1.0 2021 IN REVIEW: DIFFERENT VENDORS, DIFFERENT REVENUE MODELS

This article is a summary of our full market data vendor report which provides detailed analysis of the industry. Please contact us to purchase your copy at info@marketdata.guru

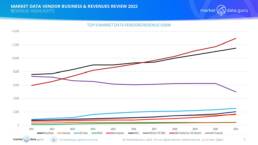

The Top 9 vendors (down from 10 in 2020 because S&P Global bought IHS Markit) estimated revenues for all their business activities grew from in 2011 $24,279 Million to 2021 $38,181 Million, i.e. an increase of 57% over the period. From 2011 to 2021 we saw:

Businesses (ICE Data, MSCI & S&P Global/IHS Global) whose core services principally revolve around providing proprietary data, such as Evaluated Pricing, Financial Benchmarks, Indices, Credit Markets and Analytics saw their combined revenues grow from $7,590 Million to $17,537 Million, i.e. 131.1%.

Vendors with a product suite built upon an aggregated model such i.e. Bloomberg, Factset, IRESS, Morningstar, Refinitiv (ex Thomson Reuters F&R), and SIX Financial saw lower revenue growth with combined revenues increasing by a slower rate from $16,689 Million to $20,644 Million or 23.7%

The big 2 super-vendors are now S&P Global and Bloomberg with the rest of the pack some way behind. Market fragmentation and the increasing presence of solutions providers like Broadridge, ION Trading and Options IT (which bought Activ Financial) in the data space could well open up Mergers & Acquisitions activity amongst this chasing pack.

2.0 2021 A NEW MARKET LEADER

The Top 9 vendors estimated revenues for all business activities grew from in 2011 $24,279 Million to 2021 $38,181 Million, a growth of 57%

2021 represents a watershed year when for the first time since 2011 Bloomberg has not been the undisputed number 1 vendor by revenue (estimated $11,500 Million) having been displaced by S&P Global ($12,947 Million)

This passing of the baton sets the market data industry tone for the 2020s where datasets created around IP are perceived to have the greatest value.

At the other end of the revenue performance scale is LSEG’s Refinitiv which was the largest vendor in 2010 (then known as Thomson Reuters) when it had revenues of $7,441 Billion which has since declined to $6,250 Million (-16%) in 2020 and 4,985 Million (-33%) in 2021. The important difference between 2020 and 2021 is LSEG moving Refinitiv’s electronic trading businesses into its mainstream trading venue business.

The vendors can be divided into 2 categories, whose core businesses are different, albeit there are significant overlaps:

1.Proprietary and IP based data vendors, offering services such as Evaluated Pricing, Financial Benchmarks, Indices, Credit Markets and Analytics. This financial information providers group includes ICE Data, MSCI, plus S&P Global.

- From 2020 to 2021 these vendors combined revenues grew from $15,769 Million to $17,537 Million i.e.11.2%.

2.Data aggregators like Bloomberg, Factset, IRESS, Morningstar, and SIX Financial have seen revenue growth, however Refinitiv’s revenue has declined in the last year due to the reasons outlined above

- From 2020 to 2021 these vendors, including Refinitiv, combined revenues declined from $20,953 Million to $20,644 Million i.e. –1.5%.

- From 2020 to 2021 these vendors, excluding Refinitiv, combined revenues increased from $14,703 Million to $15,660 Million i.e. 6.5%.

Section 8.0 of the full report briefly reviews of 21 major competitors to our Top 9 vendors, of which revenues are available for 14. While these rivals have other interests, such as media, or technology services outside financial markets, the combined revenues were an estimated US$17,217 Million. This is a clear indication that not only is the market data industry diverse, it is also exceptionally competitive, with companies seeking larger pieces of an expanding pie.

4.0 REVENUE HIGHLIGHTS & TRENDS

- Revenues are increasingly concentrated upon the 2 market leaders S&P Global and Bloomberg, yet the degree to which they compete with each other is limited. S&P focused on indices, credit ratings, proprietary data whereas Bloomberg is fixated upon its aggregated data business

- Throughout the 2010s Bloomberg has been the market leader with a market share remaining constant at +/- 30%

- Refinitiv’s market share has dropped from 30% in 2011 to 13% in 2021 but the latest decline is due to LSEG moving trading revenue to different business units

8.5 GLOBAL COMPETITION 2022 SUMMARY: IS THERE A THREAT TO THE GLOBAL 9?

At this point the answer is yes and no. These competitors may be tough, but they are not existential, their inconvenience is limited to specific markets, and for the traditional market data vendors that is regional in nature, especially the large Asian vendors which have had little success going offshore. In contrast, and with far more long term effects, the financial technology, especially in what we believe to be a critical offering, third party managed services.

However, and there is always a however, the financial websites are likely to provide the catalyst for change. There is little real competition now, their services are too low margin to interest high margin, high cost big vendors. Yet they exist in the fastest growing industry segment, possesses a magnetic attraction to investors willing to give them high valuations as start ups (and well capitalised companies have more options) or like MarketWatch and Yahoo Finance have parents with very deep pockets.

Market Data Globalisation under threat.

One problem that hopefully will not be inevitable is the threat to market data as a global commodity, when geopolitical actors (which need not only be states) realise the strategic impacts of data in capital markets. This ranges from leveraging regulation to protectionism to manipulation. All market data vendors rely upon access, to data and markets. If denied this has consequences. Rigging the game is not new, in fact it was quite prevalent until the 1990s, the danger is a comeback.

Watch this space!

The slide below provides a table of contents for the full report. Please contact us for more information

Keiren Harris

knharris@datacompliancellc.com