COMPETING IN DATASPACE

Introduction

As in Europe 2010 was a landmark year in US Exchange business, peers had merged, the focus was still centred on the traditional core businesses of trading and listings, but there were 2 crucial differences which gave American exchanges a head start:

- The presence of in-house commercial technology businesses, like NYSE Technology (now Vela TT) and OMX which brought interaction with data consumers and their requirements. This made exchanges more aware of the importance of data to their investors, and,

- Development of new pricing models based upon how clients consumed data, such as non-display (NDU), original works creation (OCW), plus client accessibility to data. This began to match how their clients generated revenue from data

Competing in the Dataspace

The US also led the way in algorithmic trading, investment strategy modelling, and index benchmarking, each requiring significant amounts of data to be effective. For CBOE, NASDAQ and NYSE competing for listed stock trading, price data is the weapon of choice. As each exchange publishes its own data, the price and depth of market for a single stock e.g. General Motors or JP Morgan will be different on each one. Only reporting via the Consolidated Tape brings all 3 together with post trade data, this means an investor needs to see all 3 feeds for clear sight of the market, something too expensive for all but the best resourced financial institutions.

This forces the exchanges to compete in attracting trading which provides the data investors execute on, which places emphasis on price quality, volume, latency, and for many the cost of licencing the data for use.

As raw price data usage within financial institutions reached saturation point, placing a natural limit on revenue growth, the logical next step was to move downstream, i.e. adding value to the data, through licence of indices (each exchange embracing index creation), offering analytics and models, with data management tools for risk and portfolios.

The direct result was, and is, North American exchanges investing in analytics and value added services to compete

TEN YEARS ON

The US is more data centric than any other market in the world driven by an unmatched liquidity pool that facilitates electronic markets to function, especially for exchange based trading. The US exchanges themselves are more advanced in developing data and analytical services than any competitor globally other than the LSE. When low latency theoretically provides an edge algorithms can react faster to data driven events, and if trading equities search for, then execute on, best prices on each CTA member, CBOE, NASDAQ or NYSE, it increases the value of the data, while simultaneously expanding the universe of the data required, and therefore subscribed to, especially value added services.

To service data driven trading, ICE and NASDAQ have aggressively been active in buying expertise, CBOE recently have adopted a similar strategy, while TMX’s purchase of Trayport has transformed their approach to value added data business. CME while easily the largest exchange globally by market cap (US$64 Billion, 23/04/2020) has adopted the approach of developing its market data business inhouse, relying on a listed product range that no other exchange matches for either breadth or liquidity.

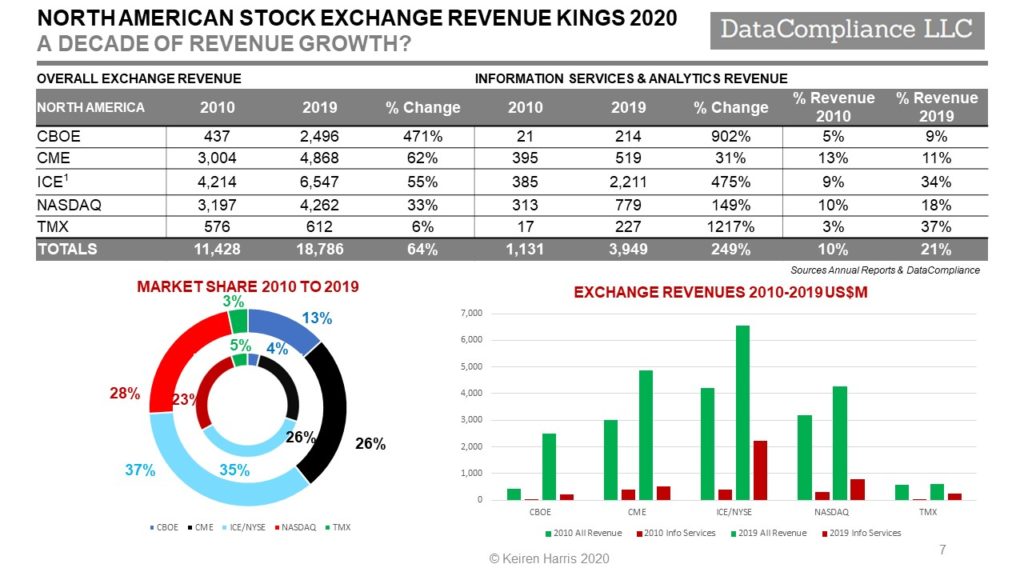

• Overall exchange revenues grew 64% between 2010 and 2019

• Information services revenues grew 249% between 2010 and 2019 showcasing exchanges data business

