2.1 FRTB Compliance and Consequences

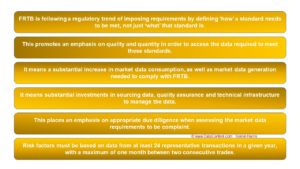

The FRTB is following a regulatory trend of imposing requirements which increasing place a premium on the sourcing of market data, its quality, consistency, and frequency.

These requirements are likely to prove not only onerous to maintain compliance but costly in terms of market data sourcing and on-going data management as there are clearly defined standards that need to be first met, and then complied with.

This places an emphasis on appropriate due diligence when assessing the market data requirements to be complaint.

Major concerns will need to be addressed by putting down some requirements around the sufficiency of the data, its integrity and the quality criteria. For instance, Banks will need to demonstrate that the data ingested by their models is real and derived from actual transactions.

This is a major change in terms of how institutions frame the data entering the models and the resultant outputs.

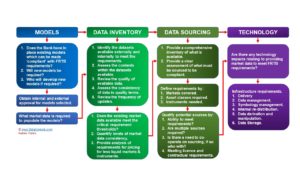

It suggests there are 4 ways to analyse the FRTB requirements in data terms from a compliance perspective.

A significant feature is the explosion in data requirements, not only in terms of sheer quantity of information generated, but the need to bundle internal and external data on an unprecedented scale while creating meaningful standardised formats.

A definite challenge to the Data Scientists, but also could truly bring out the promise of the proponents of ‘Big Data’ solutions.

2.2 The FRTB Data Trail

FRTB means a major upgrade to the traditional internal model-based approach (IMA) by working towards an enhanced standardised approach. Crucially with approvals being devolved to the desk level, this will generate a significant increase in the amount of data being produced, analysed, validated and reported.

The key feature is that this new standardised approach and models are being defined and determined by the regulators so that they have the ability to benchmark the financial health of Banks on a transparent peer to peer basis.

The FRTB Data trail now becomes an even greater consideration and it is no means as simple as our example flow diagram would suggest.

Key requirements will be access to trading data and reference data.

Trading desks that only use an internal models-based approach will have to include a capital add-on for each risk factor deemed to be underpinned by insufficient data.

This means any inability to access FRTB compliant data will have a direct impact on the financial institutions capital standing, i.e. it will be very expensive one way or the other.

2.3 FRTB The Internal Data Stakeholders

It is highly likely that every man and his dog will be want to be a stakeholder owing to the importance of meeting the new requirements.

As market data is fundamental to the requirements, this needs to be understood and the appropriate input through analysis and advice needs to be delivered from qualified personnel with proven expertise, either inhouse or external.

There are 3 core stakeholder groups:

- Business strategy and leadership level.

- Internal advisor stakeholders providing the advice and analysis for the strategy level

- External stakeholders providing their own input through the supply of services and products to meet the business’ needs.

This is not an exhaustive view, but is intended to focus the requirements.

Risk and compliance must be seen as separate parties as the impacts regarding both are fundamentally different. Equally the now ubiquitous named Responsible Managers (RMs) will be required.

How the stakeholders relate and interact with each other by leveraging the core competences of each party will define the success of implementing FRTB.