The PDF can be downloaded at https://wp.me/a8cuRb-lg

Stock exchanges around the world are waking up to the revenue opportunities of exploiting their data. Of course, there are leaders in this field, notably ICE and the LSE, but in general the exchanges efforts in fully exploiting these data opportunities remains underwhelming. In fact Exchange data services are really a lucky by-product of the exchanges fundamental business, they must have the infrastructure in place but unfortunately there are negatives as well.

Exchange’s market data teams are small, have too little end user contact, and therefore react to market data usage by their clients. This reactive strategy is because the clients find new ways to use data before the exchanges find a way to charge for them.

Exchange management want to extract money from data without adequately resourcing that business.

There are new facilitators and third party consumers which behave differently to traditional clients. This is new and revolutionary driven by new distribution channels, new ways of processing data. Equally many new players have a tendency to disregard IPRs.

Derived data and original works are where things are getting interesting and confrontational.

The result is barely adequate commercial and pricing models which need to change to meet the future because the client base will look radically different in the 5 to 10 year time horizon.

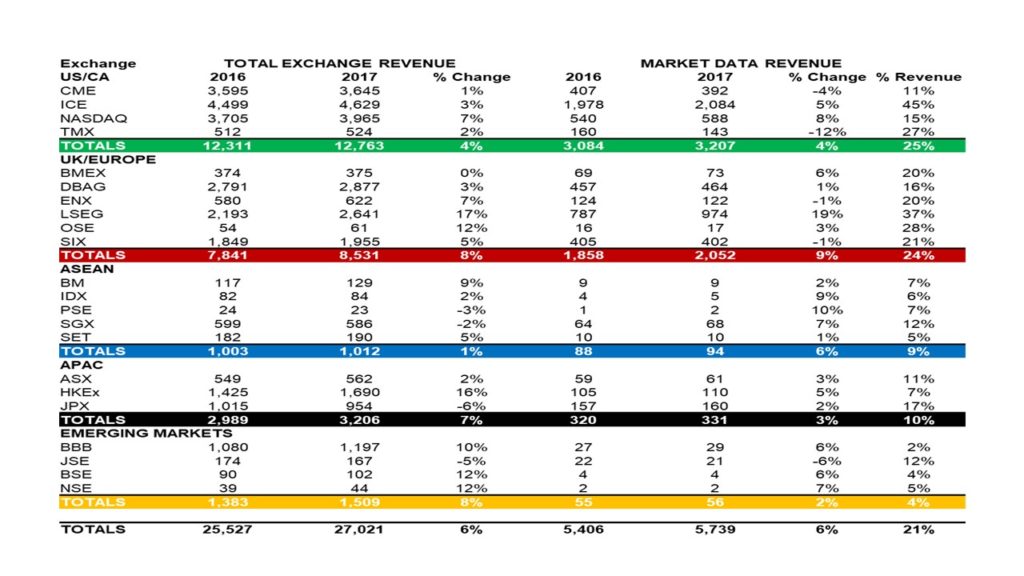

Below we look at the leading exchange’s revenue from data. These are from Year End 31/12/2017, and we will update once the 2018 figures have been released.

Global Exchanges Market Data Revenues

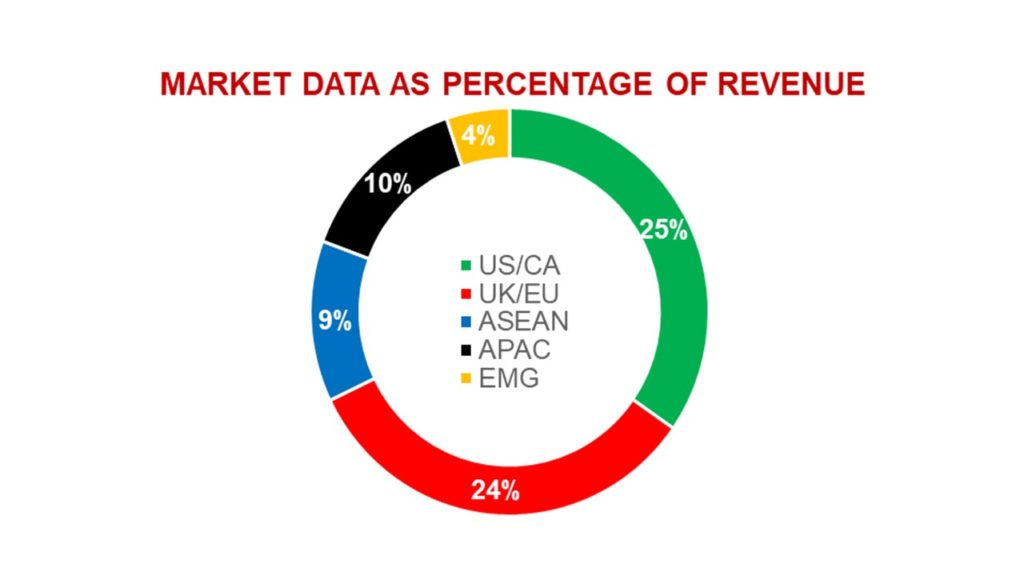

In 2017 globally, market data and related services comprise 21% of exchange revenues or US$5,739 Million of the 22 exchanges listed in the table.

