BE LIKE WATER: NEW DATA FLOWS

Bruce Lee exhorted “Be Like Water”, that a person can become ‘formless’ like water. Lee said that because water has no shape, it becomes whatever it is poured into, whether it be a cup, a bottle, or a teapot.

Data like water adapts to its environment, similarly it needs channels to flow through and vessels to fill. This is where the market data aggregators and emerging data malls come in, they provide the flow.

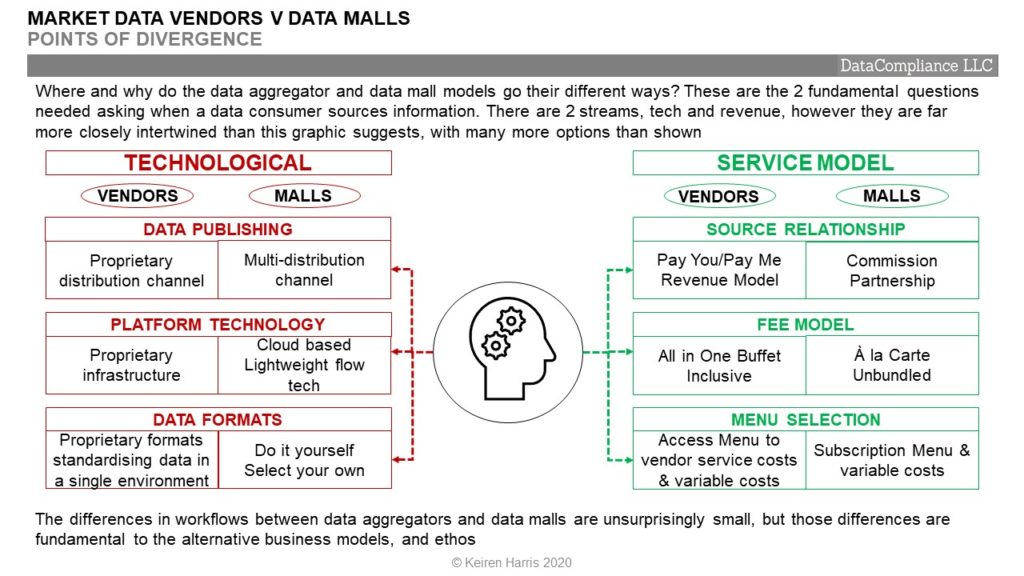

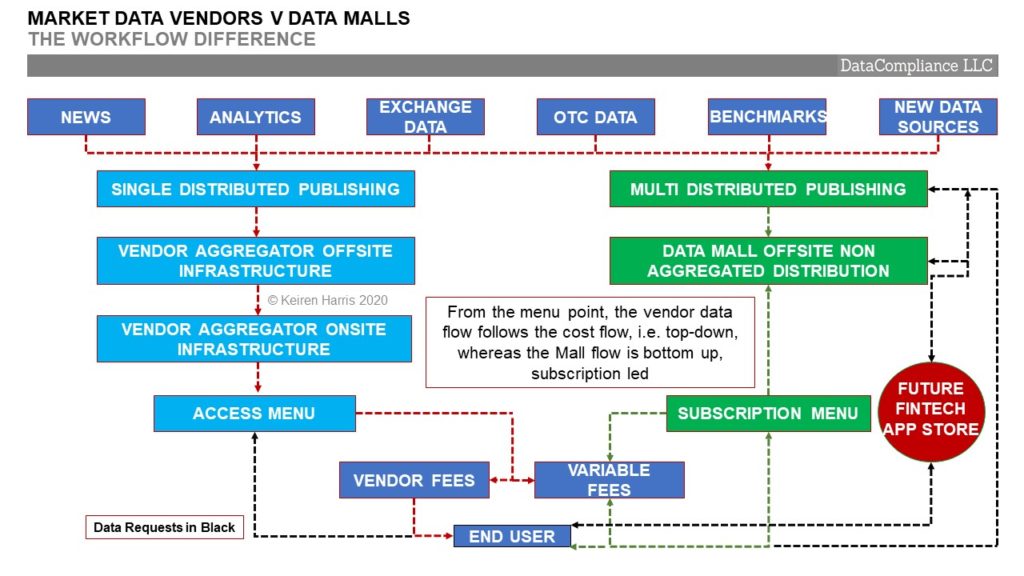

The market data vendor/aggregator represents the traditional and very effective workflow model. A vendor sources data from multiple suppliers, i.e. exchanges, standardises the multiple datasets into a single proprietary format and delivers to a financial institution as ready to use.

They forged the link that brings data supply and demand together, providing:

• Accessibility. For an exchange the system provides the resources and reach to get to clients that few have,

• Efficiency. For the bank, the link simplifies time and effort in sourcing data then organising, managing, and distributing it, and,

• Real Time. This is (currently) where the data money is. While the strength of the vendors’ heavy duty networks to reliably deliver real time prices securely cannot now be matched by alternative accessibility, their pre-dominance in the workflow chain can be maintained, however, technology is advancing mercilessly

So if this model works so well, why the rise of Data Malls?

