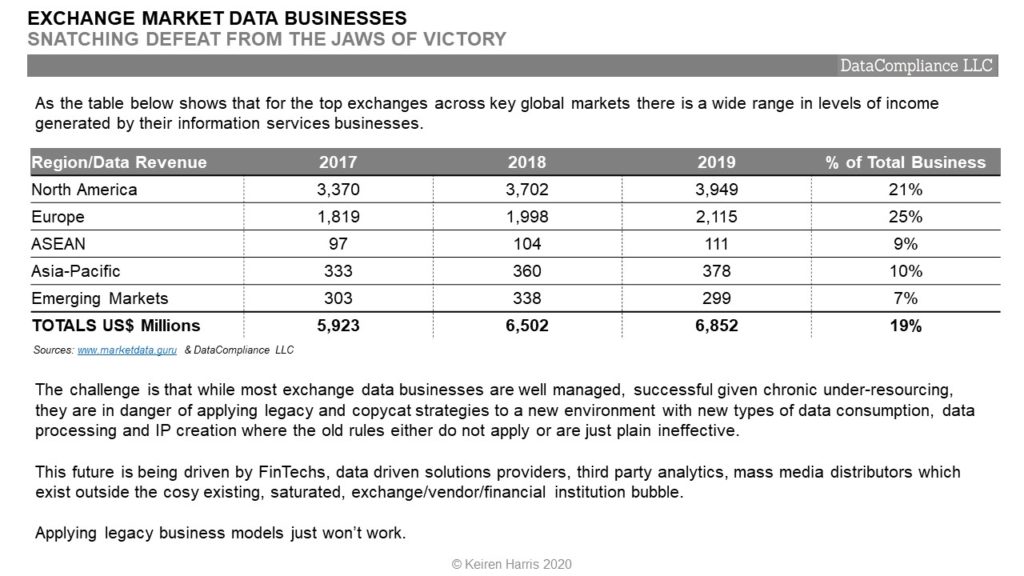

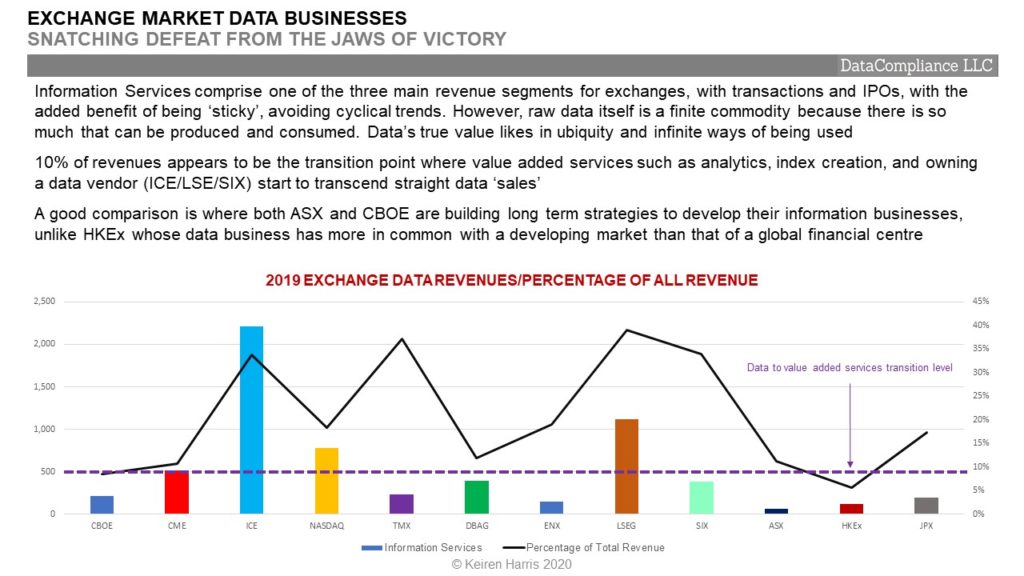

• For the top 22 exchanges for which data is available from Y/E 2017 to Y/E 2019 their information services revenues grew on average 16%, i.e. US$5.92 Billion to US$6.85 Billion,

• This is faster than overall revenue growth of 11%

• This accounted for 19% of overall exchange revenues

However, these figures are highly skewed towards North American and European exchanges which have more developed market data businesses. Pressure from data consumers and inevitably regulators are aimed squarely at these exchanges, however any regulatory restrictions directly flows straight through to exchanges in developing markets where the stable income provided by data services is more needed.

POINTS OF FAILURE

Exchanges are coming under pressure, fairly or not, over perceived high cost of market data fees. Yet most exchanges are acutely sensitive when trying to balance the pressures of revenue generation against client pushback.

This combined with increased internal pressure for exchange’s market data business to deliver greater revenues presents significant challenges to exchanges which are arguably:

- Exchange market data teams are under-resourced in terms of personnel and budget, yet management expectations increase. How to manage management?

- There is excessive revenue leakage (Our figures indicate an average of (22%+) caused by a combination of lack of transparency, i.e. misunderstood policies, lack of communication, and inadequate reporting. How to eliminate?

- Overly dependent upon vendors as their main sources of distribution of data and revenue flow. For some exchanges this amounts to 60%+ of revenues flowing via just 2 vendors, Bloomberg and Refinitiv. Are there alternatives, or complementary channels, to the traditional vendor model?

- This vendor reliance means exchanges fixate on vendor relationships at the expense of end user partnerships, which leads to a direct lack of understanding as to how end users make money out of the data supplied. This is a structural point of failure. How to reconnect data use with pricing?

- Development of inadequate business structures. Often exchanges simply cut and paste major exchanges pricing and policies without understanding their purpose, or how they function from the user perspective. The classic example is an inability to differentiate between derived data and non-display data, leads directly to impaired revenue generation. How to be inclusive while differentiating services?

- Existence of a prevailing mindset gravitating around a workflow of exchange-vendor-bank when the usage base for data is expanding beyond this dynamic. How to support the existing client base while new ones with different models develop?

Ditching Legacy Mindsets, What Happens Now?

We are witnessing a complex set of events, which superficially appear separate, but are driven by inter-locking relationships that facilitate faster development in what is a market data chain reaction.

There is the disintermediation of market data vendors (but the vendors are NOT going anywhere), rise of new data sources (a target audience), switch in the value chain from raw data to value added services (Analytics, Indices), the development of new types of consumer (the Banks are definitely NOT going anywhere), engagement by mass media, all facilitated by FinTech.

This is revolutionary, not evolutionary.

There is bright future is out there for exchange data businesses, and it does not have to just involve the annual round of price increases, what it requires is a re-appraisal about how to succeed in:

- Opening up new markets and opportunities, which are being created by,

- Embracing the new ways data is being used by new types of data consumer

- Developing a new appreciation that the client base is more than just vendors and financial institutions, there are new, bigger opportunities developing, but what works for Banks will not necessarily prove successful in seducing new data consumers and new types of data consumption

- Exploring the Mass Market, the Next Frontier. Exchanges fixate on big spending financial institutions which are saturated with data. Exchanges do not ignore mass markets, they fail to understand them, result, commercial models and strategies that drastically limit opportunities in exciting areas

The challenge is how to identify then engage new opportunities, new clients, and new business structures.

Break the Chain!

Keiren Harris 11/11/2020

www.datacompliancellc.com

Please email knharris@marketdata.guru for a pdf