WASTED DOLLARS & DATA COMPLIANCE

POOR MARKET DATA COMPLIANCE COSTS EVERYONE

When one considers that MDG’s figures for market data revenue leakage from exchanges benchmarks at 22+% and certain vendors believe it exceeds 40%, then there is obviously a systemic problem. My colleague, IPCL’s Ian Pearson, one of the world’s foremost experts in data compliance, has estimated this loss at $2 Billion per annum which with 36 months back fees could leave financial institutions on the hook for up to $6 Billion in market data liabilities

Firstly, because the data sources are not accruing the dollars due to them, and secondly for the banks and data consumers it introduces a multi-million dollar cost, business, and reputational risk when non-compliant data usage comes to light, and this can occur at any time. Regulators are not addressing the root causes, merely the symptoms

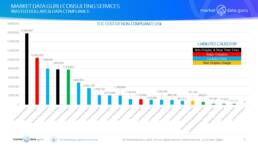

THE COST OF NON-COMPLIANCE?

It is expensive. In 22 projects we have worked on a total of $72.5 Million dollars was identified in liabilities. Fortunately for one client the auditors calculated under $8 Million in back fees, however their true exposure was $25 Million, and the settlement was for $2 Million

These findings were not total liabilities, each one is for a single data source or vendor only, and financial institutions subscribe to many.

Then there was the infamous Multi-Million Dollar Citibank case reported by Max Bowie of ‘Inside Market Data’ of which he ironically recounts “may have led to less transparency because auditors and advisors then started advising exchanges to NOT report recoveries all in one lump sum but to break them up and ‘hide’ them in their accounts so it wouldn’t be so easily discoverable by prying eyes like mine”

Unfortunately, such actions promotes turning a blind eye to non-compliance because it removes the element of accountability.

POOR MARKET DATA COMPLIANCE COSTS EVERYONE

The causes stem from mis-reporting and under-reporting of data’s usage by end user institutions and vendors. The reports submitted back to exchanges are opaque, incomplete, nor structured for effective analysis, because the wrong questions are being asked by the data sources about usage, and are rarely analysed, let alone understood.

This is especially prevalent in the areas of Non-Display Usage, Derived Data Creation, Index/Financial Benchmarks, and Digital Media.

Problems are compounded because:

1.Exchanges rely upon passive-aggressive audits to police clients, and too often, inappropriately, use them for revenue generation. This would not be necessary if more effective and data consumer friendly compliance structures were in place

2.The number of audits that can be conducted at any one time is limited, often exchanges select the same clients, so audits take years to conclude while time and resources get wasted on all sides

3.An exchange with 1,000+ clients will struggle, especially when it does not understand the clients, how they use data or just willing to settle, even ignore non-compliance for an easy life

4.Policies and licences quickly become outdated, are contradictory, open to interpretation, often not communicated to data consumers

Yet most Banks and financial institutions try hard to be compliant (with a small number working just as hard not to pay). They employ a range of high quality management tools from companies like MDSL, and TRG Screen, which are integrated into the networks along with solutions like Asset Control and Ticksmith.

The table below details the costs to both data owners and data consumers based on our own work.

MARKET DATA GURU IS PART OF THE SOLUTION

For exchanges, vendors, and financial institutions alike, more effective reporting, analysis, and understanding of data usage must be a major strategy for 2023 to:

- Ensure a level playing field between compliant and non-compliant data consumers. Regulatory friendly.

- Reduce the need to rely upon raising fees to increase revenues. Regulatory friendly, and avoids penalising compliant clients for a second time

- Reduce workload and resources wasted by current compliance strategies

- One data source emphasised their compliance review programme generated revenues quicker than audits

- Data consumers feedback stated improved flexibility made it easier to put the right licences in place in the most cost effective manner

MDG/IPCL PROJECT METHODOLGIES TO IMPROVE COMPLIANCE FOR DATA OWNERS & DATA CONSUMERS

- Switch from reactive audits (which still play a major role) to dynamic compliance by working with data consumers on a ‘go-forward’ basis

- Forensic analysis to identify non-compliance through understanding external and internal client usage

- Cross referencing data from internal and external sources to develop workflow models reflecting how data is used by the business

- For exchanges and vendors this approach increases the number of clients engaged per annum 10 Times, i.e. if an audit programme is targeting 20 users, effective compliance will engage positively with 200

- Compliance reviews can be completed within as quickly as 4 weeks and most by 6 months from initial engagement

- For banks and financial institutions, eliminating non-compliance early gives the opportunity to reset and eliminate fee liabilities, reduce spend and time on resources freeing people up to do their real jobs

SUMMARY

Going forward for both data owners and data consumers, compliance as an issue is only going to grow, and this is where MDG’s expertise and experience can prove invaluable.

For data owners there is the need to take a more regulator and client friendly approach to non-compliance while simultaneously reducing the 22%+ data revenue leakage. This can be done by identifying non-compliance before engaging with the data consumer, while employing better reporting and analysis to facilitate a better understanding of data workflows. Fundamentally exchanges must strictly adhere to the ‘level playing field’ principle to differentiate between genuine attempts to be compliant and those who actively seek to gain an unfair cost advantage over their competitors.

For data consumers, it is a mirror image, identify potential data non-compliance, calculate the extent of the problem and resolve. The same principles apply because it is always cheaper and less resource intensive to be pro-actively compliant than hoping for the best. However again it takes reporting, and analysis of data workflows to achieve the objectives.

MDG/IPCL’s consultants extensive experience in advising exchanges, data sources, vendors, and financial institutions means we understand the problems, ensure data owners increase their revenues while reducing costs for the data consumers.

Keiren Harris 07 March 2023

For information on our consulting services please email Knharris@marketdata.guru

https://marketdata.guru/data-compliance

Please contact info@marketdata.guru for a pdf copy of the article