As someone who has been critical of the Inter-Dealer Brokers (IDBs) and their seeming lack of a strategy that can adapt to revolutionary market change, the news that TP ICAP will acquire Liquidnet and its subsidiaries for up to US$700 Million in cold cash comes as a welcome development.

Even transformative in the true sense of the word rather than over-used hype.

The TP ICAP initiative comes before the window of opportunity to buy a high quality electronic trading venue closes either becoming too expensive for an IDB, and/or a dearth of suitable candidates arises.

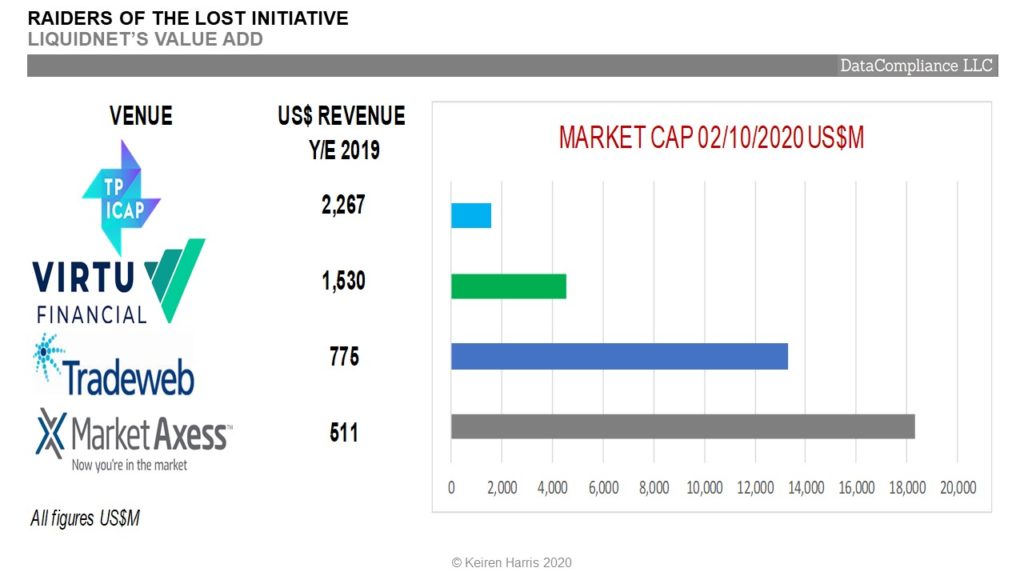

The leaders are already beyond reach, see the table below.

The market does not appear to agree, taking a short term view that has seen TP ICAP’s share price drop from £2.73 on 30/09/2020 to £2.17 as at close on 02/10/2020.

