1.0 YEAR 2022 IN REVIEW: DIFFERENT VENDORS, DIFFERENT REVENUE MODELS

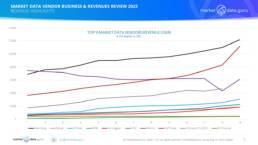

The Top 9 vendors (down from 10 in 2020 because S&P Global bought IHS Markit) estimated revenues for all their business activities grew from $25,229 Million in 2012 to $39,387 Million in 2022, i.e. an increase of 56% over the period. From 2012 to 2022 we saw:

Businesses (ICE Data, MSCI & S&P Global) whose core services principally revolve around providing proprietary data, such as Evaluated Pricing, Financial Benchmarks, Indices, Credit Markets and Analytics saw their combined revenues grow from $8,403 Million to $16,489 Million, i.e. 96%.

Vendors with a product suite built upon an aggregated model i.e. Bloomberg, Factset, IRESS, Morningstar, Refinitiv (ex Thomson Reuters F&R), and SIX Financial saw lower revenue growth with combined revenues increasing by a slower rate from $16,826 Million to $22,899 Million or 36%

IHS Markit (the 10th Market Data vendor) was consolidated into S&P Global figures in 2022. The two companies had combined revenues of $12,947 Million in 2021 however once consolidated this dropped to $11,181 Million in 2022. They key factor in the apparent decline being divestitures required to complete the merger, especially the CUSIP business.

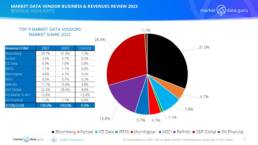

The big 2 super-vendors are now S&P Global and Bloomberg whose combined market share totalled 59.4% with the rest of the pack some way behind. Market fragmentation and the increasing presence of solutions providers like Broadridge, ION Trading, and Options IT in the data space could well open up Mergers & Acquisitions activity amongst this chasing pack.

All figures produced in this report are in US Dollars are based upon Bloomberg published FX rates on 31/03/2023

2.0 BLOOMBERG BACK TO NUMBER ONE IN 2022

The Top 9 vendors (including IHS Markit) estimated revenues for all business activities grew from in 2012 $25,229 Million to 2022 $39,387 Million, a growth of 56%, taking into account currency fluctuations in GB£ and CHF.

2021 represented a watershed year when for the first time since 2012 Bloomberg had not been the undisputed number 1 vendor by revenue (estimated $11,000 Million1) having been displaced by a combined S&P Global and IHS Markit ($12,947 Million2), however the integrated S&P Global revenues for 2022 was $11,181 Million, a decrease of 14% due to divestitures as stated. In contrast Bloomberg grew its revenues from 2021 to 2022 by 11%.

S&P’s adjustments does not negate the trend towards datasets created around IP are perceived to have the greatest value. This is reinforced by the recent deals between Big Tech and Exchanges which also emphasised the growing importance of value added solutions and particularly analytics, a major element in AWS’ tie up with S&P Global which offers a vast range of proprietary data combined with analytical products.

At the other end of the revenue performance scale is LSEG’s Refinitiv which was the largest vendor in 2010 (then known as Thomson Reuters) when it had revenues of $7,441 Billion which has since declined to $6,250 Million (-16%) in 2020 then 4,584 Million (-38%) in 2021 before rebounding to $6,128 Million in 2022 as LSEG moved the FTSE Russell business under the combined ‘Data & Analytics’ banner.

The important difference between 2020 and 2021 was LSEG moving Refinitiv’s electronic trading businesses into its mainstream trading venue business and over the period up until now developing and implementing a strategy for the data & analytics business that did not exist under the old regime.

1Bloomberg revenue figures according to Forbes

2S&P figures given in this article do not include IHS Markit prior to 2021 which are provided as separate items

3.0 UNDERSTANDING THE VENDOR’S BUSINESSES

The vendors can be divided into 2 categories, whose core businesses are different, albeit there are significant overlaps:

1.Proprietary and IP based data vendors, offering services such as Evaluated Pricing, Financial Benchmarks, Indices, Credit Markets and Analytics. This financial information providers group includes ICE Data, MSCI, plus S&P Global.

- From 2021 to 2022 these vendors combined revenues grew from $12,891 Million to $16,489 Million i.e.28%.

2.Data aggregators like Bloomberg, Factset, IRESS, Morningstar, and SIX Financial have seen revenue growth, with Refinitiv’s revenue being a standout due to the reasons outlined above

- From 2021 to 2022 these vendors, including Refinitiv, combined revenues increased from $19,743 Million to $23,282 Million i.e. growth of 18%.

- From 2021 to 2022 these vendors, excluding Refinitiv, combined revenues increased from $15,160 Million to $16,809 Million i.e. growth of 11%.

In 2022 however describing vendors like Bloomberg, Factset and Refinitiv as aggregators is becoming outdated, as their data consumers rely more upon analytics solutions. Market Data Integrators seems a more appropriate term as they increasingly combine data with analytics, and in Bloomberg’s case function as a de facto third party processor.

