PANDORA’S BOX

A leading market data industry M&A deal maker recently told me “They are all up for sale, the only question is price”

Will the $126 Billion Dollar S&P/IHS Markit data mega-deal unlock a Pandora’s Box of activity in the data space? https://lnkd.in/gdv7WCa

If yes, It is intriguing to speculate as to who is next to go under the hammer, and at what price?

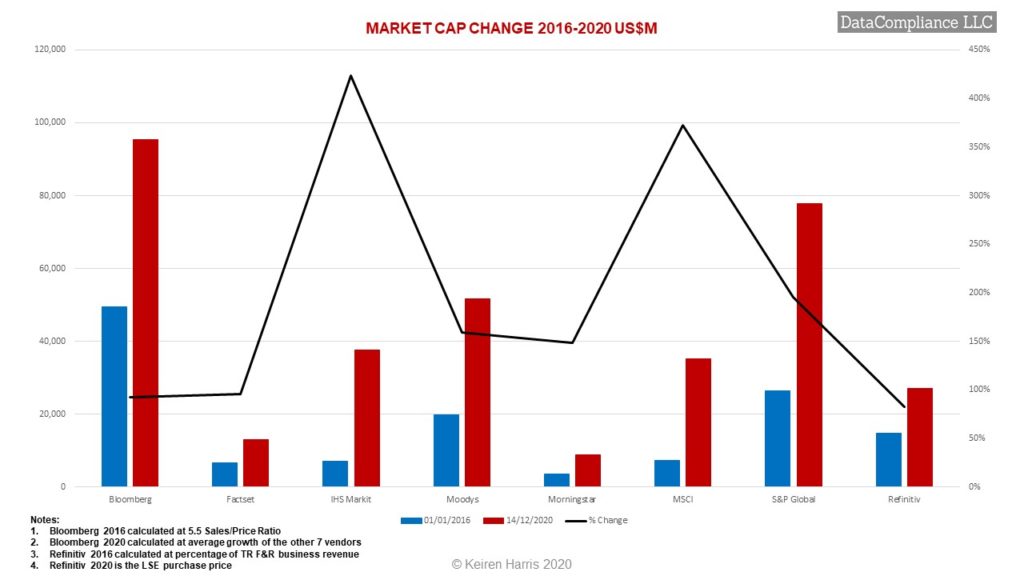

• According to our estimates the average market cap change of the top 81 US listed market data businesses grew from US$135,370 Million on 01/01/2016 to US$346,389 Million on 14/12/2020, a growth of 156%

• But there are significant variances, ranging from 83% (Refinitiv1) to 423% (IHS Markit)

• During this period there has already been a benchmark deal: LSE purchasing Refinitiv for US$27 Billion

• When this top 8 is divided into 2 groups, 4 data aggregators (Bloomberg, Factset, Morningstar & Refinitiv) and 4 data IP businesses (IHS Markit, Moodys, MSCI & S&P Global) a different picture emerges

• The 4 data aggregators average market cap grew from US$74,518 Million to US$144,279 Million, i.e. 94%

• By contrast the 4 data IP businesses average market cap grew from US$60,852 Million to US$202,110 Million, i.e. 232%

So a sooner rather than later strategy appears the best bet

Definite attractive qualities will be the complementary leveraging of owning one’s own data IP, integrating analytics and a client base seeking value added information

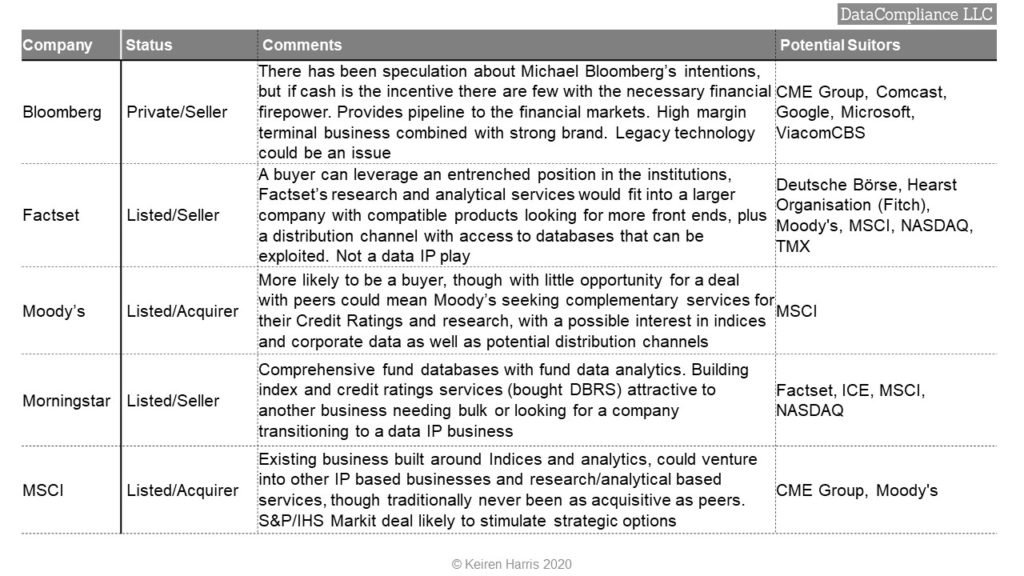

Buy/Sell interest could well centre around a ‘Famous Data 5’ of Bloomberg, Factset, Moody’s, Morningstar, and MSCI

1Note: Bloomberg & Refinitiv calculated estimates

What can we work out about potential deals?

- Investors now value data IP like content owners, analytics, indices, rating, benchmarks, over data aggregation, i.e. bringing together content from multiple sources into a standardised platform?

- Content owners, like exchanges want distribution channels and access, leading to deals such as ICE/Interactive Data, LSE/Refinitiv, NASDAQ/Quandl

- Data IP businesses want to expand their depth and breadth to consolidate brands and monopoly positions, the strategies of Deutsche Börse-STOXX/Axioma, LSE-FTSE Russell/Mergent/Yield Book, S&P/IHS Markit

- Any deal would most likely have to involve equity as the number of suitors with the necessary financial firepower is limited, which rules out smaller exchanges, even most media organisations

- Competition rules limit opportunities for credit rating agencies, and for the largest index creators

So what could 2021 bring for the ‘Famous Data 5’?

Summary & Looking to 2021

The probability of a slew of blockbuster data deals in 2021 seems limited by the tens of billions of dollars involved, competition concerns and the current parochial nature of the market data industry.

The big question mark will definitely be the future of Bloomberg in a post-Michael world, it is a company very much made in his image.

If data IP owners values keep on increasing at their current rate the potential for deals involving Moody’s and MSCI could become a self-fulfilling prophecy, and given their lean business focus change the nature of either/both as a company. Neither compete headlong with each other, but both very much have a common adversary in S&P Global. The danger is the IHS Market deal could propel S&P into a league of its own rather than being a peer in credit ratings with Fitch and Moody’s or index creation with LSE/FTSE Russell and MSCI

As to Factset and Morningstar, despite both having a good service base they are in danger of being left behind as direct competitors become subsumed into entities with larger footprints and greater capital for acquisition, especially the exchanges like Deutsche Börse, ICE, LSE and NASDAQ. Sitting in a twilight zone, these 2 companies could search for potential deals which arbitrage their underlying business value.

There is an old Chinese curse ‘May your life be interesting’, 2020 has been far too interesting, so hopefully 2021 can be interesting in good ways, especially in the data sphere. S&P Global/IHS Markit could just be a beginning.

Keiren Harris 16/12/2020

www.datacompliancellc.com

Please email knharris@marketdata.guru for a pdf or information about out consulting services