1.1 Data Sourcing & Compliance A Lack of Preparedness

In May 2012, the Basle Committee released its first consultative paper to address real and perceived systemic weaknesses in the risk measurement of capital requirements by financial institutions by introducing greater transparency and consistency across jurisdictions by clarifying and defining boundaries (the heart of which is the Capital and Trading Books), analytical models with a standardised approach.

Unfortunately, the impacts of FRTB and the work required to implement it appear to have been under-estimated. There is a strong chance that many financial institutions will not be ready.

This lack of preparedness seems to have its roots in the resource black hole called MiFID2 compliance, insufficient communication and discussion across the financial communities, with critical industry and business sectors such as market data and technology yet to be brought onboard. Exacerbating the issue is the lack of FRTB expertise.

As we focus on the market data aspects the following points need to be carefully considered.

Each of these 5 issues are intrinsically related and any change in the methodologies, processes and systems in one area has an immediate and profound effect on changes in all the others.

Therefore, the price data strategies required to be FRTB compliant requires a higher degree of co-ordination across a wider range of a financial institutions business than has existed in the past.

It is of concern that this is not recognised as widely in the market place as it ought to be, and the ramifications across the business not analysed to the extent needed.

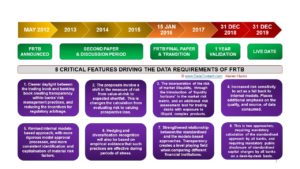

1.2 FRTB Milestones & Critical Market Data Features

Timeframes are going to be an important consideration, and worryingly few of the impacted financial institutions are on target to meet the pre-set deadlines.

Deadline for implementation is the 31 December 2019, but the regulators’ approval needs to be in place beforehand which assumes that Banks will actually have systems and processes up and running by 31 December 2019.

Our understanding from projects being initiated by major banks that putting in place the underlying market data foundations to meet FRTB compliance with take a minimum of 12 months. However, this is likely to prove over-optimistic.

The market data implications for implementing a strategy, requires a deep and thorough analysis of each and every potential pricing requirement that the FRTB will be imposing on financial institutions.

It means each new market entered into, introduces a new market data and pricing element. Questions about liquidity and lack of liquidity take on greater importance and need to be addressed.