5.4 Market Data Vendors: Monopolies, Threats & Dollar Focus

5.41 Are there monopolies in the Information & Market Data World?

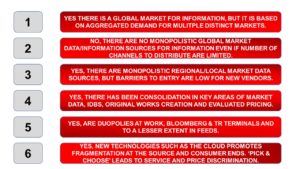

In a capitalist world, gaining monopoly is the unspoken (bare naked greed being politically incorrect in today’s world) objective of any self-respecting business, with a duopoly being a close second, and failing that a functional oligopoly will suffice.

Business on a global scale does gravitate towards a small number of providers, especially where software is involved. Given the percentages involved when looking at market shares in Search Engines and PC Operating Systems, it is very hard to claim that any obvious monopoly exists in the market data industry, though there is a strong argument for managed monopolies in the exchange space, and oligopolies in the business space.

We shall see that monopolies do exist, and new oligopolies are forming in the proprietary information space.

Information and market data is obviously not software (but needs it for access), nor hardware (but needs to have something to be displayed), but there are business characteristics in usage it does share.

In our other report sections, we have seen there exists value in both possessing a dominant position within a market (Bloomberg Terminals & TR TREP), and more crucially in owning the IPRs of original source of data (i.e. Exchanges, Index Creation and Evaluated Price Creation).

The major point of difference between comparing global market share of say a Google Chrome Browser, or a MS Windows OS, and the market data and information industry can be summed up simply.

But there is a really big ‘However’. In the proprietary data/original works field there are de facto monopolies.

- While the Index Creators do compete, there is only one S&P500, or one FTSE100. Yes, others can create imitations, but they are not the real thing.

- Barclays Bank is only listed on the London Stock Exchange, even if trading is available on BATS Europe.

- The evaluated price of a specific bond from SIX is not the same as the evaluated price of the same bond from Thomson Reuters, so once in the client systems I becomes a ‘de facto’ monopoly price.

5.42 Monopolies & Threats: Market Data Vendors in the Real Time World

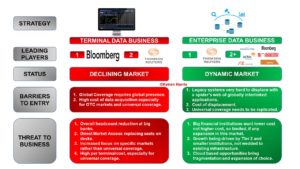

Bloomberg has a tight hold on a declining market in terminals. But it is a highly profitable, high margin business when one can command the premium Bloomberg does. But Terminals are in decline and industry growth is elsewhere.

Thomson Reuters TREP has locked the big financial institutions in a solid vice dependent upon the spider’s web of inter-connectivity between applications which host TR data. Very hard to move, but the big institutions are out for reducing costs, and again industry growth is coming from areas, businesses and institutions which are not locked into TREP.

The enterprise data segment has been the key driver of market data usage growth in the last decade. At this moment, virtually every financial institution distributes market data on an enterprise basis.

The big financial institutions were naturally early proponents of datafeeds, however this market space is now saturated. Below the larger institutions the medium sized Banks and the larger retail market has yet to reach these levels, with cost of infrastructure and data being a major disincentive to invest heavily.

This leaves these institutions free to leverage opportunities generated by new providers, new sources, as well as existing sources, distributing information utilising new technologies, i.e. ‘The Cloud’.

The threat to existing big market data vendors is the lock-in to legacy systems combined with smaller competitors’ ability to be more flexible in cost and offering.

5.43 Monopolies by Stealth Proprietary Data & Original Works Providers

As we have consistently argued at this moment, and for the foreseeable future, proprietary data which is unique to a specific source has the most value, provided it has become an industry accepted benchmark, i.e. Nikkei 225 rather than a Market Data Guru Japanese equity index.

It is in the realms of index creation and the provision of valuations reference data that there is a real danger that de facto monopolies are emerging by stealth in the proprietary data world.

FTSE Russell, MSCI and S&PDJI have consolidated their positions as the leading index creators and will grow their business to further encompass OTC markets and alternative asset classes. These 3 have not so much emerged as market leaders, more reinforced their position.

ICE, and IHS Markit are positioning themselves to becoming the dominant players in valuation services, along with Bloomberg and Thomson Reuters. A four-horse race is developing for market ascendency.

