STRATEGIES & TRANSITIONS

1.0 2022 EXCHANGES IN REVIEW: PLUS ÇA CHANGE, PLUS C’EST LA MÊME CHOSE1

The title may appear to be contradictory, yet it sums the world of the exchanges as they evolve at an increasingly rapid rate.

The combined 2022 revenue of the Top 13 Exchanges2 was US$50,014 Million an increase of 9% over 2021. The four primary sources of income remain unsurprisingly (1) trading commissions, (2) listing fees/IPOs, (3) clearing & settlement services, and (4) the increasingly important information services including data, analytics and indices which are a focus of this report. In comparison over the year the collective information services revenues climbed 11% to US$14,825 Million. An important caveat is the purchase of Refinitiv by LSEG which has significantly skewed exchange revenue figures since 2020.

The Changes

As exchanges ‘boldly go’ and grow it begs the question ‘What makes an exchange unique?’ There are now multiple ways to trade listed instruments, including dark pools, off market trading, and options to clear and report those trades. Some exchanges have entered the electronic FX, fixed income, and commodities markets arenas competing head on with venues like MarketAxess, Tradeweb, and the Inter-Dealer Brokers. All have an information services business of varying degrees of maturity. The largest exchanges are busily investing heavily in data and analytics, with multiple acquisitions every year, 2022 being no exception, and now entering partnerships with Big Tech, CME/Google, Deutsche Börse/Google, LSEG/Microsoft, NASDAQ/AWS, which are far more ambitious than the distribution agreements of an ASX/Google, or Euronext’s decision to avoid such engagements altogether.

The Same

Exchanges’ uniqueness lies in their heartland, the domestic listings and IPO business. Companies may list on multiple exchanges, but they never list on competing domestic exchanges (where these exist), though they can be traded on competing exchanges. This has created core monopolies with a parochial twist, domestic markets are relatively finite in the number of IPOs that take place each year, and the majority of trading in local markets is onshore. While listings remain core exchanges will remain differentiated from other trading venues.

1 “The more things change , the more they stay the same” Jean-Baptiste Alphonse Karr

2 SIX Market Cap is a calculation based on European exchange P/S ratios

2.0 2022 IN PERSPECTIVE

KEY EVENTS OF 2022

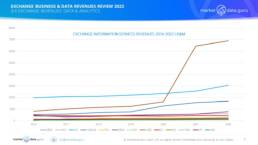

- The 13 leading exchanges had estimated revenues for all business activities of $25,019 Million in 2016 which grew to $50,014 Million in 2022, i.e. an increase of 84% over the period.

- Their data and analytics businesses had combined revenues of $5,367 Million in 2016 which increased 150% by 2022 to reach $14,825 Million. However, these figures are distorted because of the LSEG/Refinitiv merger.

- The increasing engagement of Big Tech in partnering with exchanges, looking not only for content but critically solutions to drive processing into their cloud environments

- Data driven Exchanges remain active in the information services sector with acquisitions and partnerships

NOTABLE EVENTS FOR 2022

- March 2022. DBAG buys Fund Data manager Kneip, and announces intention to build a fund data hub in Luxembourg

- April 2022. JPX finally restructures and establishes JPX Market Innovation and Research, to provide financial market data and index services related and system related services. JPX also wants to evolve into a ‘smart’ exchange allowing anyone to trade any product securely and easily

- June 2022. CBOE completes takeover of NEO a Canadian securities exchange and a non-listed securities distribution platform

- June 2022. Euronext brings MTS and Euronext Securities Milan’s trading platform inhouse buying Nexi’s technology business for €57 million

- July 2022. ICE expands ESG coverage buying Urgentem which supplies global corporate emissions and climate transition data

- October 2022. LSEG acquires Quantile for £274 Million. The deal was important because it was investigated by the UK Competition and Markets Authority (CMA) over concerns it would stifle competition in analytics for trading and risk management solutions services.

- October 2022. DBAG’s Qontigo offers the ‘Axioma Portfolio Optimiser’ and ‘Axioma Equity Factor Risk Models’ through Goldman Sachs Financial Cloud for Data

- November 2022. NASDAQ purchases Verafin for $2.75 Billion as part of a strategy to build up its financial crimes and AML businesses

- December 2022. LSEG and Microsoft launch 10-year partnership for providing data and analytics across cloud infrastructure solutions with Microsoft acquiring 4% of LSEG.

