INDICES LEAD THE WAY TO UNDERSTANDING THE LITHIUM MARKET

The commodities markets are one of the areas where the real world and market data for trading correlate most closely, yet paradoxically one where access to primary trading data is problematic. Despite this investors can gain critical insights into the markets via indices.

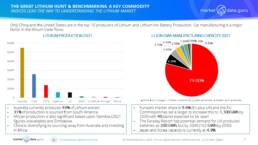

In 2008 Lithium mines produced 25,400 tonnes, this hit over 105,000 tonnes in 2021. Since 2008 the world of Lithium has become the key inflexion point for a range of commodities, like rare earths, which are heavily influenced by China, and not because China is a major producer, it is a distant third at 13%, it is because 74% of Lithium production is used for Li-Ion manufacturing capacity, an industry overwhelmingly dominated by China with 79% market share.

Given Lithium is at the centre of the green manufacturing revolution and will remain there for the foreseeable future, the metal is now a political commodity as well. It is all very well a country being a producer, they are now the centre of a competition between Chinese and Western companies seeking to buy and control this critical asset. Miners from one country will point their production towards where they will benefit. Also given the growth in demand the search is on from Chile to Canada to Cornwall for new sources.

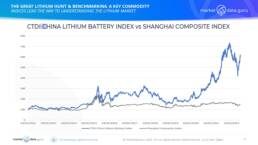

This is why an index, like CTDI’s (www.ctdindices.com) benchmarking China’s Lithium Battery industry is so important from a global perspective. The ability to act as a bellwether for China’s EV industry correlates to two economic factors:

1.The demand for China sourced Li-Ion batteries relative to increases in production elsewhere around the world, especially in the US, UK and EU, i.e. translated into will Chinese companies continue to maintain their market share?

2.The transformation of China’s own economy from being a high polluter to green industry.

Until 2016 the CTDI Lithium Battery Index closely correlated with the Shanghai Composite Exchange Index. Since then it has outperformed the SCE Index by 400%, noticeably accelerating in 2020. This tracks the increase in demand for EV products and the ability of Chinese businesses to meet that demand.

The best way to track and analyse the global Lithium market is to understand the trends, for that an index, like the CTDI Lithium Battery Index is a necessity.

Keiren Harris 13 October 2022

www.marketdata.guru

Please contact info@marketdata.guru for a pdf copy of the article

For information on our consulting services please email knharris@datacompliancellc.com