Rule 3 Objective: Understand, then place a value on the data relative to the market to form the business’ revenue bedrock

Why? Data will make money if you know what your is data worth, and what makes it valuable

Possessing a magic belt, or, employing witchcraft will not place a value on your data. Effort is needed first to understand what the data is (Rule 2), then establishing its relationship with the marketplace it comes from, and directly relates to that market’s dynamics in terms of liquidity, it’s share of the market, and the brand of the data owner. Provenance is becoming a leading indicator of data value.

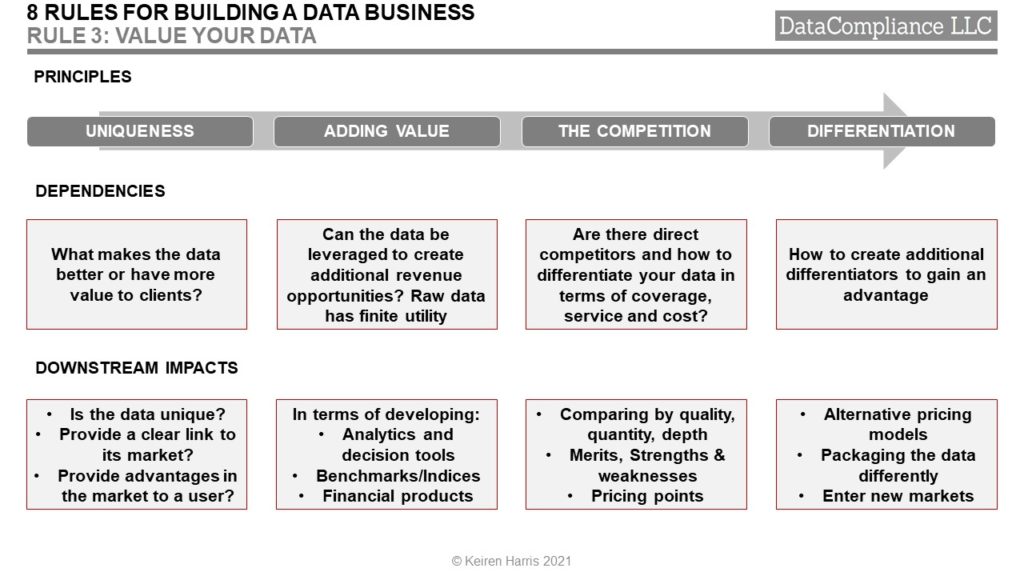

The Key factors are:

• Establishing the value of the data is dependent upon correlation to the dynamics of its usage

• Proprietary data which cannot be sourced elsewhere has more value than data than can be accessed from different sources, examples FX rates are available from multiple vendors, but there is only one S&P500

• Data which becomes established as user benchmarks (indices are the classic case) creates a virtuous circle of demand

• Where there are competing sources, quality and coverage has greater value on an aggregated basis, but there is a cost benefit analysis that needs to be done

• Decision making tools using analytics add value to underlying data, especially in data saturated markets

• Breadth of coverage widens the potential audience

• Depth of coverage creates its own premium

• Regulators place their own premium on quality

The 4 competitive edges:

Rule 3 Future Development

Placing a dollar sign on the value of your data is both a science and an art. It is intimately entangled firstly with the market it represents, and secondly the role it plays in representing that market. Traditionally price discovery through bid/asks has been the most valuable telling who is willing to buy/sell at what level, followed by latest prices, and then historical prices. However, this is changing as analytics and benchmarks take a larger part in the investment process. This changes the dynamic and value of the data, and are not the only factors to consider. The data owner needs to look beyond preconceptions.

How?

• Place maximum emphasis on data quality and data integrity in terms of:

- Accuracy

- Completeness

- Consistency

- Timeliness

• Position the data in terms of the context of the market it aims to represent, and the availability of alternative data sources

• Understand potential distribution and re-distribution of the data, the same data means different things to different people

• Link the value of the data to the purposes by which the data consumers intend to use it

• Examine how the underlying data can be leveraged to construct value added products such as analytics, indices, benchmarks, even new financial products

• Clients do not subscribe to data services out of the goodness of their hearts, they mean to use it to make money for themselves

Getting Rule 3 right maximises data potential

Rules 4 to 8 to come!

Keiren Harris 14/03/2021

Please email knharris@marketdata.guru for a pdf or information about out consulting services