When analysing each exchange individually

• CBOE was unique in being a standalone exchange upon listing in 2010. Data strategies were initially based upon driving trading from online brokers to the exchange and the pricing models reflected that. The purchase of BATS transformed this to developing a commercial model more appropriate to mainstream financial institutions. This resulted in a phenomenal 471% growth

• The CME has reportedly benchmarked its data business to ICE’s. It’s low data share percentage of revenue, 11%, indicates potential to increase to the NA average of 21%, but it is hard to see this being achieved without buying skills and revenue flows

• ICE has an entrenched and successful strategy, the only US owned of a global market data vendor (ex-Interactive), it is creating a micro-monopoly in evaluated pricing (the market leader), while purchasing analytical and index services which complement the core data services in a structured environment. With 34% of revenue from data related services, ICE is the US leader in the data sphere

• Like ICE, NASDAQ was among the first to recognise data as the way to go from 2010. Unlike ICE, NASDAQ has been opportunist in an approach lacking strategic structure. In hindsight, purchasing Thomson Reuters Investor Relations business and eSpeed from BGC were not the ways to go. More recent additions such as Quandl have yet to prove if NASDAQ can build beyond 18% of revenue

• Canada’s TMX is shedding its unloved aggressive audit policies, and its data business has been revolutionised by buying Trayport the energy and commodities platform. This purchase alone was the catalyst for an eyewatering 1,217% data revenue increase in the 2010s

M&A and REVENUES

By 2010 consolidation amongst US exchanges meant that mergers between the big 4 US Exchanges was unlikely to be approved, so the remaining small exchange quickly disappeared. North of the border in Canada, the local Maple consortium proved that outsiders were not welcome to own TMX. To expand horizontally the exchanges faced 2 choices:

- Expand overseas, i.e. CBOE (BATS), NASDAQ (Chi-X Canada), or,

- Enter OTC markets buying venues, with a major caveat, they must trade electronically, i.e. CBOE (Hotspot/FX), CME (NEX/FX & Fixed Income), and NASDAQ (eSpeed/Fixed Income). Interestingly the exchanges have yet to integrate the data services of their new subsidiaries into existing information services businesses

Alternatively vertical integration presents opportunities in the data space. With data driving trading, the US exchanges have focused on adding value, again in 2 ways, with ICE’s purchase of Interactive Data being an outlier but still fitting in with ICE’s other purchases:

- Aiding trading and investment decisions, CBOE (LiveVol, Vest), ICE (SuperDs, Algo Technologies, Bondpoint) and TMX (Trayport)

- Buying specialist data and analytics. CBOE (Hanweck, & FT Options), ICE (S&P Evaluated Pricing, BoA Merrill Lynch Indices, TMX Atrium) and NASDAQ (eVestment, Redquarry & Solovis)

In overall revenue growth the market standout is definitely the CBOE (471%) driven by being a disruptor and building a client base beyond traditional financial institutions.

Of the established exchanges, CME’s 61% increase over the decade seems almost to disprove the principle that data is the way forward, but that ignores the CME’s listed products which include S&P500 futures, along with financial futures, and commodity futures that no other exchange can match in liquidity. Which is where data does come in because I have clients who will not switch from CME data to alternative exchanges because the price discovery flow is nowhere close to sufficient.

CONCLUSIONS

US Exchanges to Continue to Lead the Way in Data. Why?

US markets are tech driven in operation, thanks to local data innovation which thrives on the sheer number of data inputs available for modelling. The desire to invest in the world’s largest markets, is assisted by:

• Geographic dispersion (domestically & internationally), data provides accessibility from virtually anywhere on the planet •Number of participants, which increases data outputs, and,

• Crucially market openness, the factor that allows data to flourish, an often forgotten principle. In a managed environment, market data cannot work its magic because the models will be inefficient and limited by unnatural restraints

Data Creates Competition

• North American exchanges will compete fiercely in dataspace as whoever leads there will have greater success in the important underlying transaction and IPO businesses. The reason why exchanges actually exist

• Data brings flow to an exchange, and revenues follow the flow. The Inter-dealer Brokers have already proven this concept. A company looking to list will in future will first analyse the ability of their preferred exchange to drive transactions to its virtual floor, and the key to this will be analytics

North American exchanges will continue, even accelerate, their data services expansion. They are well capitalised, with strong revenue flows (pre-coronavirus) providing an ability to invest in what they need, either internally, or more practically, externally, i.e. buy expertise, buy revenue. This gives them an advantage only Deutsche Börse and the LSE currently match.

The big question is what strategy will the CME adopt in the 2020s? They are 900lb Gorilla with resources to match. A personal view is they will look to acquisitions, perhaps privately held Calypso Technology, or tech based datafeeds, Activ Financial, for market data, Factset. Even more speculatively a future home for Bloomberg? That would be something.

Keiren Harris 28/04/2020

knharris@datacompliancellc.com

For a copy of the pdf, please email knharris@marketdata.guru