5.1 Market Data Vendors: Continental Drift in Action

Mountain High, Ocean Deep

The plates on which the market data vendors are shifting. Even if this looks imperceptible from a distance, there are definite movements. Perhaps these movements are not causing any great tremors, they are slowly, but surely, transforming the financial information landscape. Intriguingly, their impacts are now travelling beyond the confines of a rather parochial market data industry.

While some plates drift apart creating oceans (Sellers), others come together to build mountains (Buyers).

Indeed, as the market value of all the different types of market data mutates1, it directly alters and then drives the perceived value of the companies producing and distributing that information.

Being the provider, or creator of unique market data sets also brings an initial quality, but the true revenue multiplier comes when that unique data gets adopted as a de facto financial industry standard, i.e. a S&P500, or benchmark US Treasury from ICAP, or becomes so firmly embedded within a client’s legacy systems it cannot easily be displaced, therefore guarantees a revenue stream.

However, the emergence of ‘The Cloud’ is likely to reduce the leverage incumbent vendors have over their clients.

1 I think using ‘evolve’ in this scenario would be an incorrect term as it implies natural progression whereas market data is impacted by external factors such as regulators, making mutation seem more appropriate.

2012. A Year Zero?

Four major business trends have emerged since 2012 with clear common denominators. These have underlined many of the business transactions that have taken place since then in the market data industry.

There is a focus on Over-The-Counter (OTC) Markets, primarily the Fixed Income and Credit Markets, and, though to a lesser extent, Commodities and Foreign Exchange. Activity has been particularly noticeable in services which price and value these markets.

In addition, it also appears changes in regulatory frameworks correlate to a motivation to exit or enter the offering of services such as Indices. In particular, Bond Indices.

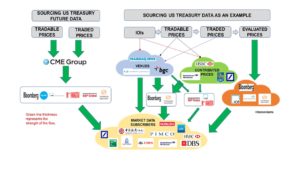

Equity and exchange traded markets are well covered with single points of sources based upon common clearing and reporting and are relatively cheap for vendors to subscribe to. In contrast, the OTC markets are far more fragmented, there are far more sources in multiple centres, and these sources do not provide regular price updates. Therefore, OTC markets require far more sources to provide consistent market pricing.

In consequence, OTC markets are expensive to source. Especially if the intention is to achieve sufficient depth and breadth of coverage, especially in terms of pricing the market, compared to exchange based markets.

The graphic below compares and demonstrates the fragmentation and complexity in sourcing outside the Exchanges.

And it is pricing the OTC markets which has been driving the deals. Excepting of Bloomberg and Thomson Reuters, many vendors face a difficult set of problems to overcome.

This presents two obvious solutions.

- Source and create your own prices, or,

- Buy somebody else’s business which already does this.

This is exactly what has happened, calling them evaluated prices, fair-market-value, or valuations, market data vendors are meeting an important mission need. Vendors, including the data business of Citi and JP Morgan have created sophisticated algorithms to provide a price for any given instrument that as accurately as possible reflects its true value should at that point in time the instrument be bought or sold.

Importantly, this is a market segment which is growing, with datafeeds feeding applications creating the risk, portfolio and reporting outputs required. The terminal market is not part of the equation.

This growing market immediately points to strategies led by ICE and IHS Markit where they are bulking up on proprietary data and eliminating where possible market competition.

Of the 9 deals we review in Section 5.2 Business of Market Data: Buyers and Sellers, The Key Deals, 8 relate directly to proprietary data, evaluated pricing, valuations, analytics, and Know Your Client (KYC).

This trend is especially pronounced in the provision of Index Providers, to which we have dedicated Section 5.3 Providing Financial Benchmarks: Market Place Consolidation.

Trend 2 The Trading Platform Space

Buying into transactional businesses such as trading platforms is foremost about expanding the trading venue product base. Many smaller and domestic focused market data vendors especially in Asia offer trading platforms and these often prove to be more profitable than the underlying market data price business.

But a deeper examination suggests this strategy also provides a valuable information and market data revenue generating opportunity by providing instant access to the observable transactions so desired by the regulators, i.e. quality data with a seal of approval.

This links seamlessly to the provision of trading data which proprietary trading houses and hedge funds incorporate into their algorithmic trading programs, as well as providing underlying data to construct and produce evaluated pricing.

This is what a trading data based market data service combined with multi-asset class trading could look like.

Trend 3 Analytics and Adding Value to Price Data

This tends to be pursued by vendors having a specific strategy to grow their business based on analytics which can add value from the output derived from the service, and with the exception of ICE’s purchase of SuperDerivatives in September 2014 for US$390 Million, deals tend to be small.

While many analytics providers have an entrenched client base their businesses are not large owing to competition and that many financial institutions do create their own in-house analytics, especially if like Blackrock they have platforms to leverage like Aladdin.

IRESS from Australia seems to have found its own niche in developing a market data business based upon analytics, and specifically for analytics aimed at the High Net Worth Individual and mass affluent. This is a retail market the large vendors tend to shun, as they are highly competitive, come with low margins, and a client base notoriously unwilling to pay. However it is large.

Trend 4 Market Data Vendor Consolidation

Trend 4 involves a market data vendor buying another market data vendor, and since this rarely occurs now. Gone are the days of Thomson and Reuters buying up competitors left, right, and centre, and when opportunities ran out Thomson consumed Reuters. Now deals are focused on rounding out existing businesses by filling in the gaps. Where market data vendors are buying into their competition appears to be limited to smaller deals.

That is not to ignore the very significant purchases which have been made, and these are not from the usual suspects. It is a new, and likely prescient, phenomenon with outsiders buying into the market data industry.

Prominent deals include ICE (An exchange) buying Interactive Data, IHS (information business) ‘merging’ with Markit. There are obvious synergies, ICE is in the financial markets business already, and IHS is an information company, but the primary drivers behind these deals are access to the proprietary data the selling companies possess. ICE was not buying IDC for its real-time feeds.

The third major recent deal was FIS’ purchase of Sungard. This is significant less because of the market data element, Sungard has a market data business (MarketMap) more as an afterthought, but because Sungard’s systems and solutions are globally used and require market data to populate them.

The Big Fifth Trend?

The fifth and most profound trend is in its nascent stages. This is the advent of the big content deliverer, companies such as Amazon, Google, Microsoft in the US, Alibaba and TenCent in China which are rapidly connecting financial institutions but need content to serve this market.

There will be the realisation the money is not in the delivery of content, but control over the sources.

What could they bring to the financial information business space?

- Global reach, connectivity, and a large, extremely diverse client base.

- Analytics of structured and unstructured data beyond the capabilities of other organisations.

- Scalability and flexibility allowing greater choice and competitive access.

- Financial firepower.