1.0 2022 EXCHANGES IN REVIEW: PLUS ÇA CHANGE, PLUS C’EST LA MÊME CHOSE

The title may appear to be contradictory, yet it sums the world of the exchanges as they evolve at an increasingly rapid rate.

The combined 2021 revenue of the Top 13 Exchanges2 was US$45,991 Million an increase of 22% over 2021. The four primary sources of income remain unsurprisingly (1) trading commissions, (2) listing fees/IPOs, (3) clearing & settlement services, and (4) the increasingly important information services including data, analytics and indices which are a focus of this report. The combined market cap of the exchanges in April 2022 was US$418,085 Million, up 1% year on year. In contrast in the same period the collective information services revenues climbed 10% to US$4,727 Million.

THE CHANGES

As exchanges ‘boldly go’ and grow it begs the question ‘What makes an exchange unique?’ There are now multiple ways to trade listed instruments, including dark pools, off market trading, and options to clear and report those trades. Some exchanges have entered the electronic FX, fixed income, and commodities markets arenas competing head on with venues like MarketAxess, Tradeweb, and the Inter-Dealer Brokers. All have an information services business of varying degrees of maturity. The largest exchanges are busily investing heavily in data and analytics, with multiple acquisitions every year, 2021 being no exception. The Refinitiv merger has resulted in LSEG being more a data vendor than it is an exchange, at least for now.

THE SAME

Exchanges’ uniqueness lies in their heartland, the domestic listings and IPO business. Companies may list on multiple exchanges, but they never list on competing domestic exchanges (where these exist). This has created core monopolies with a parochial twist, domestic markets are relatively finite in the number of IPOs that take place each year, and the majority of trading in local markets is onshore. While listings remain core exchanges will remain differentiated from other trading venues.

KEY EVENTS FOR 2021

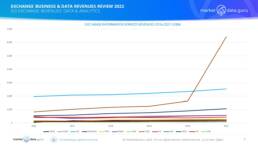

- The 13 leading exchanges had estimated revenues for all business activities of $25,055 Million in 2016 which grew to $43,973 Million in 2021, i.e. an increase of 76% over the period.

- In contrast their data and analytics had combined revenues of $5,369 Million in 2016 which increased 141% by 2021 to reach $12,918 Million. However, these figures are distorted because of the LSEG/Refinitiv merger, and the adjusted increase, excluding Refinitiv would be approximately 76% underperforming the overall torals.

- Exchanges engage and enter the crypto-markets, see below

OTHER EVENTS FOR 2021

- Jan 2021. LSEG completes merger with Refinitiv, invests £1 Billion in re-structuring and replaces senior management at Refinitiv

- 2021. LSEG re-organises its subsidiaries by transferring Refinitiv’s OTC trading platforms to its venues business, and moves FTSE Russell Index and Analytics units into the remaining Refinitiv data business

- June 2021. Deutsche Börse acquires of trading and brokerage firm Crypto Finance to offer its clients direct digital assets services including trading, custody, investment services and post-trade

- August 2021. Euronext completes purchase of Borsa Italiano including MTS Bond trading platform from LSEG for €4.4 Billion as divestiture for EU approval of LSEG/Refinitiv merger

- August 2021. TMX completes acquisition of AST Trust Company for CA$165 Million to add a complementary portfolio of transfer agency, equity plan solutions, corporate trust, structured finance, and proxy-related services.

- September 2021. SIX gains regulatory approval for digital asset exchange to act as a central securities depository with associated company, SDX Trading, obtaining a licence to act as a stock exchange

- December 2021, CBOE buys US-based digital asset spot market, ErisX Digital Holdings aimed at a growing market for digital assets by institutional investors

- December 2021. ICE expands in alternative data and ESG analytics with purchases of risQ and Level 11 Analytics.

