MAREX GOES PUBLIC

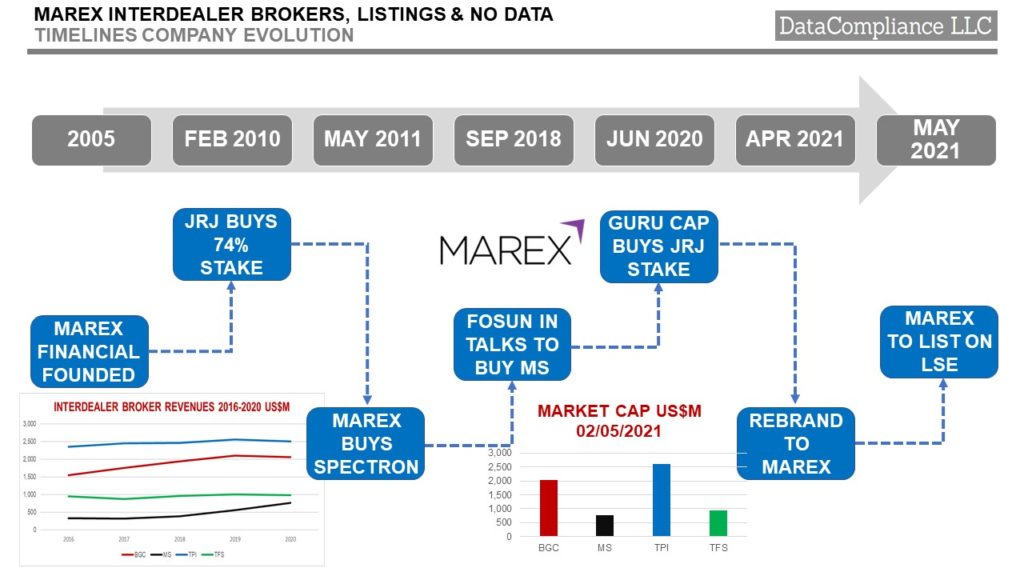

I found the news that Marex, the World’s number 4 Interdealer Broker, plans a listing on the London Stock Exchange interesting on multiple levels.

To me the major question is motivation. Research analysts, well the rare few that follow the IDBs, do not provide the same level of either coverage or understanding of the IDBs they give to their electronic peers (MarketAxess) or the exchanges. My personal view is there is a lack of understanding as to the importance of IDBs to OTC markets, price discovery, and liquidity when compared to the more transparent nature of fully electronic venues, the IDBs assets are more human than physical, and the IDBs are not good at promoting themselves.

Undervalued

The result is the top IDBs have an average Price/Sales Ratio of 1.01 (read here) against the top exchanges whopping 11 (read here). Intriguingly, I calculated a notional market cap of US$768 Million in April 2021 which sits comfortably with the estimated valuation of £500 Million ($706 Million) suggested in the press including the FT.

To an extent while both BGC Partners and TP ICAP have been acquiring competitors, they have also compensated for the low valuations. BGC by building, before divesting a realty business, and repeating the formula with insurer, Corant Global, so creating businesses outside core broking, while TP ICAP has embraced electronic markets by buying Liquidnet.

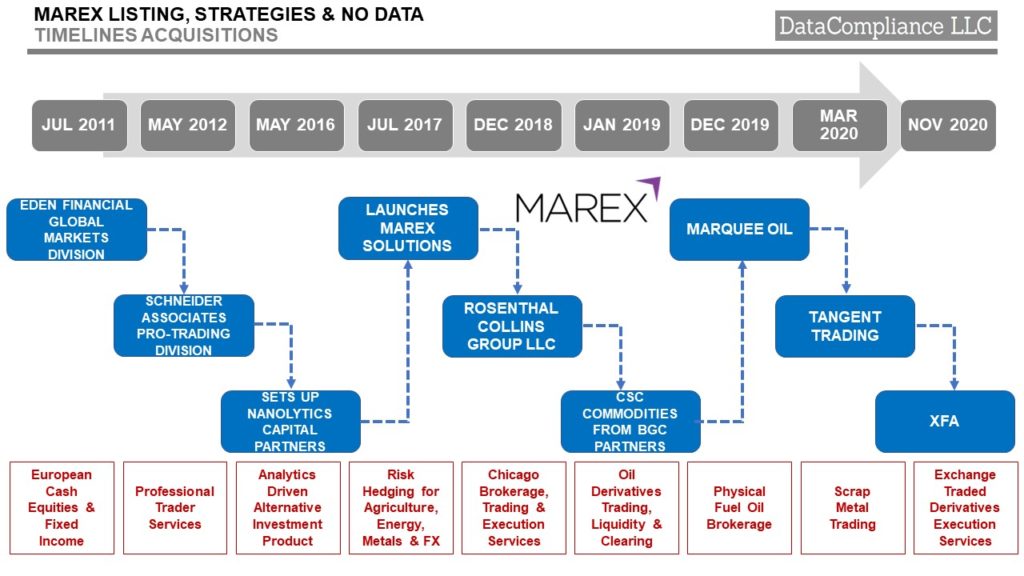

Since Fosun’s proposed purchase of the then Marex Spectron, Marex has not only had a change of shareholders, but also embarked on an ambitious acquisition spree, which has dramatically increased revenue from $330 Million in 2016 to $762 Million, year end 2020, taking them from 35% to 77% of third ranked IDB, Tradition.

The problem is there are only so many independent IDBs left, and Marex has largely ignored the fastest growing IDB business segment, the provision information services and data. While overall business revenues of the IDBs increased 22% 2016 to 2020, data related services grew by 46%. This could be telling for a listed Marex if the big 3 IDBs unlock the value of their data business’.

HOW DEVELOPING A DATA BUSINESS HELPS MAREX

Lack of Data Commercialisation

The key to the IDBs is the ability for their clients to find high quality prices in the market to facilitate trading, and for the major markets Marex is active in, Power, Gas, Carbon, even the politically unpopular Coal, Marex more than holds its own, and can claim to be the market leader ahead of the likes of BGC and TP ICAP. The problem is Marex has yet to put this data to work, and as other IDBs have found and exploited, the more clients use their data, the more likely they are to broke with them.

Marex has broking desks in offices located at key centres globally, an electronic platform, Neon Trading that does supply data, and is also arguably functionally superior to competitors, including TMX’s Trayport. Yet data revenues have remained a paltry $2 to $3 Million for a number of years, consistently playing second fiddle to the production of rather good, albeit small amount of, research.

Data and Listing

This is where Marex can put the current under-development of their data business to practical use. Information services is something research analysts can and do directly relate to. By developing and demonstrating a future looking information services business, it is not unreasonable to expect to reach a level equivalent to Tradition (estimated $15-$20 Million pa data revenues). Given the potential data asset inventory available this target could be achieved in a relatively short timeframe.

Work to be Done

Putting in place a fully functional market data business is a challenge at the best of times, there is establishing the data inventory, accessing it, putting in place IPR safeguards, licences, policies, and contracts. All this before creating functioning pricing models.

However the rewards will speak for themselves, Marex, and the putative investors in one of the most interesting businesses in financial markets.

Keiren Harris 06/05/2021

Please email knharris@marketdata.guru for a pdf or information about out consulting services