MEASURING THE MARKET

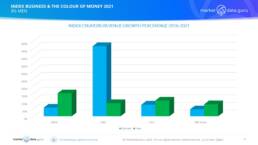

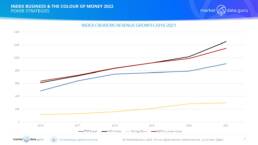

Index Creators continue to be very successful businesses, for the big 3½ their combined revenues in 2021 totalled US$3,608 Million up an impressive 94% on 2016. Though it should be noted the recent weakness of both Sterling and Euro has deflated their US$ values. During this period, MSCI Indices averaged a pre-tax margin of 78%.

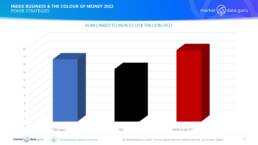

Even more remarkable is the index business, especially when combined with analytics has consistently outperformed their overall group companies, and if they were standalone businesses based on a percentage of revenue/group market capitalisation their notional valuation would be US$46,787 Billion as at 15 November 2022 compared with US$35,148 Billion as of 13/04/2019, i.e an increase of 33%. However the market cap of all the companies have been hit by recent market declines.

Another factor in the recent changes in the index businesses has been the London Stock Exchange Group (LSEG) takeover of Refinitiv. This has made LSEG more of a data business while simultaneously reducing the FTSE Russell share of the overall business from 28% to 8% in revenue terms. On the other side FTSE Russell now has access to a far wider range of data to work with when creating indices and also able to incorporate the, albeit smaller, Refinitiv Index business.

The same consideration can be applied to S&P’s purchase of IHS Markit, except that IHS Markit brought a more complementary, though stronger, suite of indices to S&P so the percentage of the overall business made up by indices remained constant at 14%. It was surprising that the regulatory authorities did not conduct more due diligence of the potential impacts the merged entities will have on benchmarks.

POKER STRATEGIES: THE IMPORTANCE OF BRANDS

As I continue to argue, index creators and definitely key individual indices are now ‘Brands’. A DJIA, S&P500, FTSE 100, Nikkei 225, MSCI Global can be replicated but not replaced. This inherently limits index competition because key indicators have become monopoly products, and financial institutions find it easier to sell products linked to specific brands, not indices the market fails to recognise.

This creates a ‘Virgin Cola’ barrier to entry where even a well known entrant cannot compete with established Coke and Pepsi.

From 2016 to 2021 the index creators revenue growth has been consistent, Stoxx (153%), MSCI (104%) FTSE Russell (87%), and S&PDJI (80%).

In 2021 the Big 3 linked Assets Under Management totalling US$48 Trillion equal to 40% of IPE’s researched Top 500 Global Asset Managers AUM of US$120 Trillion. Note S&P includes S&P500 while FTSE Russell and MSCI report all indices.

The index creators are not deviating from their 2 prong strategy each being a trident, a business led strategy and an index led strategy.

BUSINESS LED

1.Grow the market, especially via AUM driven revenues

2.Add value driven analytics

3.Ruthless compliance

INDEX LED

1.Create new indices out of old, i.e. development of thematic indices and a continuing focus on ESG

2.New instruments i.e. ETFs

3.Cover more asset classes, especially fixed income

PERFORMANCE LED BUSINESS MODELS

The three prong business strategy can be seen as create a pricing model that is efficient (for them) and fuses together stickiness with a large performance element, i.e. charging a fee relating to the size of assets under management. Amongst data sources early on, the index creators identified the need to build upon raw data as a foundation by adding value added products like analytics. Rather than spend time and money developing in-house they have preferred to buy the expertise in.

There are three drivers of success

1.AUM continues to be a major driver of index creators’ revenues as it links the success of funds to the fees received by the creators. This has proven to be a double edged sword for benchmarked funds locked to a specific index. Equally while current market conditions do not appear favourable, the sheer size if market AUM makes this a highly profitable strategy

2.The index creators were amongst the first to realise raw data is not enough to develop a data business, because saturation point eventually gets reached. Their answer is to add value to the data through analytics. The index creators continue to be avid buyers of analytics businesses.

3.Ruthless compliance. Understandably all entities quite rightly want to protect their Intellectual Property Rights. Backed by some of the tightest written contracts and licences in any industry the index creators are particularly vigilant to police, protect, and enforce their rights

LEVERAGING INBUILT ADVANTAGES

The index led strategies employed by the creators not only complement the business led strategies but fit seamlessly in as they take advantage of AUM led revenue models (in good times), leverage analytics for adding downstream revenue streams, and with added active revenues according to the Index Industry Association 2020 Survey the number of members indices started to grow again after dropping in 2019, rising to 3.05 Million (2020) from 2.96 Million (2019), a modest 3% gain.

There are three core approaches:

1.Develop new types of index built upon traditional indices but tailored, (themed) to meet specific investing parameters. Environmental, Social, and Governance (ESG) indices are blossoming with 40.2% growth rate in 2020 according to the IAI

2.Producing indices for new instrument types, i.e. structure products, and especially ETFs. ETF Trends reported that as of 02 Dec 2019, US ETF assets were US$4.3 Trillion, up 26.6% year to date. Index creators earn on ETF benchmarks and market benchmarks

3.Expand into OTC markets. Index creators are trying to exploit the opportunities brought by the introduction of IOSCO principles to buy Banks’ fixed income and commodities indices, however the nature of data sourcing for these markets hinders growth. According to IAI Bond Indices still only account for 7.1% of the 3.05 Million Indices available

WHAT TO LOOK OUT FOR

In 2021 I wrote there was little systemic threat to the underlying businesses of the leading index creators. I was thinking in terms of monopolist use of ‘brands’ and high fees passed on to the underlying investor.

