5.3 Financial Benchmarks: Indices, IBORs, Deals, Dollars & Sense(?)

Index Creator Listings Click Here

The Value of Proprietary Data

In the data industry, there are no more vigilant and uncompromising protectors of their IPRs than the Index Creators lead by possibly the most ruthless of them all, MSCI.

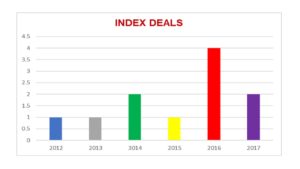

We have argued that amongst the most valuable information and data is proprietary and original. Indices are right up at the top in qualifying on both scores. This position is supported by the number of deals amongst the purveyors of indices and their willingness to invest significant amounts of dollars in expansion.

Banks have been pushed out of the business while both exchange and vendors, well the big ones with the money, have identified indices as being of strategic long-term value, and are willing to pay serious money for a ‘piece of the action’.

The question is why buy, when you can create indices?

Well they do, and there are multiple overlaps, however once an index has been established as the industry benchmark they are next to impossible to dislodge.

A DJIA, S&P500, FTSE 100, Nikkei 225 MSCI Global can be replicated but not replaced. Once the index has embedded in the business it is going nowhere.

The index providers are more than aware of their products true value, and can use this pedestal position either to sell out at a good profit, or maximise the revenue flows.

True Value

- S&PDJ produces 1 Million+ Indices1

- US$7.5 Trillion is Benchmarked against the S&P5001

- US$2.1 Trillion is indexed to the S&P5001.

- US$3.1 Trillion in assets are directly indexed to S&P Dow Jones Indices1.

- 68% of all assets linked to S&PDJ are linked to just one, S&P500.

The leading index creates the brand, the brand builds the business.

1 Source S&P Global Investor Factbook

Musical Chairs, All Change

If there is one area where changes can be directly correlated to the actions of the regulators it is the provision of Financial Benchmarks.

In the last 5 years Index business has undergone wholesale transformation. Not the slow moving plates here, more the building of mountain chains built on strong revenue backed by stronger IPRs.

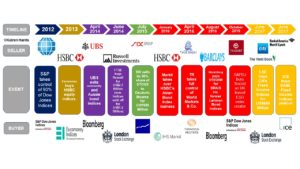

Changes in who produces indices and consolidation since 2012 have been driven by the need to comply with IOSCO Principles, and the ability and/or willingness of the index creators to meet the high and intensely detailed standards these principles are setting.

I wrote in 2013 that the Banks for one reason or another could not continue producing OTC, and to a lesser extent equity, indices in the world of more intrusive, detail driven IOSCO financial benchmarks, and that they would exit.

The natural result has been an exodus of the Banks with the vendors and exchanges mopping up their index business’, and for quite considerable sums.

In June 2017 LSE paid US$685 Million for Citi’s Yield Book business, which Bloomberg in 2016 had a reported revenue of approximately US$100 million, and ICE took over Merrill Lynch’s index business for a yet to be disclosed sum.

The once long list of leading Banks producing indices is now down to a mere three main holdouts, Credit Suisse, Deutsche Bank and JP Morgan.

Scandals and Consequences

The LIBOR scandal amongst others has created a complete sea-change in the entire creation of financial benchmarks, however it is not widely considered there are 2 forms of benchmarks:

However, in the wake of the LIBOR scandals, regulators through the International Organisation of Securities Commissions (IOSCO), via their IOSCO principles felt compelled to act and cover all types of financial benchmarks, clean or otherwise.

We shall cover this in more detail later, but for now it is worthwhile considering the business consequences, and the 5 inter-connected trends.

The Takeover Timeline

If we delve deeper into the deals, more signs can be divined.

- The traditional index creators long ago maximised their coverage of the exchange based markets, primarily equities.

- To grow in terms of coverage they must venture bolder and deeper into the OTC markets.

- In the past, the OTC markets tended to be avoided and for good reason.

- It has always proven difficult to get reliable and consistent data, and the Banks that could supply this data had their own index businesses, until recently.

- The Banks exodus from the index creation business is an opportunity being seized by exchanges and market data vendors alike.

- IOSCO Principles has opened the door to wider index coverage of the OTC markets, especially in Fixed Income, and to a lesser extent, Commodities, and Energy by the traditional index creators.

MSCI are noticeably absent from the fray.

Strangely, the index creators and the Inter-dealer brokers could never work out a deal, as this at least from the outside appears a logical match.

FTSE and ICAP explored a partnership only to founder at the very top levels of management. A little later when FTSE and Tullett Prebon discussed co-operating in Asia there was zero interest from TPI management, so the initiative withered and died.

Summary: Index Provides & the Future

The immediate and obvious result has been a coalescing into two groups of index creator, plus a third more disparate group, essentially banks and niche index providers over whom there must be question marks as to whether these will continue to offer index services themselves.

In addition, there are the 3 licensed financial benchmark administrators.

Crystal Balls

- There is little opportunity for any major consolidation amongst the index providers for the foreseeable future.

- It is unlikely the market data vendors will be able to take too much, if any, of the traditional index providers business away in their core areas of benchmarking exchange/equity indices.

- There will be greater competition outside this area, in OTC markets, starting with Bond Indices as the buyers of the Fixed Income business of the Banks re-vamp and update the product offering on more commercial lines.

- There will also be greater competition in the high margin ‘tailored’ index business, i.e. for General Funds, ETFs and Structured Products.

- This could have a variable effect on costs to the consumers, there will be greater demand, partly owing to regulators, but there will be greater competition.

- The market data vendors will struggle more to develop and grow their index businesses than the exchanges.