SUM OF THE PARTS

Frankenstein’s monster was a kludge, an amalgam of disparate body pieces thrown together to create a single entity. To me Refinitiv has come together over the years from multiple mergers and acquisitions, and always achieves to be less than the sum of its parts.

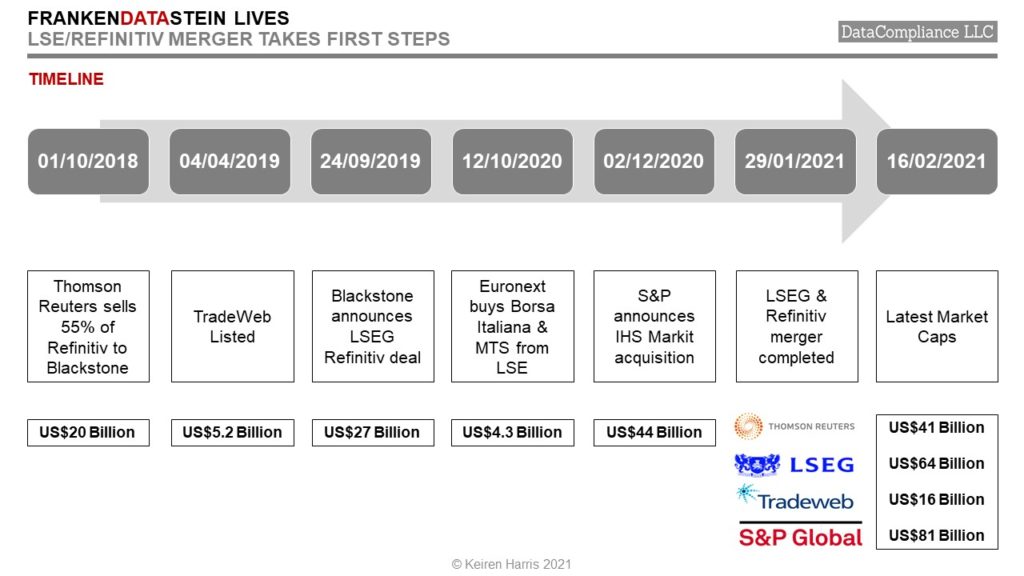

Conventional wisdom (i.e. the market) holds that the LSE/Refinitiv deal makes short term sense, and certainly each of the 4 key parties gains from the deal chain:

- Thomson Reuters disposes of an underperforming asset

- Blackstone and partners flip a few billion dollars

- Refinitiv management keep their jobs

- LSE gains one massive poison pill as protection from predators

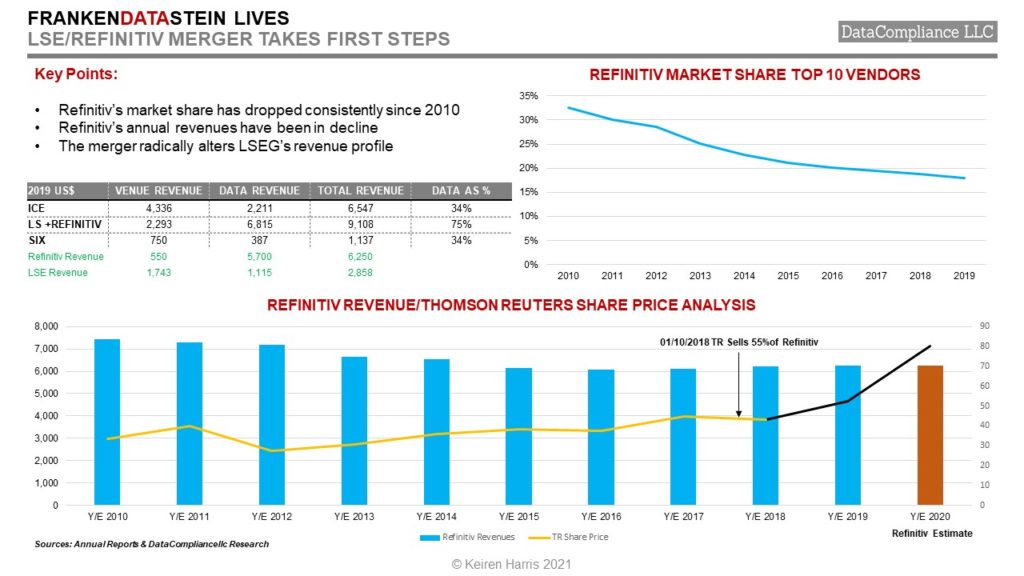

More independent thought will look to the old Chinese adage that ‘A journey of a thousand miles starts with a single step’, and that the road ahead has yet to be mapped. Certainly, the trend in the data world is towards greater vertical integration as data sources like exchanges seek to close the distance with their consumer base, plus tap into a more stable revenue base than traditional transaction commissions and IPO income, but compared to its immediate peers ICE/ICE Data (Interactive Data), and SIX/SIX Financial, the LSE/Refinitiv relationship is unbalanced.