There was 6% growth from 2016 to 2017, however exchanges more reliant upon basic data licence sales such as CME, and ENX did not perform as well as those offering value added services, example ICE and LSEG.

For LSEG, indices, and related services accounted for 6X more revenue than data services.

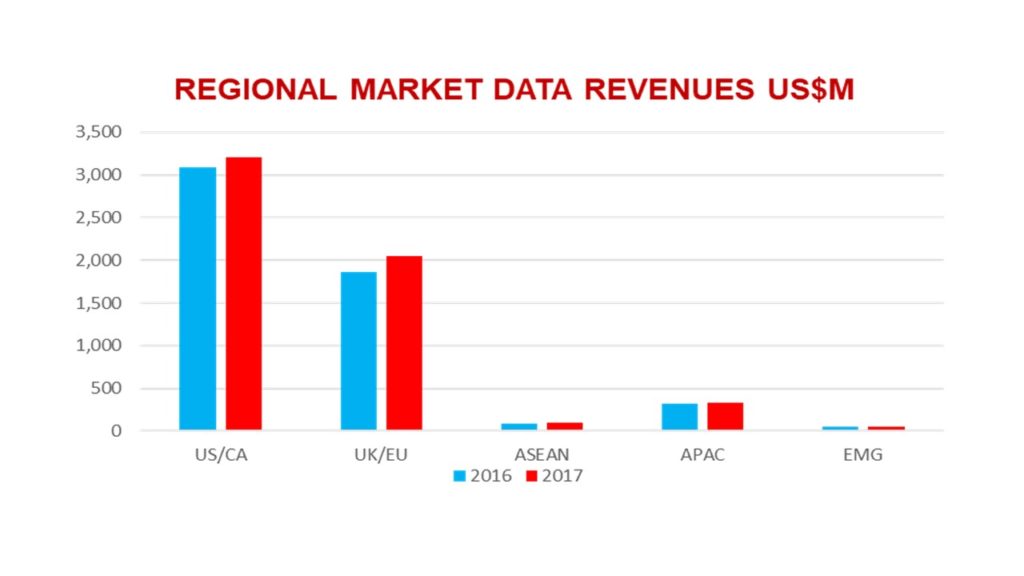

There are substantial variances when analysed on a regional basis.

It must be noted that each exchange has its own definition of what comprises market data services, many include infrastructure and connectivity services, i.e. LSEG and SGX, while others like NASDAQ separate out market technology as an individual business unit.

Market By Market Growth

In 2017 Market data revenues grew across all 5 regions, but in the 3 APEC and 4 Emerging Markets exchanges listed was the market data revenue growth below the overall growth in the exchange’s revenues.

In every other region market data and information related services increased as a percentage of overall market data revenue.

In North America and Europe market data and related services make up about a quarter of overall revenues, which is 2½X more than in the APAC and ASEAN regions and 6X more than the Emerging Markets region.

The trend and pressures on exchanges to increase revenues from data and information services grows in Trans-Atlantic markets.

Other exchanges globally are now expanding their own data services business units, introducing new usage and derived data policies, index services, and investing in compliance programmes.

