1.0 IDBs IN REVIEW: FORGOTTEN, IGNORED, BUT FAR FROM IRRELEVANCE

When I was a kid growing up the staple of a television diet was the Western. John Wayne was still around and Hollywood still lived, breathed cowboys. Little did we know the Golden Age of the Western from the late 1930s to early 1970s was near its end, and sadly without any romantic ride off into the sunset. In writing this report, and reading some negative numbers, I have been asking myself are the Interdealer Brokers heading the same way?

After all the combined 2021 revenue of the Big 4 Brokers was US$6,481 Billion, greater than TMX’s US$778 Million yet their notional market cap (Marex being a calculation) on the 18 April 2022 valued the IDBs at US$4,600 Million compared to TMX’s US$5,593 Million! For perspective TMX is the smallest of the 13 largest global exchanges by market cap currently.

If TP ICAP alone with revenues of US$2,427 Million is valued at US$1,483 Million, applying TMX’s Sales/Price Ratio of 7.2 would deliver a market cap of US$17,447 Million. In comparative income terms the HKEx has similar revenues of US$2,671 Million yet has a market cap of US$53,601 Million.

Restless Shareholders

Reality is the IDBs are either grossly under-valued or the market thinks they are heading the way of the on-screen cowboy. In March 2022 Phase 2 the US Hedge Fund wrote to TP ICAP’s Chairman urging the group to be put up for sale, citing its “disastrous share price decline”. Slight problem, finding a buyer.

What is the problem?

This report analyses the IDBs from a high level with specific emphasis on the importance to all IDBs of the datasphere. Included are the now 4 ‘majors’, BGC Partners (BGC), TP ICAP (TPI), Marex and Tradition (TFS).

All except Marex are listed, though in 2020 this was an active option, one is based in New York (BGC), two in London (Marex & TP ICAP) and Tradition is Swiss/French. Four brokers may sound like an oligopoly, however, the Interbank market is rife with cutthroat competition from companies of all shapes, sizes and flavours, plus the IDB’s own clients as well.

2.0 2021 IDBs IN REVIEW: KEY EVENTS

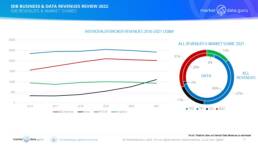

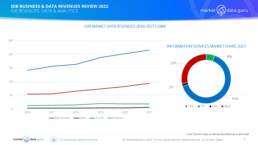

- The leading 4 IDBs had estimated revenues for all business activities of $5,817 Million in 2016 which grew to $6,481 Million in 2021, i.e. an increase of 25% over the period.

- In contrast the IDBs data and analytics had combined revenues of $210 Million in 2016 which increased 49% by 2021 to reach $335 Million

2.1 2021 IDBs IN REVIEW: OTHER EVENTS

- Marex surpasses Tradition to become the third largest broker by annual revenue. US$1,483 Million to US$896 Million.

- Marex’s business aided by higher energy prices, and the data business by an IP disposal (therefore an once off)

- Marex continues with an acquisition strategy buying Tangent Trading, Paris based grain futures broker Arfinco & BIP Asset Mngmt, Anglo-French Volcap Trading

- TP ICAP completes purchase of Liquidnet opening up new markets, but unfortunately got hit by lower equity revenues in 3Q2021, however this can be considered a temporary phenomenon

- TP ICAP launches new digital assets platform with Jane Street and Virtu Financial added as market makers

- TP ICAP reported to have looked at outside investment or spinning off its market data and analytics business, valuing it far higher than the underlying brokerage, an initiative that is highly likely to be returned to in the future, if it is not already a strategic objective. The renaming of the business to Parameta was probably an earlier indicator

- BGC Partners re-organised their electronic broking and market data business under the ‘Fenics’ brand. This is a deliberate approach to differentiate the business from the hybrid broking operation, plus Fenics is also a name more familiar beyond the IDB world, though again looks like a pointer towards a potential spin-off.

