4.1 FRTB Market Data Strategic Harmonisation

Objectives

Banks will be forced into rebuilding their Market Data foundation for reference data with a far more detailed, harmonised specifications to meet requirements by identifying the right sources, distributors and analytics. These are likely to require justification for selection of specific sources, as well as individual datasets.

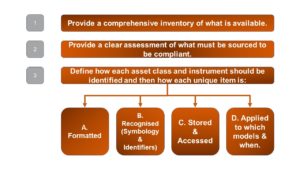

The core answer to the previous sections of this report is all about what market data needs to be sourced, and then the level of compliance.

The market data strategy.

Banks will effectively be creating new models for their ‘Golden Hierarchy’ of sources based on the following:

- Markets covered.

- By asset class.

- By instrument.

- Sources identified as meeting the above requirements.

- Contracts and documentation in place for usage.

However, compared to older linear style hierarchies, FRTB will be far more detail oriented and intensive in application, therefore ‘Big Data’ style approaches with a dynamic hierarchy will necessitate functional changes to traditional style reference data management and operational processes.

4.2 FRTB Sourcing and Licensing.

Objective.

Ensure compliance with sources policies and licences so that the data required to comply with FRTB regulations is used within the scope of those policies.

4.21 Requirements

Traditionally reference data licensing has not been as rigorously pursued as real-time data, however historic intra-day tick data is high value alongside evaluated pricing.

A little noticed but there has been a major movement of the pricing goal posts made in the ultimate development of FRTB. At one point, FRTB required all sourced pricing to be ‘observable transactions’, however the obvious impracticalities of this has led to the requirement morphing into the more business friendly ‘based upon observable transactions’.

This is a critical update as it introduces new options, for instance, to use evaluated pricing, though it is not clear whether the methodologies used to create evaluate prices need to be defined for use in models required by FRTB.

No matter, this subtle policy adjustment increases the value of Intra-Day tick data, evaluated pricing and more traditional end of day data, and sources will inevitably seek to recognise and exploit this.

4.22 Costs, Compliance, Resources

For the banks this means more costs, more licence management, and more resources required. All at a time when many Banks are trying to move in the opposite direction, and worryingly eliminating core expertise from their existing management.

This leads to the inevitability that Banks will need to be compliant with an even broader range of market data policies. This should necessitate a review of the existing agreements and contracts with data suppliers so that the market data assessed as required can be used within the permitted scope of the agreements to be compliant with FRTB regulations.

The objective must be to ensure the right agreements are in place for FRTB usage and that there are no potential dollar audit liabilities from any potential out of scope data usage.

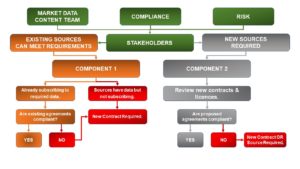

There are two process components which require management input from the advisory business departments.

Component 1.

Review existing agreements with existing data suppliers. If these are compliant with proposed market data usage, then they must be flagged as such.

If non-compliant then Banks will need to put in place the necessary steps to bring their market data licences into compliance.

Component 2.

As it is highly likely there will be gaps in coverage, there will be the need to bring on-board new sources and suppliers to meet the identified gaps in data coverage required to ensuring compliance with FRTB regulations.

At this point a prudent Bank will review its existing Contract Management and Document Management Systems methodologies. A leading reason for non-compliance with data licensing is failures with the CMS/DMS process structures resulting in key information becoming ‘unavailable’ to the right managers.

Once the preferred data sources have been established it is time to put them to work within the new FRTB environment for validation in the approval process.

4.3 FTRB Data Approval Planning.

Objective.

FRTB will require Banks to stress test and get approval for, the integration of market data within the new FRTB complaint models, including back testing, stress analysis, with a 12-month implementation period leading up to regulatory approval.

We review what is required to take the process up until the regulatory deadline of 31 December 2019. This assumes the regulators do not at this stage change that date, which could well be a possibility if Banks are unable to meet the challenge.

So, what are the likely approaches Banks are likely to take?

The Basle Committee has defined a two phase process for implementation.

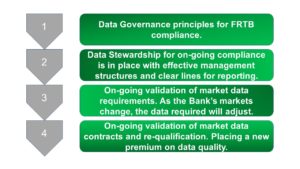

Phase 1 Internal Approval Process

Once a Bank has thoroughly taken into account all its complete range of requirements and potential requirements for market data, there begins the process of internal testing. Once this testing has been approved by business management, the Bank can submit these models to the appropriate regulators for their review and approval.

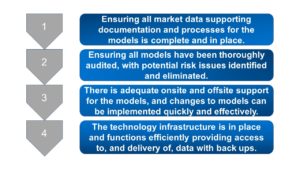

In market data management terms this encompasses:

Phase 2 Regulatory Approval Process

Once Phase 1 has been completed successfully with exhaustive due diligence and it has received internal approval by every one of the designated Responsible Managers (RMs), the regulatory approval process can commence.

Key market data criteria to consider is extensive, but can be summarised in 4 process structures.

In Summary

It may not be obvious to many banks that market data and pricing is core to the successful implementation of FRTB, however without having a market data strategy which is an inherent foundation of the whole principles of FRTB, Banks which do not prepare themselves will only see increased costs and an unnecessary waste of resources.

The issues that need to be addressed are in themselves easily identifiable, the problem lies in managing the processes. Methodologies, formats, and symbologies are unlikely Kings, but there they are.

Big Data has an opportunity to show what it can really do in the FRTB world, as FRTB not only creates new demand for data, but is going to be a creator in its own right.

While the focus of this report has been the market data itself, probably not enough has been written on the technology aspects of meeting the challenge, and it could well be the Banks strategy for technical storage, access and delivery that makes the difference between success or failure in implementing FRTB.

I doubt it was the intent of the regulators to introduce the level of complexity and data mining required needed to be compliant with FRTB, it is just a function of the enterprise wide impacts of FRTB.

Identifying the market data challenges that lie within FRTB as soon as possible is key. The closer the deadline is, the greater amount of resources will be required, and importantly the greater amount of pressure there will be on the overall supply chain.

Banks which do not plan effectively regarding their market data requirements for FRTB are going to find future regulations even more painful to implement.