With ICE and SIX it is clear they are exchange businesses first, the trading venues are the foundations upon which the data business adds value, yet Refinitiv could well be the tail that wags the dog. 75% of the new group’s revenue will come directly from data related services compared to 34% for both ICE and SIX, and that 75% is before the LSE sold Borsa Italiana and MTS to Euronext to gain regulatory approval.

TRADEWEB OR REFINITV?

One of the first things Blackstone did when it acquired Refinitiv was to spin off and list Tradeweb, however in retrospect a LSE/Tradeweb merger made more sense. Tradeweb is well managed, with a strong presence in electronically traded OTC markets, and the opportunity to provide complementary data deepening LSE’s index and analytics business. It would also have maintained a better balance between the trading and data businesses.

In a Tradeweb narrative, the value of original data over aggregated data becomes obvious, where originally sourced Fixed Income and other OTC data from liquid electronic markets is owned and mined by the owner. This is the environment where IHS Markit gets valued at US$44 Billion on revenues of US$4.4 Billion, whereas LSE bought Refinitiv for US$27 Billion with income of US$6.3 Billion

VALUE ADDED PARTS

Refinitiv does have some attractive features if they can be put to more effective use, of which the following are critical to the merger’s success

• A strong revenue stream which is larger at US$6.25 Billion than LSEG’s own US$2,858 Billion. Exchanges have financial firepower, but that comes more from leveraging share price than access to cash. This opens the door to strategic flexibility

• Global presence and reach, only the largest exchanges have offices in major financial centres, Refinitiv’s network dwarfs these

• Content. While exchange traded data is now available at low cost through multiple vendors, only Refinitiv, along with Bloomberg, offers globally comprehensive breadth and depth of OTC markets. The investment to match this is beyond the resources of other competition.

• WM Benchmarks to complement FTSE Russell indices. OTC benchmarks are beginning to come into their own and WM is the leader. The potential to create a wider range of tradable products is waiting to be exploited

• Entry point into OTC electronic markets especially FX through the Refinitiv Brokerage which goes someway to mitigating the loss of MTS’ fixed income trading. As liquidity grows in OTC markets which generates electronic trading opportunities it offers a way to tap into trading a wider range of asset classes

• Refinitiv has a hodgepodge of bolted on, under-utilised, and disparate subsidiaries ranging from esoteric analytics, risk to trading solutions on to Regtech, and beyond that would be better off as independent entities converted from the cost side to client side of the ledger

However, leveraging all this undoubted potential requires re-structuring, and therein lies problems.

TRIPPING UP

Identifying problems with a business is always easier than solving them, however, on the plus side, it does provide places to start.

• Refinitiv’s byzantine management structure. Think when Franz Kafka met Sigmund Freud. Data is dynamic, financial markets are changing faster thanks to data, requiring greater management agility and flexibility that is just not there.

• Revenue is going nowhere. From US$7.74 Billion in 2010 to an estimated US$6,250 Billion in 2020, stagnation has set in over the last decade, however two parts of this problem are pretty clear:

- Inefficient pricing model(s). Refinitiv’s pricing models are driven more by what can be negotiated than operating a standard model. Changing the model would stabilise the issue

- Plugging revenue leakage. Poor reporting, ineffective audits, both contribute to revenue leakage. Ensuring clients pay for what they use ought to be high on the agenda. This is all about effective process

• Heavy reliance upon aggregated data, a fiercely competitive market. This is one problem going nowhere, data saturation within major financial institutions is a fact, so price becomes a key differential. Refinitiv needs more of its own original data to provide better points of differentiation

• Prisoner of Legacy technology. Quite simply the infrastructure cost of installing, then supporting, a Refinitiv feed or terminal places the company at a clear disadvantage, especially at smaller institutions. More lightweight tech, costing less, requiring lower maintenance, is the wave of the future. While providing heavy duty tech does (reluctantly) lock in clients, does it benefit either Refinitiv or their clients? Is it really necessary for Refinitiv to be so heavily committed to the technology end of the business? At least to the degree it is right now?

FUTURE PERSONALITY

The question now is what kind of company will the LSEG become? Will it be primarily a data business, an exchange, or find a balance between the two?

Given the disparity in corporate sizes there is the real danger that LSEG will detach itself from its exchange roots. This has never been a danger for ICE because the management and business balance clearly favours the trading venues

When valuing companies, investors have a clear preference for trading venues, especially CME, and MarketAxess, original data providers, S&P Global, IHS Markit, MSCI, Moody’s or balanced hybrids, ICE. Owning the data at source, a happy by-product of being a trading venue, benchmarks like indices, is far more sticky and commands large premiums over data aggregators which will need to look more at their tech to gain an advantage.

The Refinitiv deal gives LSEG bulk, but is this mass or muscle?

Keiren Harris 17/02/2021

www.datacompliancellc.com

Please email knharris@marketdata.guru for a pdf or information about out consulting services