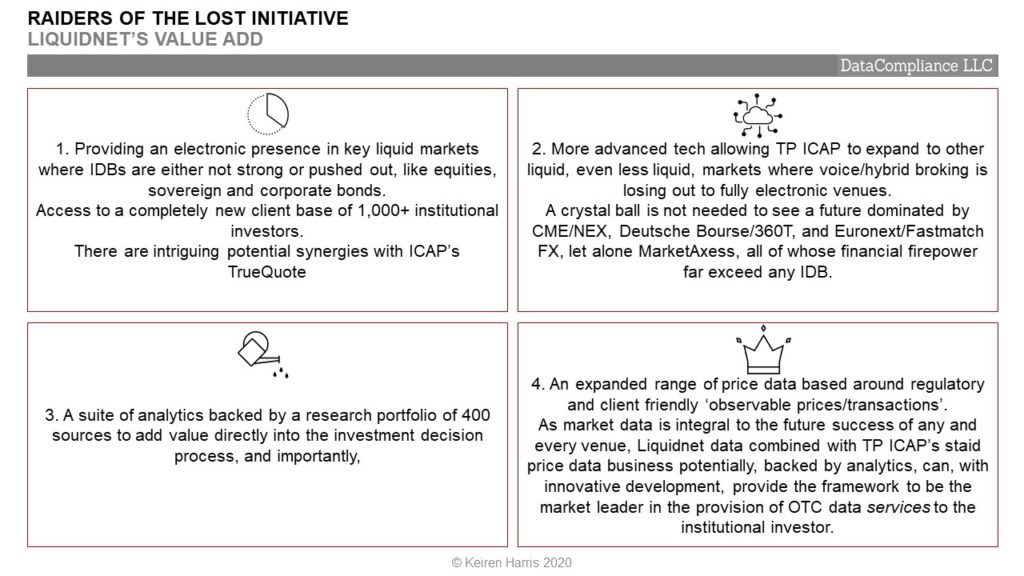

Although the overall market did take a battering, it has been suggested the sentiment towards the deal appears to be more an (irrational-my comment) assessment based on a dividend hit with a rights issue rather than the longer term practical benefits Liquidnet will bring through:

The problem the IDBs have faced in the last decade is war on two fronts:

- From above, in the liquid markets, especially FX and Fixed Income, where well-capitalised exchanges buying electronic venues based around high numbers of transactions, but ultra-low margins, driven by DMA and tech, then,

- From below, the growth of specialist IDBs, such as Arraco, Conticap, Evolution, Kyte, Marex Spectron, and Square Global Markets focusing on deep service, particularly in the more opaque Commodity and Energy markets

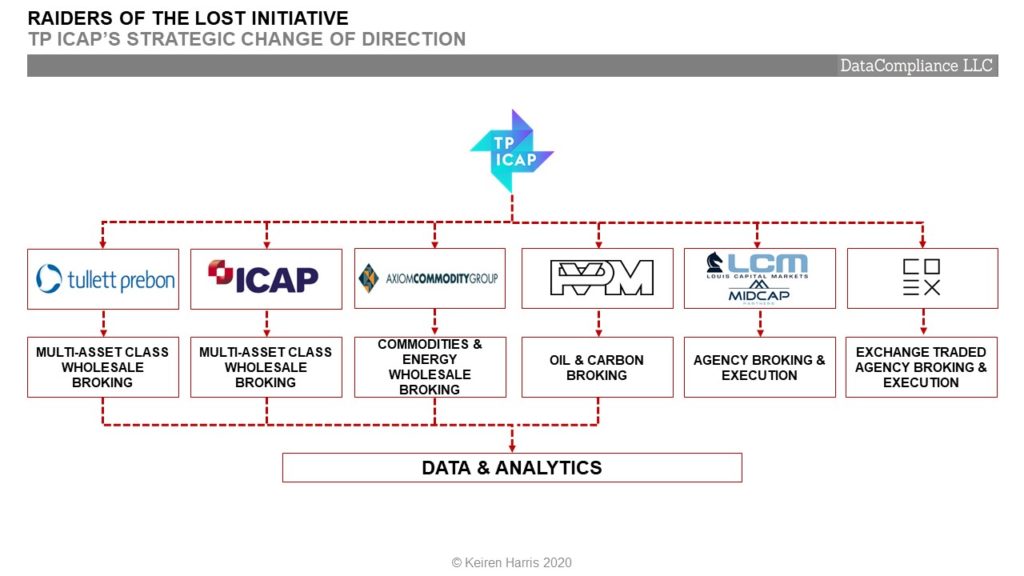

TP ICAP, like BGC Partners, have until now focused on the threat from below, by buying a portfolio of specialist brokers themselves, plus the rather bizarre purchase of Burton-Taylor International Consulting.

In contrast Liquidnet’s strategy has been to drive value directly to the underlying trading platform. Achieved through emphasis on analytics that provide better investment decisions to trade specifically on their proprietary venue, backed by research that offer insights on the products available.

The Best of Both Worlds?

Legacy Tullett Prebon has never been comfortable with electronic trading. The Liquidnet deal indicates a willingness to embrace a new future where access to liquid venues is valued higher than traditional OTC broker markets.

However, there is must be recognition that voice/hybrid broking in markets where electronic trading functions inefficiently, that traditional brokers are intrinsically under-valued.

In combination this will allow the brokers to structure more attractive deals for their clients.

Bringing the two businesses together will not prove seamless, and this is where the data and analytics business becomes critical to success. The ability to discover, price, analyse, then trade a wider cross-section of the OTC market space opens the doors for investors to a greater range of opportunities.

Keiren Harris 05/10/2020

www.datacompliancellc.com

Please email marketdata.guru for a pdf