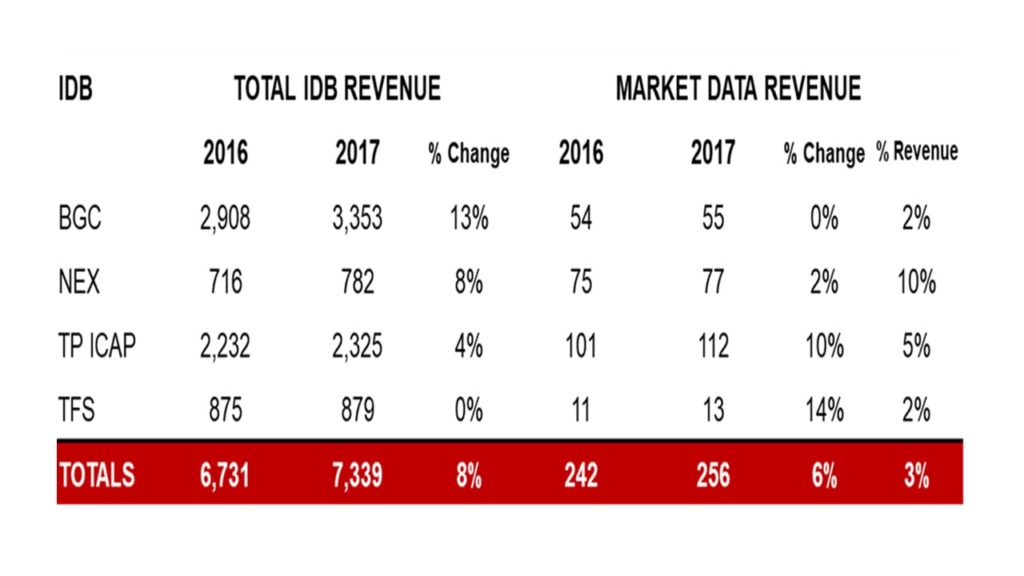

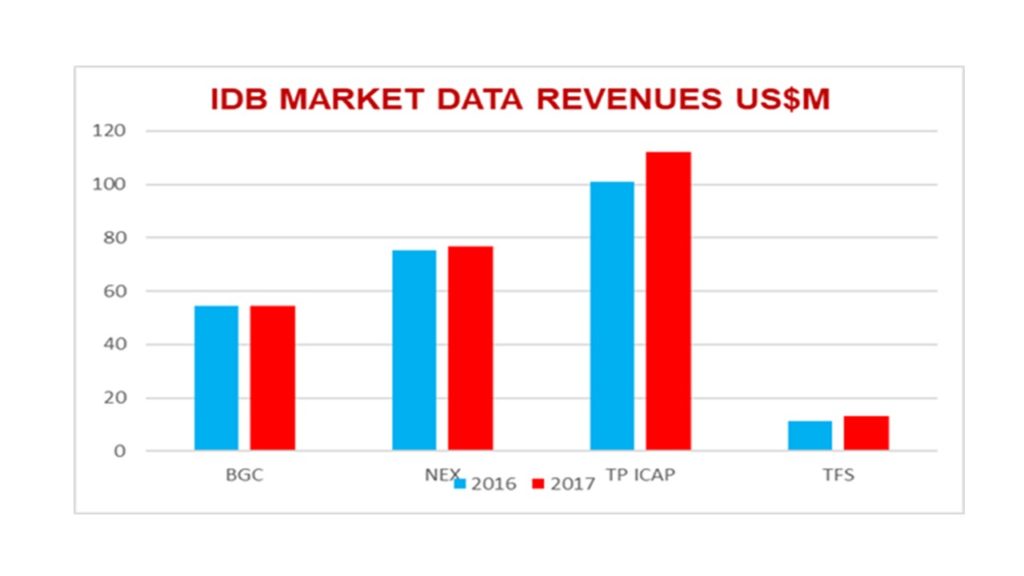

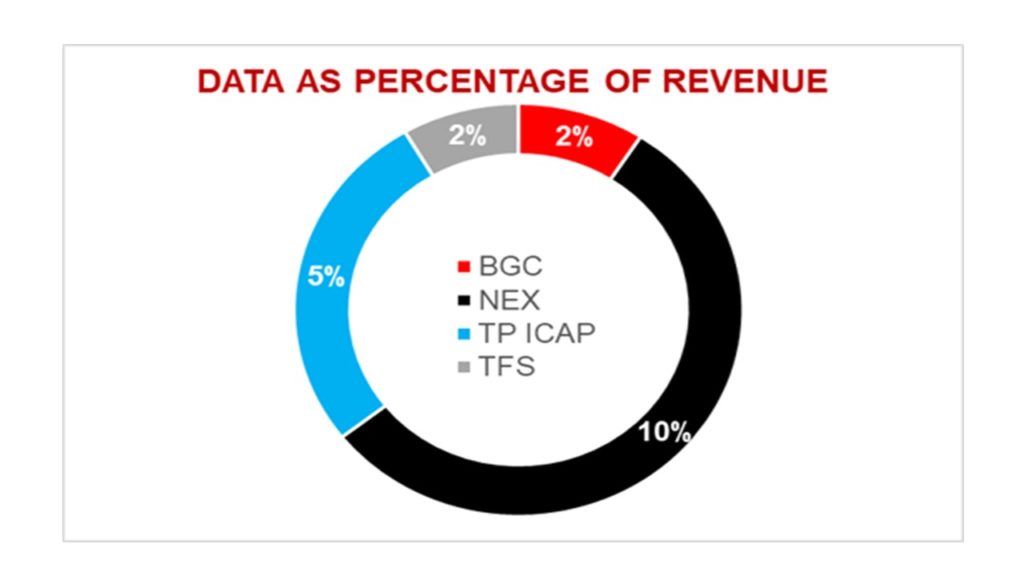

Inter-Dealer Brokers Data Revenues

In terms of overall revenue the 2 largest IDBs are the equivalent in size of the large UK & European exchanges.

The IDBs data businesses are unique in coverage, focused on OTC markets, however, do not perform as well as their exchange counter-parts who are increasing their presence in OTC Markets.

- Data revenue growth at 6% is below overall business growth at 8%.

- This is due to a number of factors:

- More direct competition.

- Greater reliance of raw data services and vendor licence sales.

- Less emphasis on data licensing for usage and compliance.

- Lack of index businesses.

Notes:

- The TP ICAP 2016 figures are pro-forma including businesses bought by TP.

- TFS market data fees are estimates.

- NEX has been bought by CME.

To find out more about DataCompliance please visit us at www.datacompliancellc.com or email me at knharris@datacompliancellc.com