THE IMPORTANCE OF LISTED CHINESE STATE OWNED ENTERPRISES INDICES

In 2013, as someone who studied and follows China’s politics and history, shortly after Xi Jin-ping became President I stated that he was seeking to emulate Deng Xiao-ping to become China’s next paramount leader. Well the great and the good of Hong Kong’s expatriate business pooh-poohed the notion, I was told China had changed and that I was ignoring the trends.

Guess what chaps, I was RIGHT!

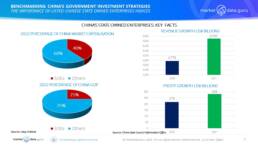

Why is this important to indices? We have to think globally, from a Chinese perspective. Under Xi China is returning to more centralised policies, and at the same time is expanding its worldwide influence primarily through internal economic development and exports, of which the ‘Belt and Road’ initiative is just the most well known of many. Infrastructure is literally the structural foundation of their strategy which is being fronted by China’s State Owned Enterprises (SOEs). This is straight from the domestic playbook where the SOEs build rail, road, ports, hospitals, and then manage the framework around them.

As China’s GDP growth falters the SOEs take on a special importance, they become the funnel through which the government pours cash into supporting the economy, jobs, and future growth. New, more interventionist, planned economic policies with directed investment via SOEs combines stimulating economic growth while also meeting the employment and pay objectives outlined at the recently concluded 2022 National People’s Congress.

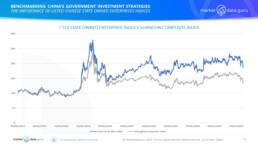

Unlike in other countries, China’s State Owned Enterprises are exchange listed providing investors the opportunity to tap into the companies that benefit from increased central government investment. If we accept that China’s economic policies in the 2020s are more interventionist leveraging directed investment to meet the requirements of a more centralised economic strategy, then tracking the SOEs must be a priority.

The best way to track and analyse both domestic investment and the global economic influence of the Central Chinese Government is to understand the vehicles they use to meet their strategic objectives, i.e. the State Owned Enterprises. For that an index, like the CTDI China SOE Index provides a leading insight.

Keiren Harris 02 November 2022

www.marketdata.guru

Please contact info@marketdata.guru for a pdf copy of the article

For information on our consulting services please email knharris@datacompliancellc.com