THE VENDORS ARE STILL HERE, THEY JUST WILL LOOK DIFFERENT

Introduction

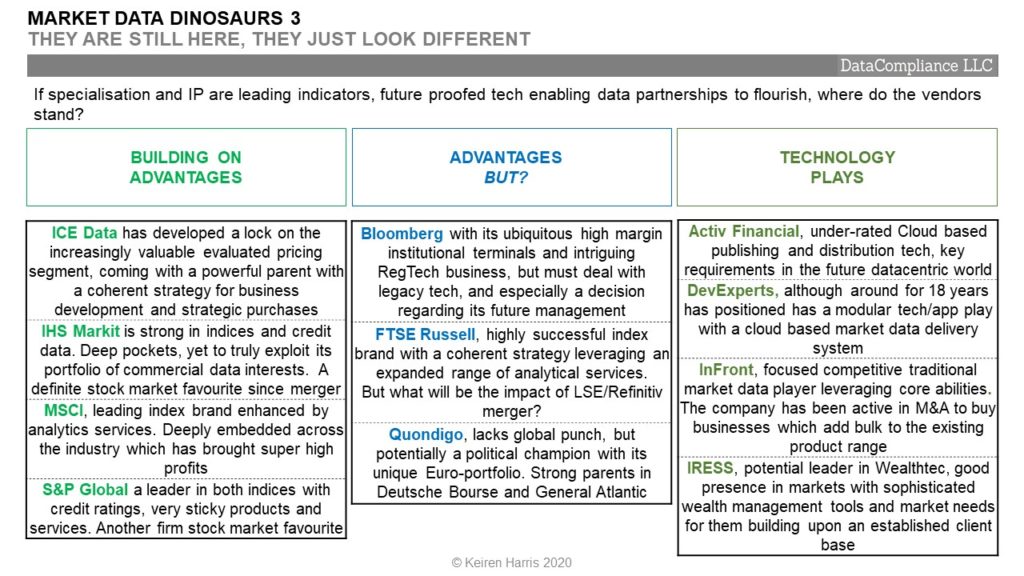

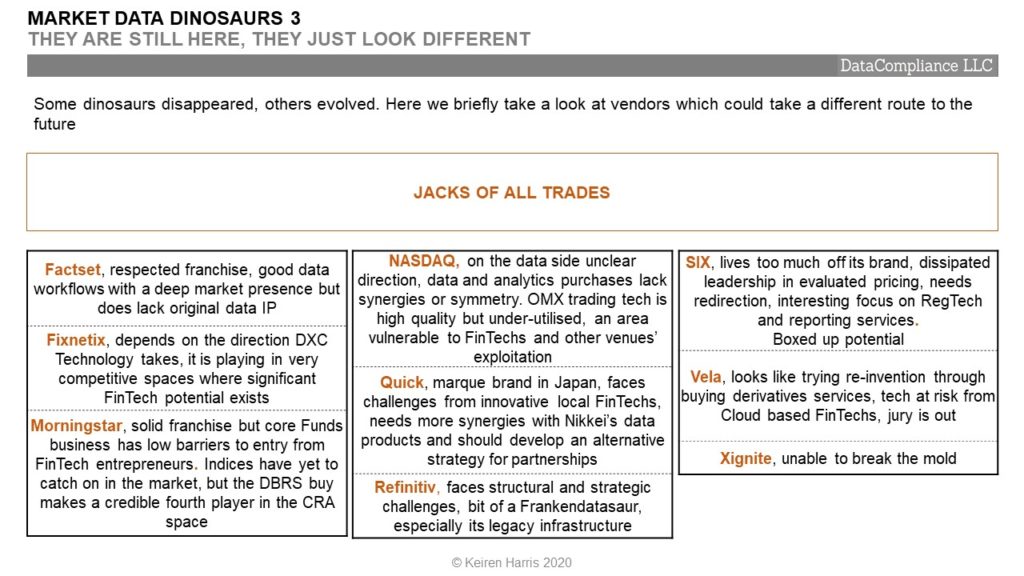

In the final of our three articles we briefly review what the main ‘universal’ vendors bring to the table. Every one has their positives and negatives, and the question as to future success lies in how they apply themselves to evolving demand.

