1.2 Open Skies: New Technology Horizons

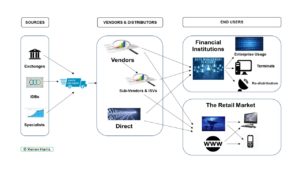

Traditionally there has been a simple linear progression in market data delivery from source via a vendor/aggregator to the end user, with a single closed terminal sitting on a desktop.

The view only world.

This then evolved into a more complex enterprise network usage environment where an end user can now be anything from the lone terminal to an application ingesting and re-distributing market data from multiple sources and vendors.

The Networked world.

However, evolution is now being displaced by revolution. New sources, trading venues, and technologies driven by ‘the Cloud’ and Predictive Analytics are changing the models by which information is delivered, accessed and used.

The Cloud World.

In a brave new omni-directional world, sources and vendors can slice the market data into user-defined components, which combine with models and analytics that increase the elasticity of usage.

In this world, users can select from pre-packaged, tailored, or their own proprietary solutions to access, analyse and deliver results. All available via multi-layered and discreet data sharing.

Market Data relationship flow is becoming 3D multi-directional rather than 2D linear.

How?

- Innovative technologies like the Cloud are breaking barriers to entry for new players.

- Already some players, in China, for example, are looking beyond the Cloud towards artificial intelligence.

- These new technologies are increasing choice by dramatically improving ease of access for both the buy- and sell-sides. It removes the tyranny of artificial technical limitations.

What’s the result?

- This impacts traditional vendors by reducing lock-ins in two ways.

- New technologies change the infrastructure dynamic. Currently market data gets tied up into multiple known and unknown systems, therefore changing vendors can be a costly, and even virtually impossible, business. Try removing the Thomson Reuters Enterprise Platform (TREP). As technology improves customers will have greater flexibility in choosing which vendors to use.

- New flexibility in using services needs to be accompanied by changes in contractual terms and conditions. This benefits innovators. Although do not expect the immediate ‘uberisation’ of the market data world, this is unlikely in the near term, but not impossible for later.

- Technologies also reduce the costs of service enabling smaller players to compete on a more level playing field with the big boys. It opens new doors and new windows on accessibility.

- Even the smallest companies can now potentially offer their services globally, as long as they can market them.

- Specialisation in content driven by quality and a greater understanding of what that content comprises.

- Greater use of analytics to drive usage of market data.

- Greater use of analytics to understand how market data is being used.

- The growth in the High Net Worth Individual and New Mass Affluent markets for market data consumption, with analytics. These might be low margin, but the market is potentially huge. East Money in China has 30 Million+ subscribers and growing, compared to Bloomberg with a high-yielding 300,000+ installed terminal base, but getting smaller.

Who are the beneficiaries of the latest technology innovations and why?