IT IS ALL ABOUT TECHNOLOGY & WORKFLOW

Irrespective of the future success of ‘The Cloud’, there already is the question of the relationship between the sources of data and the end users. This is driven by the data workflow which in turn depends on the technology delivering the required information.

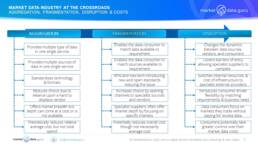

The current state of play is data can either be aggregated by middlemen, i.e. the vendors or by consumers themselves, or most usually by a combination of the two. Where data is being aggregated at the consumption level this is the result of fragmentation in delivery, and when an environment changes the inevitable result is disruption. Standing behind all that is the perennial ‘How much does it cost?’

As MDG has discussed previously there are multiple drivers in the market data industry right now, but two stand out as being inter-related.

1.Costs. For the big banks, they need to get costs down to compete but are locked into legacy systems which use proprietary codes and inputs. These are hard to change, but if the dollar benefit is big enough they will make this happen. It is very hard to displace proprietary information once it has become embedded in large scale platforms with multiple applications on a global basis. There is often no effective tools in place monitoring where information is really flowing to. Universality comes at a cost. However, right now costs are the main focus of the CFO of any institution with a large market data spend, making this the ideal time to start long term strategic planning.

2.Workflow Balance. This is a tough one, the universal vendors are quite simply a ‘one stop shop’. Theoretically, this supermarket approach argues that accessing multiple vendors is likely to be more expensive proportionately, plus introduces chaos at the data governance level. However, where the growth in the market is, even if the average spend is higher, by selecting sources on their individual merit while resulting in higher average costs actually results in lower total costs, with the value of additional depth in the selected markets. Naturally this is all about identifying, then maintaining, the right balance, never a constant anyway.

Flexibility of choice introduces new elements of both fragmentation and disruption structurally altering workflow relationships from source to vendor to consumer as the graphic below details.

ACTION V INERTIA

Consumers of market data and financial information now have easier access to a wider range of sources, on both global and local levels, increasingly enabled via the Cloud. Theoretically this ought to create new found freedoms when devising market data strategies allowing consumers to adapt and change their requirements at times of their choosing, potentially lessening their reliance or almost nigh on addiction to the whims of vendors and sources.

That’s when reality comes into play. When making decisions, data consumers 95% of the time will go with the safest/easiest option, inertia becomes the strategy. Fragmentation brings change to known data workflows, change is disruption. This works to the advantage of the aggregators and where vendors do not have specific coverage or sufficient breadth/depth (broker data/news/ESG) data consumers can engage a specialist third party. Though this may not always be the best decision for the business.

CHANGING WORKFLOW DYNAMICS

Fragmentation changes the workflow dynamic, especially, for smaller financial institutions as well as smaller sources of data. It creates a shift in terms of relationships because total cost is under constant pressure, which paradoxically means sticking to the known can be a preferable option to the risk and disruption coming with any change. Equally vendors can be so embedded within the trading workflow, like Bloomberg, offering data, trading connectivity, risk and valuations that the data consumer would have to radically change beyond their capacity to do so.

In a world of creative data chaos there needs to be a competitive advantage to create new markets for information and market data where the financial institutions invest in potentially more appropriate covering the markets they invest in.

The graphic below highlights the inputs required when analysing re-balancing information requirements and costs.

FORWARD LOOKING STRATEGIES

There are strong and sound arguments for continuing to offer and subscribe to aggregated services. The sheer universe of data offered by the Tier 1 aggregators, Bloomberg and Refinitiv, and their Tier 2 brethren is unlikely to be replicated by anyone else, and for many financial institutions this is a logical strategy, but no vendor has everything. Fragmentation comes from filling in the data cracks.

In 2023 with market data costs sitting atop of the CFO’s priority list means tech investment will be driven from the perspective of how much it saves, not from any inherent long term strategy. Understandable but financial institutions should right now re-orient their information needs to plan ahead for the cycle uptick. First by getting costs down to foundations upon which to build, second through deciding how and who by, their data should be delivered, and processed, using which investment decision tools.

SUMMARY

Market data industry fragmentation is likely to prove more disruptive to data sources and vendors forced into developing new business and pricing models to accommodate changes to existing data workflow patterns.

Is the market data industry at a crossroads (possibly in terms of regulatory involvement, but that is another story)? No. Is it heading towards a crossroads? Yes, but reaching it might just be like Sisyphus and the boulder because new Tech will constantly be offering the next best thing, which is good (unlike for poor Sisyphus) because it is continuously opening up new opportunities.

There is not one single crossroads for the industry and market data consumers but numerous alternative pathways are available by financial institutions should they decide inertia does not offer enough. Deciding which one take will be driven by the unique requirements of each individual data consumer.

Talk to us about our consulting, and our independent advisory services

Keiren Harris 19 July 2023

For information on our consulting services please email Knharris@marketdata.guru

https://marketdata.guru/data-compliance

Please contact info@marketdata.guru for a pdf copy of the article

#exchanges #Bloomberg #TheCloud #Bigdata #ESGdata #ESG #marketdata #data