RegTech, including offering such services as Legal Entity Identifiers, Know Your Client, and Anti-Money Laundering, is the latest development. While many consider an offshoot of reference data, these services should be seen on their own regulatory driven merit. Bloomberg and Thomson Reuters appear to be strongly positioning themselves for market domination in this area.

5.44 Monopolies & Competition: Exchanges & Trading Venues

Most exchanges are monopolies, but the larger exchanges now face competition within their local market places, and for good measure many are now regulated to avoid the abuse of their position.

Exchange data, like TREP which itself contains a large universe of exchange data, once embedded in a clients’ system it is extremely hard to displace, making it hard for insurgents (such as BATS) to replace incumbents (such as NASDAQ).

Exchange data, unlike TREP often cannot be replaced. This means that exchanges can push the envelope in fee pricing, even if not always successfully. Big Banks will push back, and financial institutions will exit markets, especially emerging markets, if the costs of information outweigh the dollar opportunity of trading that market.

The Inter-Dealer Brokers are probably the least under-pressure in the short term, but possibly in the riskiest position long term. NEX Data and TPI are the market leaders, with BGC/Fenics and Tradition offering data services.

Yet they are operating in OTC markets where regulators are seeking greater transparency, control, and reporting placing pressure from above, and competition at peer level and insurgents from below.

Deutsche Bourse, ICE and NASDAQ have all bought venues in the OTC space and are likely to venture further in their quest for new trading opportunities. Equally CME has been somewhat thwarted and could well be in the market as well. Please see Section 5.2 ‘Trading Places & Market Data Vendors’).

According to ‘TradeNews’ the number of Bond Trading platforms available grew to 128 in 2017.

Almost certainly this is too high a number for the Fixed Income market to support, it does mean their electronically driven pricing services are far more in tune with regulatory demand for ‘observable transactions’ than feeds combining electronic prices, voice broking (though e-capture is gaining ground) and indicators of interest (IoIs).

The blurring of the lines between exchange venues and OTC venues in terms of ownership and price service offerings indicate a breaking down of monopolies in most western markets.

However this has not stopped the CME Group being able to successfully and substantially raise their fees for market data over the last 2 years.

The market is driven towards liquidity, and those high liquidity venues, such as CME, may not be a monopoly per se, but they can certainly act like one.

Competition is limited in the exchange market data segment, but looks like it is set to expand in the OTC markets.

5.45 The Crystal Ball.

There are two potential streams of market data business growth, the first based upon leveraging and maximising the latent underlying value of the market data.

The second is an overhaul in the overall industry structure as existing vendors seek to adapt and insurgents enter the market to tap and exploit under-developed businesses.

- Maximising Market Data Information Value

- Market data vendors focus on the specific value of market data and information, especially when they own the core Intellectual Property Rights, such as for Indices.

- Increased emphasis on OTC data especially for Fixed Income and Credit Markets, but also commodities. Partially regulatory driven, but also client driven as greater price transparency from discovery to trade to settlement.

- Locking in clients by embedding data into their systems.

- Growth of market data services such as analytics and wealth management aimed at High Net Worth Individuals and the Mass Affluent retail market. Vendors exploring beyond the Bulge Bracket Banks.

In the Cloud World of fragmented information sourcing where choice of service and supplier becomes both broader and deeper, it is the interest of the market data source to provide something nobody else can offer or easily replicate.

- Maximising Market Data Strategic Value

The flip side of maximising the underlying market data value is to create business wealth which is measured by the available information service portfolio. As we have seen the vendors are positioning themselves to getting rid of the non-core assets to bulk up on their product strengths.

- Mergers are not coming within the industry due to lack of real synergies to exploit between competitors.

- Mergers are happening with outside players looking for complimentary synergies across industries, i.e. IHS and Markit.

- Larger players looking to build their businesses through targeted acquisition.

- Vendors divest themselves of non-core assets to focus their higher value data sets where they have a competitive advantage.

What could this mean?

- Thomson Reuters being split up on the basis its individual parts are worth more than the whole?

- An Amazon or Google decides to buy and control content rather than deliver it.

LINKS TO LISTINGS OF INFORMATION PROVIDERS

Global Vendors Click Here

China Vendors Click Here

Japan Vendors Click Here

APAC Vendors Click Here

India Vendors Click Here

Emerging Markets Vendors Click Here

Index Creators Click Here

Credit Rating Agencies Click Here