To download the Presentation please go to https://wp.me/a8cuRb-jx

Understanding Data Ownership & Lifeblood of the Business

While this article is aimed at Financial Information and Market Data Professionals, the principles behind the concepts are gaining increased traction across all areas of data sourcing and usage.

Since the beginning of time access to information has been the most important business tool for decision making. The explosion in data utilisation is critical to understanding why effective data compliance will only become ever more important. The question then becomes why is it important?

- Financial Institutions, like all companies, rely on increasing access to externally sourced data, thanks to availability and accessibility.

- Data ubiquity means greater data utilisation both within the enterprise and distribution beyond to connect with clients.

- Critically this data is licenced, not sold, for use.

Data Ownership

- That data is owned by someone, for instance, Exchanges, Index Creators, Original Works Creators, Newswires, and many others.

- The greater the number of ways to use data, means the greater number of ways to charge for it, and data sources are in the game to make money.

- Equally broader and deeper data usage substantially raises the risk over loss of control, monitoring and reporting.

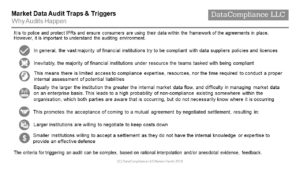

- Data Sources lay down rules (policies) for use, and out of scope usage (non-compliance) is policed by the auditors.

Non-compliance brings liabilities which run to the million$ and beyond. So what triggers a data audit and why?

So what should data consumers do?

- Implement best practice data governance and compliance policies.

- Backed by full and complete management documentation

- Have a proper contract and document management system in place, with a proper filing methodology (This is invariably done so badly………………)

- Conduct regular internal audits

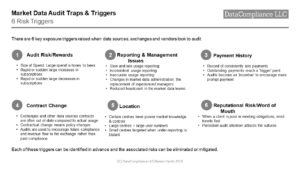

- Address the potential audit triggers