- December 2022. LME’s nickel woes may encourage HKEx to sell to another exchange, ICE said to be interested, CME possibly. Would be an interesting backdoor route into China with the LME’s valuable clearing business

3.0 EXCHANGE BUSINESS REVENUES & MARKET SHARES

2022 KEY POINTS: TOTAL REVENUES SUMMARY

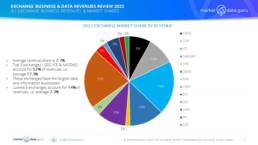

The five largest exchanges, (CME, DBAG, ICE, LSEG & NASDAQ) all have market shares over 10% and combined account for 73% of the Top 13 revenues. These exchanges are more diversified, global in operation, highly liquid and face few difficulties attracting investors. All except ICE have recently inked deals with Big Tech Cloud Providers, unlike any of the other exchanges. This is significant.

- It is somewhat a repetitive theme that from 2016 onwards LSEG produced overall revenue growth of 367% and that mostly came in 2021 through the Refinitiv acquisition, giving it the largest market share of 22%

- However, over the period CBOE produced an even more spectacular rate of revenue growth, 463%, driven by a broad acquisition strategy including venues, e.g. Chi-X, clearing services, and analytics to gain a share of 8%. CBOE has an unique global portfolio of trading venues

- The second and third largest exchanges ICE (19%) and NASDAQ (12%) are both combinations of US and European exchanges with substantial data and analytics businesses. ICE being a major global vendor as well, while NASDAQ has a strong index business and has been increasing its presence in the financial markets surveillance and AML space

- CME (10%) is the largest exchange still primarily focused on traditional trading activities having bought out regional rivals. Its key products including S&P500 and UST30 Year Treasuries are globally traded, and where other exchanges may have competing products they do not have anything close to CME’s liquidity. This has a direct data impact allowing CME to charge premiums for its ‘super-instruments’

- In some ways Deutsche Börse (10%) has adopted the most interesting diversification strategies, buying into power trading venues across the EU and US, as well as purchasing 81% of Institutional Shareholder Services, a leading governance, ESG data, and analytics services provider.

- Euronext (3%) has pursued a strategy of buying a Pan European equity market presence, however there are few, if any, remaining opportunities of significance

The smaller exchanges can be characterised by their domestic market focus, with limited non-domestic presences.

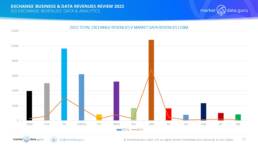

3.3 EXCHANGE REVENUES: DATA & ANALYTICS

2022 KEY POINTS: INFORMATION SERVICES SUMMARY

- Exchanges information, data and analytics revenues have seen steady yet unspectacular growth, which is to be expected as the business is built upon recurring subscription income.

- This produces a stable flow unlike the more volatile trading and IPO revenues, and exchange managements are increasingly expecting more from these businesses, but in many cases are still not providing the resources to meet their aspirations.

- The exchanges that have invested in adding value added services (primarily through acquisition) like analytics and providing solutions are seeing better revenue growth

- Certain exchanges have become too dependent upon raising fees as their primary revenue generator without taking their data businesses to the next level.

- The result for at least one exchange was to raise fees 10% only to see revenues increase less at 7%. This leads on to the point below

- A data content only strategy hits the twin barriers of finite consumption by financial institutions, and their reluctance to pay for marginal price data usage. This looks to come when primarily price data only businesses generates in the region of +/-15% of total revenues

- In 2023 the concept of audit led revenue generation is coming into question, partially because of client and regulatory pushback but primarily because it is inefficient. This does negate the value of some audits, more the need for better compliance strategies

Note: This is an area where MDG and partners have worked with both exchanges and data consumers to create and provide practical and mutually beneficial compliance friendly environments

3.5 EXCHANGE REVENUES: DATA & ANALYTICS BUSINESS DEVELOPMENT

2023 CHALLENGES

- Increasing direct competition from off market/alternative transaction venues such as dark pools which according to a December 2021 article published by NASDAQ accounts for 40%+ of average daily market share in the US. Continued over-reliance upon Bloomberg and Refinitiv for direct and indirect revenue flows. For many exchanges these two vendors alone account for 60%>70% of data revenues, and the smaller the exchange the greater that reliance

- Vendors will continue to be the primary mechanism exchanges use to reach their clients, firstly because of the cash generation, and secondly, most lack presence outside their domestic markets.

- However upside revenue growth from the vendors is limited because there are a finite number of vendors and they are also at saturation point. All the traditional vendors have all the exchange vendor they want and need.

