Welcome to MDG’s first guest post!

25 July 2017 London. FinTech company, Invstr Ltd, makes finance social by Democratising access to Information.

The financial services sector is the second largest industry on earth, and the largest digital industry, calculated at approximately US$5 Trillion in revenues. If a country, only the US and China would be bigger when compared in GDP terms. Inevitably, financial services face tremendous challenges, more varied, more complex than other industries, which creates opportunities.

Changing Dynamics, Changing Demand

Banks are experiencing more and more regulations, cost pressures, uncertainties with legacy technology, and an ageing client base. At the same time, younger generations are coming along with far higher consumer expectations; including a far greater financial awareness than their parents, and a desire to have full control of their finances from payments to investing.

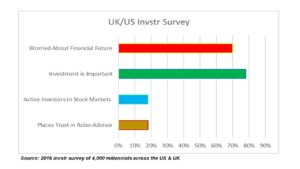

This implies 60% of digitally aware but not yet active millennials believe investment is important, a group three times more than the active millennials. Here is the opportunity*.

Fintech Growth Opportunities in Personal Finance

The fast evolving Fintech sector is tapping into the opportunities caused by all this disruption, with the personal finance and investing space offering the greatest growth opportunities. Refocusing away from the financial elite to the hundreds of millions of people capable of managing their own financial future, but who are presently discouraged, is the (achievable) holy grail. One such company taking up this challenge is called Invstr.

Invstr Fills a Need

Changing demographics, consumer empowerment and a loss of trust in the financial legacy system are driving a trend towards self-directed investing. However, this desire is neither met by consumer know-how*, nor provided by legacy financial services.

Which is why invstr sets out to make finance social by democratising access to financial information through empowering everyone to take charge of their own financial future by learning how to become skilled investors.

We do this by engaging users with the things they love to do in a single, multi-faceted, app: Playing, by using gamification to both participate and educate; Learning, by providing access to multiple news, data and an increasing roster of learning resources; Sharing, by offering a full social user experience to make investing collaborative, and; Investing, by introducing a low-cost entry to buying and selling shares.

With 250K+ people downloading the invstr app from over 170 countries, invstr is on the path to empowering self-directed investors.

Access to Financial Information

One of invstr’s core missions has been to deliver content that, until recently, has been locked in the domain of so-called City and Wall Street experts, and then unravel its ‘mystique’ by making data simple to use and understand. But attaining this has been a challenge.

Exchanges’ market data policies and news wires’ commercials are locked in the past – still focusing much of their attention on lucrative but waning professional, enterprise-wide use. Also, legacy exchange data and content businesses’ reputations for quality and relevance have been severely eroded by challenger companies. For example, alternative trading venues now offer simple, attractive commercial models. News services add value against scrolling news by delivering signals, sentiment and relevancy to each individual reader’s interests and habits. In the real world if you can’t provide what the user desires, you’re in the wrong business. The luxury of time has given way to the instantaneous meeting of needs.

Information Transfer: The Heart of the Problem

People talk of legacy technology in the financial services sector – whether they be banks, exchanges or news agencies, and focus the attention on financial technology as the solution, but perhaps the real problem lies elsewhere.

So far financial services have avoided the transfer of information to the end consumer – something that has happened in every other walk of life. The fact is they have been morally, commercially, managerially as well as technologically bankrupt. And yet they all recognise a desperate need to re-engage with end-customers. It is desire without the wherewithal.

As famous aviation pioneer Amilia Earhert once said. “The most difficult thing is the decision to act, the rest is merely tenacity”.

People must recognise the distinction between financial technology and fintech. Financial Technology just looks at maintaining or improving efficiencies by embedded processes. Conversely, FinTech strives to disrupt or disintegrate traditionals by opening up access to totally new products and services. The financial world needs this type of disruption and is the principle drive in the growth of fintech companies – along with adoption of their services.

Innovative management culture combined with a recognition that fintech companies deliver efficient solutions offer the best of all worlds for the end-user: Trust in an established name combined with socially empowering technology, delivered free at source.

Disclaimer. The views of Invstr are Invstr’s and not necessarily those of MarketData.Guru.