2022 KEY POINTS: SUMMARY

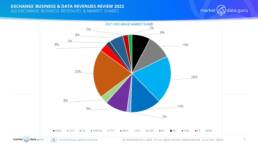

- The four largest exchanges, (CME, ICE, LSEG & NASDAQ) all have market shares over 10% and combined account for 63% of the Top 13 revenues. These exchanges are more diversified, global in operation, highly liquid and face few difficulties attracting investors

- It is somewhat a repetitive theme that from 2016 onwards LSEG produced overall revenue growth of 307% and that mostly came in 2021 through the Refinitiv acquisition, giving it the largest market share of 20%

- However, over the period CBOE produced an even more spectacular rate of revenue growth, 397%, driven by a broad acquisition strategy including venues, notably Chi-X, clearing services, and analytics to gain a share of 8%

- The second and third largest exchanges ICE (20%) and NASDAQ (13%) are both combinations of US and European exchanges with substantial data and analytics businesses. ICE being a major global vendor as well.

- CME (10%) is the largest exchange still primarily focused on traditional trading activities having bought out regional rivals. Its key products including S&P500 and UST30 Year Treasuries are globally traded, and where other exchanges may have competing products they do not have anything close to CME’s liquidity. This has a direct data impact allowing CME to charge premiums for its ‘super-instruments’

- In some ways Deutsche Börse (9%) has adopted the most interesting diversification strategies, buying into power trading venues across the EU and US, as well as purchasing 81% of Institutional Shareholder Services, a leading governance, ESG data, and analytics services provider

- The smaller exchanges can be characterised by their domestic market focus, with limited overseas presence. However, CBOE, SGX, and TMX have demonstrated innovative data strategies.

2022 KEY POINTS: TOTAL REVENUES

Without LSEG acquisition of Refinitiv, and ICE’s 18% rise, the remaining 11 exchanges had a modest combined 5% increase in revenues, although CME and ASX recorded total marginal drops in income. Overall exchanges revenue growth has been steady and positive

2022 KEY POINTS: INFORMATION SERVICES SUMMARY

- Exchanges information, data and analytics revenues have seen steady yet unspectacular growth, which is to be expected as the business is built upon recurring subscription income.

- This produces a stable flow unlike the more volatile trading and IPO revenues, and exchange managements are increasingly expecting more from these businesses, but in many cases are not providing the resources to meet their aspirations.

- LSEG’s takeover of Refinitiv provides the group’s obvious outlier

5.1 EXCHANGE REVENUES: DATA & ANALYTICS

2022 CHALLENGES

- Increasing direct competition from off market/alternative transaction venues such as dark pools which according to a December 2021 article published by NASDAQ accounts for 40%+ of average daily market share in the US. Continued over-reliance upon Bloomberg and Refinitiv for direct and indirect revenue flows. For many exchanges these two vendors alone account for 60%>70% of data revenues, and the smaller the exchange the greater that reliance

- Vendors will continue to be the primary mechanism exchanges use to reach their clients, firstly because of the cash generation, and secondly, most lack presence outside their domestic markets.

- However upside revenue growth from the vendors is limited because there are a finite number of vendors and they are also at saturation point. All the traditional vendors have all the exchange vendor they want and need.

- Still not enough emphasis on new types of data consumers, especially for third party managed services, FinTechs, wealth management and mass market distribution via the internet

2022 STRATEGIC OPTIONS

- Broaden the capture of internal data, especially transaction and unstructured data for commercialisation

- Develop fee structures for delayed and historical data, these tend to be ignored by the exchanges, but certainly not by the data consumers

- Assess the value of data for use in benchmarks and indices

- Need to identify and develop new channels to market, there are brokerages which are developing price and trading applications, as well as quasi venues linked to charting and trading tech such as TradingView

- Leverage new technologies for data capture and distribution, especially analytics

- Engage with new types of data consumer and data usage, especially in the software solutions and informational services spaces

- Broaden the horizon beyond the primary market and large secondary market players

8.0 PEER REVIEW MARKET DATA & INFORMATION SERVICE REVENUES

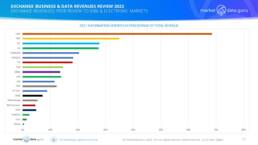

ICE, LSEG, and SIX are not really comparable to IDBs let alone other exchanges because these exchanges own fully fledged vendor businesses, while others like CBOE, DBAG, and NASDAQ have been acquisitive. However, they all compete in the same space with each other.

For exchanges, and IDBs, both transaction commission fees or IPO fees can be highly volatile as they are both built around once off events impacting smooth revenue flows. HKEx’s relative collapse in its Market Cap over the last year has been directly correlated to an IPO drought.