- Still not enough emphasis on new types of data consumers, especially for third party managed services, FinTechs, wealth management and mass market distribution via the internet

2023 STRATEGIC OPTIONS

- Broaden the capture of internal data, especially transaction and unstructured data for commercialisation

- Develop fee structures for delayed and historical data, these tend to be ignored by the exchanges, but certainly not by the data consumers

- Assess the value of data for use in benchmarks and indices

- Need to identify and develop new channels to market, there are brokerages which are developing price and trading applications, as well as quasi venues linked to charting and trading tech such as TradingView

- Leverage new technologies for data capture and distribution, especially analytics

- Engage with new types of data consumer and data usage, especially in the software solutions and informational services spaces

- Broaden the horizon beyond the primary market and large secondary market players

4.0 BUSINESS TRENDS 2023

SUMMARY

Exchanges are protected by being highly regulated, and potent political symbols. This is a double edge sword which has meant once opportunities to expand in the domestic market become closed, there are few overseas peer possibilities, so by default the only option for growth is diversification. Fortunately there have been and are many opportunities which have exchanges have taken to varying degrees of success, or logic, and this pattern continues, especially in areas where regulation is not as proscriptive, i.e. Electronically traded OTC markets, indices (for now), data and analytics.

The 5 key points of diversion albeit with market overlaps continue to be:

1.Clearing, settlements & post trade solutions. Often the first stop for exchanges, opening doors to new asset classes and a backdoor entry into overseas markets. CBOE, Deutsche Börse, Euronext, and LSEG all have interests in clearing houses which operate on an international basis.

2.OTC electronic venues. Competitive but highly liquid, preference has been for FX and Fixed Income markets but increasingly commodities, energy, and power, as long as the venue is automated, and regulatory friendly.

3.Indices, Information, Data & Analytics. The largest exchanges have broadened their strategies to add value to their core domestic price data, and expand into new markets. The first port of call has usually been indices based upon the home market, (Euronext, NASDAQ, NYSE and SIX).

4.ESG & Shareholder services. Corporate governance is increasingly fundamental to investment decisions, but like ESG Data the market is fragmented and relatively low margin. Virtually all exchanges have some form of plan to develop ESG based products and services yet are now facing the intrinsic problems related to lack of standards, and poor data methodologies. Exchanges seem to be pulling back from E and S, to focus on G

5.Realty. The world’s largest asset class, yet only ICE has seriously entered this market, having made a series of recent acquisitions. This could open up intriguing possibilities.

6.0 REPORT CONCLUSIONS

2023 LOOKING FORWARD

The ‘Static Theory of the Universe’ is a cosmological model in which the universe is both spatially and temporally infinite, with space neither expanding nor contracting. This would be good description of exchanges 20 years ago where each one could be considered their own galaxy that did its own thing in isolation but all similar in the way they functioned.

What we see in 2023 is each Exchange is still its own individual galaxy, yet some are growing through diversification into new markets, especially data & analytics while others focus on internal organic growth which seems to offer limited opportunities.

The Tier 1 exchanges are stratifying into two levels, the upper differentiated by offering a wide range of value added data and analytical solutions and services pushing clients towards multiple asset class trading venues with a range of proprietary price data and index products. All of which proving attractive to Big Tech wanting to push financial institutions and their data processing to their Clouds, who in return offer the exchanges the ability to reach new universes of investors and data consumers on a global scale.

These are the Top 5 (CME, DBAG, ICE, LME & NASDAQ) plus the CBOE which is rapidly rising through the ranks. Their relationship with Big Tech (excluding ICE, and CBOE for now), is one of partnership which is both broader and definitely deeper than other exchanges more limited distribution oriented arrangements with the likes of AWS, Google and Microsoft.

The remaining 7, of which at least two recognise they need to develop new strategies, do not have the same financial firepower despite being asset rich. The APAC exchanges in particular seem wedded to legacy thinking, although JPX has established its new data innovation business (yet still fixated upon their domestic market) and SGX invested in Scientific Beta Indices.

They are in danger of becoming ‘content fodder’ and will find their own trading clients become increasingly reliant upon third party services, often owned by other exchanges. While many markets remain ‘protected’ to some extent, smaller exchanges can expect increased, albeit indirect at first, competition, from their global peers.

Adapting to The Cloud should be forefront of any exchange’s thinking across all businesses. However, what works for one exchange will not necessarily work for another, therefore flexible strategies with a long term focus need to be developed sooner rather than later.

Keiren Harris 18 April 2023

For our information on our consulting services please visit www.marketdata.guru/data-compliance

To contact us knharris@marketdata.guru

Please contact info@marketdata.guru for a pdf copy of the article