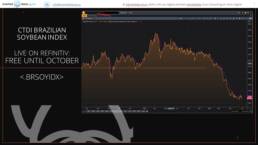

The SAFRAS CTDI Brazil Soybean Cash Index is the only reference price index for the worlds’ largest global soybean producer. It goes under the radar, but Soybean is the second largest exported agricultural product after Wheat. SAFRAS with CTDI and partner Refinitiv are addressing the lack of a comprehensive benchmark for this product. Soybean is a critical element in the global food chain as feed for livestock.

Brazil’s importance and meteoric rise as the major exporter to China saw a huge increase in price. However lower demand from that region has meant prices have started to fall since 22 March.

Reuters reported on 01 June ‘Brazil’s 2023 soybean harvest, estimated by the U.S. Department of Agriculture at 155 million tonnes, topped the prior record by 11%. Production had never exceeded 100 million prior to 2017, though USDA sees the 2024 crop jumping to another new high of 163 million tonnes.

Booming soybean demand from China early this century drove extensive crop expansion across the Americas, but while production is set to swell even further in top exporter Brazil, growth in Chinese imports has cooled.’

With the prospect of uncertainty creating volatility, SAFRAS CTDI Brazil Soybean Cash Index is currently being used by some of the largest commodity traders, and producers for benchmarking and hedging risk being the definitive reference point derived from 37 local markets.

Soybeans are also an ESG play given what is happening with rainforest deforestation.

MDG has been informed the CTDI Brazilian Soybean Cash Index is currently available with free access to all users of Refinitiv EIKON until October 2023.

Keiren Harris

02 July 2023

For our information on our consulting services please visit www.marketdata.guru/data-compliance

To contact us knharris@marketdata.guru

Please contact info@marketdata.guru for a pdf copy of the article