3.1 FRTB Market Data 4 Strategic Components.

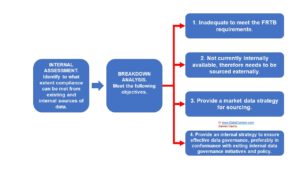

There are critical 4 components when reviewing the strategic requirements to implementing FRTB compliance.

In addition, there are also 7 immediate and diverse challenges to face, owing to the wide range of impacts right the way across the business.

It is inevitable that additional and unforeseen ‘Murphy’s Law’ challenges will be identified as clients implement their strategies.

But there are basic parameters that Banks will need to put in place when assessing their future market data requirements to be FRTB compliance.

This will transform the way Banks look at their trading data internally, and how they source data to meet future regulatory requirements.

3.2 FRTB Market Data Resource Assessment.

Objective. Banks must have access to the right market data to be in compliance with the FRTB regulatory requirements.

The financial institutions are likely to have to start from scratch and apply basic principles firstly in terms of models, and secondly the data required to populate those models.

This must bear in mind the intended environment brings together a new universe that comprises a number of factors which did not exist previously on such a business level scale.

- There will be multiple models requiring multiple inputs from multiple sources.

- These inputs will almost certainly come in different formats, employ different symbologies, as well as possessing other differentiators.

- All of these must then come together into a standardised environment.

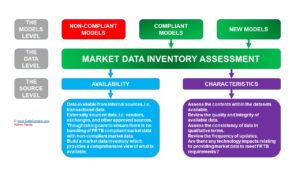

This creates a three logical three level assessment providing the foundation of a strategy approach.

- Understanding the Models and their data requirements.

- Assessing current and required data needs.

- Analysing availability and characteristics of the data requirements.

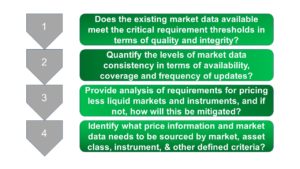

The FRTB market data environment assessment has to provide clear answers to the following 4 questions:

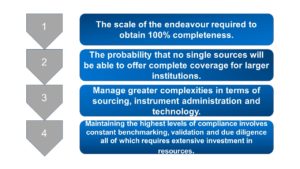

In itself, the process of conducting this internal audit of market data resources is logical and straightforward. However, there are 4 challenges that are clear and obvious.

3.3 FRTB Price Discovery and the Unvirtuous Circle

However, creating best practice frameworks around the requirements for and management of market data will lead to more successful implementation of FRTB requirements, and importantly ensure on-going compliance.

For financial institutions, it is better to invest more at the strategic planning stage than to pay out way more dollars later to reverse out of a bungled implementation.

Two of the reasons for the success of Millennium Compliance was the wide spread knowledge that the problem existed and the willingness to expend the effort in dealing with it.

Yet in stark contrast, one of the most important issues which seems to fly low under the radar regarding FRTB is the extent to which this will impact financial institutions. FRTB affects the majority, and there are potentially substantial costs, firstly to become compliant, and secondly to stay compliant. Neither of these issues should be under-estimated.

This could well drive Banks to look at marginal businesses, reduce competition, and be detrimental to liquidity across multiple markets.

What this could create is the opposite of the virtuous circle. As Banks pull out of market segments this reduces access to price discovery, which in turn places pressure on price quality, and so making it harder to stay compliant with FRTB.

It has been reported this is of concern to leading Central Banks, and so it should be. Price quality is an area FRTB intended to address in a positive format, however it could have completely the opposite effects, by:

- Reducing access to pricing in illiquid markets

- Reducing competition in low margin liquid markets.