BENCHMARKING MARKET DATA VENDOR MARKET CAPITALISATIONS

1.0 MARKET DATA VENDORS ARE ALL DIFFERENT BEASTS

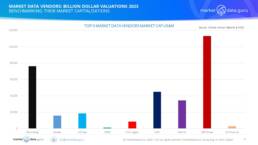

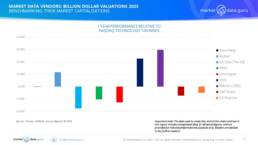

MDG has estimated the total market capitalisation of the top 9 market data vendors as US$315,482 Million on 31 March 2023, a decrease of

-13.3% from 01/04/2022. This compares to a drop of –9.6% for the S&P500 and -14.1 for the NASDAQ Technology 100 for the same period. The standouts are MSCI which increased 8.6%, Refinitiv 15.6% (calculation) thanks to the inclusion of FTSE Russell in LSEG’s ‘Data & Analytics’ division, and the decline of S&P Global -21.4% caused by impacts of the IHS Markit merger and associated divestments.

In context without the impact of S&P Global’s drop in market cap, the other eight market data vendors drop was -8% and the notional calculation for a Bloomberg market cap at $76,055 Million seriously undervalues the business, and importantly the brand, because it is extrapolated from smaller competitors with lower revenue growth. MDG estimates a buyer of Bloomberg must pay well over $100 Billion.

The nine vendors analysed in this report can be divided into two basic categories:

1.Primarily IP data. ICE Data (Evaluated Pricing, Indices, Analytics), MSCI (Indices, Analytics), and S&P Global (Indices, Credit Ratings, Analytics)

2.Hybrid IP and Data Aggregator. Bloomberg, Factset, IRESS, Morningstar, Refinitiv (LSEG’s ‘Data & Analytics) and SIX Financial

This is somewhat simplistic as these companies are evolving and none can truly be compared like for like, or even the same company year on year, like Refinitiv. Morningstar has a growing index and credit ratings business, but its core data services remain built around Fund Information. With the new Refinitiv the inclusion of the FTSE Russell index and analytics within the LSEG ‘Data & Analytics’ unit has changed the balance from the old Refinitiv, especially since the trading platforms have been carved out.

There is also an oft missed important element of convergence. By developing analytical services the vendors are increasingly processing data on behalf of clients as well. Bloomberg was first into this segment which will become an ever more vital future revenue generator.

All figures produced in this report are in US Dollars are based upon Bloomberg published FX rates on 31/03/2023

2.0 MARKET DATA VENDORS CAPITALISATION IN FIGURES

If we take a deeper look at the background figures we can see:

- Bloomberg and S&P Global together account for 50% of the total valuations, and as stated earlier this understates Bloomberg’s true potential value

- Bloomberg would have been neutral compared to the NASDAQ Technology 100, with Factset, MSCI, and Refinitiv (via LSEG) outperforming

On 01/04/2023 the 3 IP vendors, ICE Data, MSCI and S&P Global accounted for:

- 56% of the total market capitalisation

- Had an average notional market cap of $58,794 Million

- Had an average notional Price/Sales ratio of 10.7 with MSCI having the highest ratio of all vendors, 19.9

On 01/04/2023 the 6 hybrid vendors, Bloomberg, Factset, IRESS, Morningstar, Refinitiv and SIX Financial accounted for:

- 44% of the total market capitalisation

- Had an average notional market cap of $23,183 Million

- Had an average notional Price/Sales ratio of 6.1 with Factset (a company analysts are familiar with) having the highest Price/Sales ratio 8.6

This demonstrates investors’ preference for IP driven businesses with quasi-monopolistic brands. The low Price/Sales ratios of IRESS (3) and especially Morningstar (4.6%) indicate these businesses are undervalued relative to their peers.

3.0 MARKET DATA VENDORS FUTURE WORTH

The transition of market data vendors from aggregators to information integrators is driven by offering higher margin value added services, analytics, and increasingly data processing which in turn increases the value of their businesses to the stakeholders. Vendors that cross this Rubicon quicker will reap the rewards.

Subscription based services, backed by restrictive contracts, are key, combined with once the data and applications are incorporated into a consumer’s environment they become very hard to displace or remove unless the client is exceptionally determined.

It is obvious in the information space proprietary IP is rated highest and the trend is only increasing. Specific services become brands in their own right, for instance S&P500 as an index, or Bloomberg as a company become de facto capital market standards.

We believe the three metrics to measuring the future corporate worth of market data vendors, whether as independent entities or part of a larger organisation are:

1.Proprietary information and data, IPRs, S&P Global being the model

2.Analytics and data processing, especially when combined with proprietary data, in an integrated environment, Bloomberg is the model

3.Ability to expand the potential client universe beyond data saturated financial institutions to wealth managers, high net worth individuals and the retail market. Already in the US retail brokerage own clients are moving towards using third party decision tools

4.0 SUMMARY

The market data vendors are increasingly competing with their core data suppliers, the exchanges, each is moving into the others space, especially with Big Tech taking an interest. Yet the market data vendors do not command the premiums of the exchanges which highlights their potential, at least until the transition from data aggregators to information integrators becomes more readily apparent.

Keiren Harris 11 April 2023

www.marketdata.guru/data-compliance

Please contact info@marketdata.guru for a pdf copy of the article

For information on our consulting services please email knharris@marketdata.guru