The SEC fine of US$9 Million passed out to S&P DJI in 2021 could represent a long term shift in how the regulators view indices. This fine related to how an index functioned which caused losses to Credit Suisse. It presages a debate on conflict of interest within the index creators between the underlying principle of creating indices and how they can be leveraged to generate substantially higher revenues from charging for how indices are used. A debate that has yet to happen.

1.The business is high margin, the index creators are able to weather any immediate storms like the possible upcoming recession, and wait it out until calm returns because regulators will have other more pressing concerns. Even a significant drop in revenue potentially caused by a collapse in AUM would be mitigated by the high profit margins currently earnt. In 1998 Gordon Brown, proclaimed the ‘End of Boom and Bust’, history has proven him and every other ‘this time its different supporter tragically wrong

2.Without major regulatory change, the index creators’ clients will still be bound closely to their benchmark providers. Changing index providers is hard work on many levels, and costly, even when ignoring the limited choice

3.Barriers to entry are high.

- The Big 3 have brand awareness and global presence. Asset owners aren’t known for conducting competitive exercises when selecting an index, relying on set of advisors which do not seem to stray far from the well known

- Equally the regulatory framework for creating indices for commercial purposes is clear and concise but onerous. It is why the Banks dropped their indices. Unfortunately, BMR is only going one way, i.e. stricter rules and interpretation, this does not favour insurgent index creators

- The expertise available to create indices, associated methodologies, then implement as a business is expensive and not readily available

- Establishing competition in the post-IOSCO principles world is time consuming to build critical mass except in niche markets. Again this favours incumbents

The notion that it is easy to create an Index is fanciful.

THE COMPETITION

From what I have written so far, one would assume there are only 4 index creators out there. Thankfully, this is not the case, Market Data.Guru (www.marketdata.guru lists 200+ providers of indices of multiple flavours, and these can be divided into several categories:

1.Global index creators that do compete with the Big 4 such as Morningstar which has invested heavily in building up their index business, and Germany’s Solactive which has adopted a non-AUM based model and has led the development of white label and self-indexing, plus the widely followed though US market only Wilshire Indices, and CBOE Indices which are expanding their global footprint

2.Exchange’s index businesses, which usually focus on producing indices related to their own markets, most notably SIX’s SMII, in China, B3, the China Index Securities Company, a venture including the Shanghai and Shenzhen Stock Exchanges, NYSE’s proprietary indices, and most notably the exchange with the greatest potential to expand their index business, NASDAQ. Adopting an alternative strategy, several large exchanges, ASX and TMX with S&P and ASEAN Exchanges with FTSE have chosen to outsource their index businesses to the Big 4. A decision they may come to regret because re-establishing an independent business could prove to be too difficult

3.Traditional and long established brands, most famously Hang Seng Indexes in Hong Kong and Nikkei in Japan which are also helped by having listed products created around their indices

4.Diminishing number of bank created indices, they have generally exited the market after the introduction of the IOSCO Principles, but some remain including Credit Suisse, Deutsche Bank, Goldman Sachs, and JP Morgan

5.Specialist index creators especially in OTC markets and Realty, for instance, Argus Media, CBRE, CTDI, Eureka Hedge, Redrocks Capital, more esoteric like RW101 Rare Whisky Indices, and SIFMA Swap Index

6.Crypto market indices, for example Bitwise and Crypto Index

7.ESG related indices have entered an expansion phase, from companies like Ethos, GRESB, GRP, ISS (part of DBAG), and IIGF

It is surprising how diverse the index creation market is, with high quality indices being produced by global providers and specialists. What much of the competition to the Big 4 lack with certain exceptions (HSI, Morningstar, Nikkei, Wilshire) is brand awareness and resources.

SUMMARY: TROUBLE AHEAD?

As we enter the post-COVID world the 4 immediate challenges the index creators are facing from previously have not disappeared, merely postponed. Regulators are currently focusing on Exchange Data services which presages a more activist role in analysing the dynamics of pricing markets, exactly where indices sit right at the centre.

1.Clients are increasingly dis-satisfied with the cost of subscriptions, and lack of transparency in how the index creators pricing models function. Quiescence is being replaced by restlessness. Client willingness to pushback is there, but grounded in the reality that changing from one index creator to another does not solve the problem

2.Regulators are interested in costs and quality, especially if it has a negative effect on the costs of pensions and funds

3.Data sources, primarily exchanges, are now becoming aware of how little they are paid by the index creators to use their data, and how much profit the index creators are able to make from the sources’ data. Some exchanges have considered linking fees to AUMs, though the inherent problems have prevented a trigger being pulled

4.Mergers and Acquisitions will continue to be a major factor in the index creation industry, it is less challenging, and quicker, to expand by buying out the competition, especially to acquire specialist providers

5.Often competition may not seem like a threat because it is small and then suddenly emerges, the big index creators are facing two levels of competition

- Small new index providers which have not adopted the AUM model, such as, INDXX, ScientificBeta, and Solactive

- Self-indexing, which has been embraced by the likes of Blackrock, Charles Schwab, State Street, and Vanguard

- The importance of these 2 levels of competition is the battleground is not in the field of existing benchmarks, but In areas where ‘brands’ have yet to be established, such as ESG and OTC markets

There is trouble ahead and the index creators will have to make compromises, however unwillingly, but their business models are sound, if not liked, and the future for benchmarks looks bright as new markets open up, especially in OTC markets.

Keiren Harris 16 November 2022

Please contact info@marketdata.guru for a pdf copy of the article

For information on our consulting services please email knharris@datacompliancellc.com