It is therefore noticeable that the two vendors which are weaker in providing value added solutions, IRESS and SIX Financial revenue growth from 2021 to 2022 was significantly lower as can be seen from the graphics below.

4.0 REVENUE HIGHLIGHTS & TRENDS

- Revenues are increasingly concentrated upon the 2 market leaders S&P Global and Bloomberg, yet the degree to which they compete with each other is limited. S&P focused on indices, credit ratings, proprietary data whereas Bloomberg is fixated upon its aggregated data business

- Throughout the 2010s Bloomberg has been the market leader with a market share remaining constant at +/- 30%

- Refinitiv’s market share has dropped from 30% in 2011 to 16% in 2022 but is now on the rebound

Bloomberg: Revenue increase 11% 2021 to 2022. Market Share 31.0%. Despite its legacy technology perhaps Bloomberg should be seen as a ‘Cloud’ based provider in its own right. The capability to offer a wide range of value added services including trading, analytics, and third party processing in one place has been around for a while. In many ways Bloomberg is the precursor model for the recent Big Tech forays into market data.

Factset: Revenue increase 16% 2021 to 2022. Market Share 4.7%. Increasingly an analytics and data workflow technology business which is an attractive combination for its core clients, buy-side firms, with a high level of retention, vital for subscription driven income, Factset’s business model needs to adjust to expand its consumer footprint. However, Factset’s purchase of S&P’s CUSIP business could backfire if current legal proceedings result in negative findings.

ICE Data: Revenue increase 20% 2021 to 2022. Market Share 7.8%. Not the right name, ICE’s data services have been re-organised to centre increasingly around fixed income, analytics and evaluated data services. An example is the risk based solutions offered to analyse US municipal bonds. All high margin businesses, though it is not clear which path the overall business will be taking.

IRESS. Revenue increase 4% 2021 to 2022. Market Share 1.1%. There has been management changes which seems to have impacted business strategies. Australia is core with a range of trading platforms, especially DMA, and solutions aimed at the Wealth Management industry. Growth has come through acquisitions in the UK, Canada and Africa.

Morningstar: Revenue increase 10% 2021 to 2022. Market Share 4.7%. Building a portfolio of IP based services around indices and credit ratings (buying DBRS) with an increasing suite of ESG products to complement the core fund services businesses. Growth has come through acquisition.

MSCI: Revenue increase 10% 2021 to 2022. Market Share 5.7%. One of the big three index oligarchy which recently has had a special focus on the ESG space and has been busy integrating this into their suite of investment decision tools. The purchases of Carbon Delta (2019) and Real Capital Analytics (2021) indicate current strategies. With its IP based data and analytics services MSCI appears to be a prime candidate for the next Big Tech Cloud partnership.

Refinitiv: Revenue increase 41% 2021 to 2022. Market Share 15.6%. Under LSEG, Refinitiv appears to be staging a remarkable turnaround from a decade of decline. The re-organisation to focus on ‘data & analytics’ with acquisitions, like Maystreet, are now designed to add value to the overall business. The LSEG Microsoft tie-up also opens the door to new markets giving a potential first mover advantage of other market data aggregators. It now seems to be a priority to properly leverage and monetise its data asset inventory.

S&P Global: Revenue increase 35% 2021 to 2022. Market Share 28.4%. Having integrated IHS Markit, S&P Global is now competing with Bloomberg for the crown of number 1 market data vendor by income. The core product sets of indices and credit ratings are being built upon through developing business intelligence solutions and analytics. This is precisely the business suite which attracted AWS to enter into a partnership, offering unique content with added value solutions.

SIX Financial: Revenue increase 2% 2021 to 2022. Market Share 1.1%. Given SIX Financial has a strong data asset inventory, especially in the high value field of evaluated data, the company has continued to generate revenues of CHF400 Million annually since 2010 without breaking beyond this barrier. Recent activity has centred upon ESG (Buying a stake in Orenda Software), partnering with Sustainalytics (owned by Morningstar) and offering regulatory services.

8.5 GLOBAL COMPETITION 2022 SUMMARY: IMPACT OF BIG TECH

The big news in the 2022 market data industry is the direct entry of Big Tech. The amount of money generated in market data service is not only high margin, it is incredibly ‘sticky’ thereby delivering long term revenue flows. Combine these attributes with the ability to tie in major exchange groups offering global multi-asset class capabilities is attractive to Cloud Providers determined to maximise their investment in infrastructure and delivery. In other words, the Cloud providers need content with value added services, like analytics, which can be processed within their environments, preferably exclusively. That is what will make them money.

For market data vendors to avoid becoming like small exchanges, ‘content fodder’, they must offer something more than commoditised price data, i.e. unique content and value added solutions are required.

With LSEG/Refinitiv and S&P Global already tied up, next up prime candidates must be Morningstar and MSCI. Yet all the vendors have something of value, the question is can they step up to the plate?

Watch this space!

Keiren Harris 04 April 2023

www.marketdata.guru/data-compliance

Please contact info@marketdata.guru for a pdf copy of the article, or to purchase the full report

For information on our consulting services please email knharris@datacompliancellc.com