• Costs. Annual fee increases needed to pay for services, but a fraction of bundled services actually get used

• Contracts. Vendor contracts are restrictive and long term not reflecting trading cycles. Services go unused but still cost

• Technology. Locked into legacy technologies means locked out of potentially beneficial changes, also inhibits business development by restricting cross-fertilisation of data flows across sources and vendors

• Reduced Dependencies. Over-reliance upon one or two vendors for absolutely critical data becomes a business risk if alternatives are not readily available

• Increased Choice. Unbundling and access to new sources creates investment opportunities through having access to information competition may not have

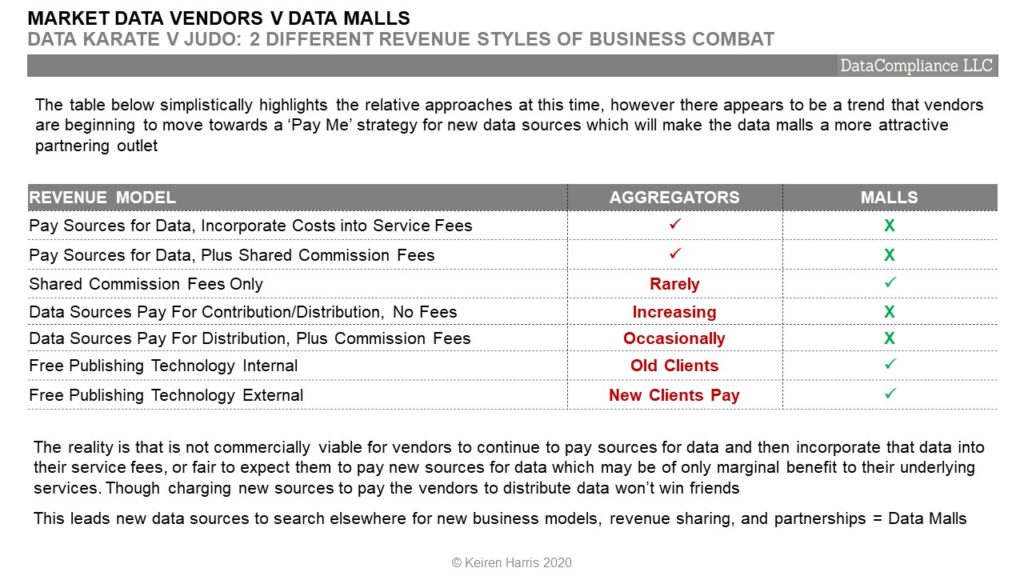

DATA KARATE V JUDO: 2 DIFFERENT REVENUE STYLES OF BUSINESS COMBAT

Karate is direct relying upon first person contact, whereas Judo uses an opponents’ weight and moves against themselves, both are effective methods of incapacitating an opponent but done in different ways.

The difference in workflows feeds into why Data Aggregators and Data Malls have their own unique revenue styles directly influencing those owning the data IP, i.e. the sources, meaning future preferences in the route to source data lies in the way intermediates select appropriate business strategies and revenue/cost models.

The impacts are immediate:

• Old Friends. This will prove problematic to deal with for established data sources, such as exchanges who are reliant upon existing relationship frameworks, unlike newer data sources which lack prior vendor relationships

• Jam Today. Exchanges are too smart to forego existing lucrative and functional vendor revenue for nebulous risk/reward partnerships, instead they will expand their distribution base by creating their own Data Malls (CME, KOSCOM, NASDAQ/Quandl) and work with independents, all the while maintaining vendor partnerships

• Not Friends. However other electronic trading venues in the OTC space are proving more reluctant to work with vendors which have their own trading systems in competition. But they still want/need the market to see their prices, this allows Data Malls (and smaller vendors as well) to access high quality observable transactions that Banks want and feed off

• Alternative Data. These sources exist outside the market data world, but want in, there is a lot of competition, and they need shop windows for their data wares. Vendors might not have that window space, data malls have space to fill

• Installed Client Base. Vendors especially Bloomberg and Refinitiv have an exceptionally entrenched, and reluctantly loyal client base, which can be equally reluctant to change. They deliver what the market wants, and they are not going anywhere soon. This is incredibly attractive and valuable to all data sources. Though it is worth reflecting upon how effectively Bloomberg displaced Reuters in the terminal space

• The Twilight Zone. The grey areas of the marketplace , FinTechs, new types of data consumers, processors, and facilitators, smaller institutions where loyalties have yet to be established

SUMMARY: A KNOCK OUT CONTEST?

Once the market has adjusted for the overlapping presence of both market data aggregators and Data Malls, there will come the realisation they can be complementary as well as being competitive, especially for the specialist market data vendors

To increase their market coverage, these smaller aggregators will realise it is simpler to source specialist data via the data malls because it will be quicker to identify and then onboard. These vendors will evolve into valuable hybrid FinTech plays

At the same time these aggregators can utilise the Data Malls as distribution channels to reach new client bases they currently are unable to service, enabling them to compete better with the Bloombergs and Refinitivs of the world. In return the Data Malls can expand to add content that would be to costly to subscribe to direct under their business models

This heralds a future shift in balance of capabilities versus cost effectiveness.

- FinTech Friendly. Data Malls through open architecture platforms will allow FinTechs to be able to plug and play their apps straight into the client environment. Clients will be able to do more using less by taking the best solutions from a broader selection than currently available

- Structural Cost. That Data Mall environment will prove more cost effective, minimal market data infrastructure charges (overt or covert), Data mall infrastructure is sunk cost, not an ongoing revenue stream, and comes without the baggage of intensive in-house support and management

- Relationship Dynamics. As the big vendors increasingly compete with their data sources and data consumers, questions of neutrality enters into the equation, ones the smaller market data aggregators and data malls won’t have to answer (yet)

An imperfect, messy, world, yes, but both the data sources and the data consumers have much to look forward to because it drives more choice in terms of data content, publishing, accessibility, tech, and pricing models, balanced by reduced dependencies upon large legacy vendors

Keiren Harris 26/10/2020

www.datacompliancellc.com

Please email knharris@marketdata.guru for a pdf