- TraditionData launched new SOFR Indicative Rate service combining it with anonymised trade and volume data from BNY Mellon

- Meitan Tradition in Japan becomes a wholly owned Tradition subsidiary

4.0 2021 BUSINESS REVENUE HIGHLIGHTS

- From 2016 onwards Marex easily produced the largest overall revenue growth of 237% driven an acquisition strategy with a surge in 2021 propelled by volatile energy trading but continues to neglect its data business

- TP ICAP and Tradition’s revenues have remained relatively flat, while BGC has seen growth, however this plateaued in 2019

- Given acquisitions and data business expanding as a share this indicates pressure on the core brokerage businesses

- BGC Partners and TP ICAP combined market share declined from 77% for all businesses in 2020 to 68% in 2021 and 93% for data & analytics services

- IDBs percentage of revenues from data & analytics, 5%, lags significantly behind exchanges

4.1 2021 MARKET DATA REVENUE HIGHLIGHTS

- Each of the IDBs data businesses have unique OTC market coverage, albeit with content overlap, leading to different prices for many of the same instruments depending upon source.

- This works to the IDBs advantage because financial institutions demand a minimum of 2 sources for OTC markets

- Although TP ICAP and BGC represent 93% of the IDB’s data revenues, they do not produce anywhere near the same percentage of prices and data generated.

- Tradition has brought onboard new sales people in a renewed bid to increase revenues

- The challenges faced by IDB’s data businesses in 2022, and how these should be met, remain similar to those of 2021.

8.0 PEER REVIEW MARKET DATA & INFORMATION SERVICE REVENUES

Unlike their exchange equivalents (and excluding the US Equity markets), the IDBs do not have a relatively captive domestic market which can underpin their information services business.

What they do have is a far more diversified audience with a global presence, while competing head to head with each other by leveraging their relative strengths and weaknesses across asset classes. Importantly although each IDB offers prices across multiple markets, in the same market (i.e. Bonds) the volumes and values will be different. There is no OTC equivalent to the Consolidated Tape.

KEY POINTS

- Exchanges with larger data & analytics revenues than the IDBs are more diversified businesses, often with significant index services, and vendors in their own right

- In income terms TP ICAP and BGC are broadly comparable to Tier 2 Exchanges whose information businesses are still primarily driven by underlying trading prices and yet to expand

- Tradition is renewing its focus on market data with new hires, but needs to integrate more front office data from across its global dealing desks to broaden breadth and appeal.

- Marex brokers critical commodities, energy and freight markets, producing unique high value data it is disinterested in monetising

11.0 2022 LOOKING FORWARD REPORT CONCLUSIONS

I have long argued that the IDBs need to evolve their core businesses and leverage their data more effectively. It appears over the last 12 to 24 months this is happening. Whether this is by strategic design or lucky opportunism, which itself shows ability to spot then take advantage of a situation, this is altering overall businesses balances, by leveraging the core services, then adding value (that can be premium priced unlike broking) which did not previously exist. Major caveats must still be considered.

- Voice and hybrid broking has its place in the market. There are things humans can do which automated processes can’t, especially where complex multi-leg transactions involve less liquid markets, and there is difficult price level discovery.

- Such deals also entertain a premium, but the IDBs must accept that this is at best a declining market in percentage share terms.

- Inevitably, the ability to trade electronically will always trump voice, if only because of costs and client demand.

- The option the IDBs have is to sunset their own services before others do it for them, by moving existing voice brokerage services over to electronic trading at the earliest opportunity, which means planning in advance, not exactly the IDB’s strong suite. Certainly this will not be a popular choice but there might not be a viable alternative if the IDBs want to remain relevant.

Data as always is at the heart, especially if Bloomberg and Refinitiv are the IDBs two single largest dollar clients. There is plenty of opportunity for IDB’s to develop value added information related services compared to other data sources like the exchanges, if only because of their broad coverage across asset classes and unrivalled global presence. The IDBs should be leveraging their IP rights more effectively by building around consumer usage to create new revenue streams relatively rapidly. The opportunities are there.

Keiren Harris

08 June 2022

For the full report with detailed analysis please email: info@marketdata.guru. The Table of Contents is shown below.

For information on our consulting services please email:

knharris@datacompliancellc.com