What stands out is the level of differentiation. Competing in the same sandbox drives down fees, when that happens an inevitable drop in service levels tends to be a given. An unvirtuous circle quickly follows.

Firstly, there is the uniqueness of data (IP), including the vital value added components of analytics, benchmarks, and decision making tools. These are the dollar enhancers.

Secondly, there is making those services accessible to the client base within environments not closed to plugging in, then playing new entrants. This moves the preference of the data consumer away from proprietary infrastructure to neutral delivery venues. These are the data enhancers.

Where both sides have the greatest impact is by revolutionising the nature of the relationships between the Data Source generators and the data consumers, plus the new breed of fintechs and facilitators that are rapidly connecting into the data omniverse. The market data vendors have to figure out where they fit in this new world

To read the first article please visit https://lnkd.in/gcpyRiA and second https://lnkd.in/gqJBNFk

Evolution: A Question of Choice

But the dinosaurs did not all die out, the ones able to adapt are still around, thriving. We can see them flying in the shape of birds, along with other remnants from the Cretaceous Period, like crocodiles, alligators, sharks, even turtles and crabs.

If dinosaurs can survive into the modern era, so can legacy market data vendors, but being all things to all men is unlikely to be a recipe for long term success. Big vendors have resources, some unique data products and services and are becoming important players in key areas such as RegTech, financial benchmarks, and trading venues in their own right.

Equally, the need for aggregated data will not just disappear. It is too expensive and time consuming to source, replicate and re-distribute, let alone manage multiple types of data in varying formats, but what will fall away is the reliance upon antiquated technology and infrastructure. By doing this, vendors can reduce costs to themselves, and their clients, making them better able to compete with more nimble, faster acting new competition. The more quickly the vendors can cast off these millstones, the better their chances.

But vendors risk undermining their own future, as clients question slipping service levels, and sometimes a dated arrogance creeps in. All the while dogmatic adherence to inflexible business structures leave vendors vulnerable in an environment that changes faster than they can.

So, specialisation and core IP are the keys once Comet FinTech truly hits.

The question now becomes how are the market data vendors going to survive?

Most could well survive only as subsidiaries of larger entities.

Summary. The Market Data Vendors’ End is Nigh

Or is it?

In reality, the FinTech Meteor is a powerful growing series of trends, getting stronger each day. There is unlikely to be one huge bang, but more a waking up one day to the realisation that the world has radically changed, then waking up the next day to find the world has changed yet again, ad infinitum.

Why? Because that is the inherent nature of the underlying product, data, an intangible item combining high value with infinite flexibility. Trying to lockdown data is like preventing water from flowing. Market Data Vendors business strategies, legacy infrastructures, out of date workflows, reflect a past that is incompatible with the future.

Data consumers want to reduce their dependencies. Data sources want new relationships. Accessibility is key.

I now constantly enjoy discussing with ‘insurgents’ who have no intention of being part of the traditional vendor club but desire to play the game using their rules. Their market outlook is intuitive towards creating change, instinctive in developing demand, recognising without innovation momentum they will in turn be surpassed.

If one takes the view that the future will reflect increased omni-directional data sharing and a necessity to access data from even more sources, with different formats and structures involving/reliant upon players with alternative world flows then the opportunities are going to open up wide.

The biggest challenge lies within the data vendors themselves. All (well perhaps not all) have the capability to thrive in the FinTech future by using the assets at their disposal, except they must re-orientate their priorities to master a changed environment.

For a comparison look at Microsoft and Apple, 1980s giants, re-invented 2020s giants in a very different world.

Are the Market Data Vendors to be supply side dinosaurs, or demand creating innovators? Do they have the mindset to grasp not only what needs to be done, but have the balls to do it? The insurgents do………….

Keiren Harris 23/10/2020

www.datacompliancellc.com

Please email knharris@marketdata.guru for a pdf