In comparison information services fees are remarkably sticky. While not as ‘sexy’ as transactions offers reliable and stable income across the business cycle. Unfortunately exchanges over-demand from their data businesses

KEY POINTS

- ICE, LSEG and SIX are outliers with their vendor businesses

- The lower the percentage of overall revenue represented by information services the greater the business potential

- There is a limit to how much revenue traditional price data can generate before saturation point has been reached.

- 15% of total revenue appears to be a saturation point/benchmark transition level where exchanges below this can still grow their base data revenues.

- To increase revenues above 15% then exchanges need to develop advanced strategies by introducing value added services like analytics, investment decision tools, plus enter new markets

9.4 BUSINESS TRENDS 2022 SUMMARY

Exchanges are protected by being highly regulated, and potent political symbols. This is a double edge sword which has meant once opportunities to expand in the domestic market become closed, there are few overseas peer possibilities, so by default the only option for growth is diversification. Fortunately there have been and are many opportunities which have exchanges have taken to varying degrees of success, or logic, and this pattern will likely continue.

The 5 key points of diversion albeit with market overlaps have been:

1.Clearing, settlements & post trade solutions. Often the first stop for exchanges, opening doors to new asset classes and a backdoor entry into overseas markets. CBOE, Deutsche Börse, Euronext, and LSEG all have interests in clearing houses which operate on an international basis.

2.OTC electronic venues. Competitive but highly liquid, preference has been for FX and Fixed Income markets but increasingly commodities, energy, and power, as long as the venue is automated, and regulatory friendly.

3.Indices, Information, Data & Analytics. The largest exchanges have broadened their strategies to add value to their core domestic price data, and expand into new markets. The first port of call has usually been indices based upon the home market, (Euronext, NASDAQ, NYSE and SIX). However some exchanges (ASX, SGX, TMX) have outsourced these.

4.ESG & Shareholder services. Corporate governance is increasingly fundamental to investment decisions, but like ESG Data the market is fragmented and relatively low margin. Virtually all exchanges have some form of plan to develop ESG based products and services.

5.Realty. Only ICE has seriously entered this market, having made a series of recent acquisitions. This could open up intriguing possibilities.

11.0 REPORT CONCLUSIONS

2022 LOOKING FORWARD REPORT CONCLUSIONS

The ‘Static Theory of the Universe’ is a cosmological model in which the universe is both spatially and temporally infinite, with space neither expanding nor contracting. This would be good description of exchanges 20 years ago where each one could be considered their own galaxy that did its own thing in isolation but all were pretty similar in the way they functioned.

As we discover more, theories change. The exchange universe is extremely active, on the one hand they are moving away from each other rapidly as they diversify in different ways, on the other there is the occasional collision when mergers happen, producing the likes of CME Group and Euronext, or a competing venue moves on to another’s turf, CBOE.

Fortunately for many exchanges, local protectionism keeps their core trading commissions, IPO fees, and local price data services insulated from their larger brethren, and for some this allows them to avoid making long term strategic decisions. For those exchanges which are listed high market caps and positive dividend yields keeps the investors happy, while unlisted exchanges need not worry so much about pesky issues like revenue generation.

Unfortunately for many exchanges, the ability of their larger brethren to grow services like clearing, buy trading platforms, develop index businesses, and acquire data & analytics providers will bring competition to their markets because they will be offering these services to financial institutions on a global basis. Smaller exchanges already see DBAG, ICE, LSEG, and NASDAQ active in their territories, indeed many rely upon NASDAQ technology for their trading platforms.

What we see is the top 13 exchanges dividing into two tiers, the Tier Ones (CME, DBAG, ICE/NYSE, LSEG, & NASDAQ) pulling away from the Tier Twos (ASX, CBOE, Euronext, HKEx, JPX, SGX, SIX & TMX) in revenue terms simply because they will grow through relatively aggressive strategies of acquisitive diversification, and money flows begets greater money flows.

Keiren Harris

24 June 2022

For the full report with detailed analysis please email: info@marketdata.guru. The Table of Contents is shown below.

For information on our consulting services please email:

knharris@datacompliancellc.com