1.0 US RETAIL INVESTOR DEMAND OVERVIEW

This article provides insights into the tools that facilitate trading by US retail clients, and as the leading domestic market it is a good proxy for retail investors globally as to what decision tools they use when making an investment decision. They have an influential impact on the total market.

- The Top 9 retail brokerages have a combined total of 105.4 Million accounts (Broadridge)

- In January 2023, US retail investors traded a record $1.51 Billion every day into stocks according to VandaTrack research. This excludes other assets like Bonds, Foreign Exchange, and increasingly Crypto

- The overall market share of retail investor trading in equities grew from 14% in 2012 to 23% in 2021

- Estimated 15% of US retail investors got their start in 2020, i.e. the internet generation

US retail investors like their international counterparts are cost allergic, their willingness to pay for tools limited, they want something for nothing. The cost benefit equation can be broken down into questions for market data providers, brokers and retail investors:

1.To what extent do the brokers, or third parties like financial portals, themselves offer tools?

2.Should the brokers provide their clients with third party tools on a chargeable or non-chargeable basis?

3.Which tools does the retail investor want?

4.For the retail investor, which third parties can provide tools their brokers cannot or do not want to provide?

5.What if any relationship is there between third party tools and the brokers?

6.How much does it cost?

1.1 US RETAIL INVESTOR DEMAND INSIGHTS

In 2021 NASDAQ Research conducted a survey to assess US retail investors requirements, ranging from are clients satisfied with what they have to what services and tools are in demand. MDG built upon the report’s findings to gain additional insights. What NASDAQ found was 67.3% of respondents want more news, charts and alerts.

Interestingly these are entry level services which brokers do offer suggesting either the users do not fully understand what they have access to, or the services are simply too basic. More detailed information that can be obtained from Pre & Post Trade Data, SEC Filings and third party data, do not appear to be priorities. Professional and the majority retail investors are different beasts when it comes to investment decision making and their application of tools. However there is a sizeable and sophisticated minority of retail investors who put time and effort in research and analysis before executing a trade, and their needs are not necessarily met at this time.

If brokerages and their information suppliers can identify what the demand is and who the users are then it opens the door to providing more bespoke services maximising the value to the investor, and revenue generation for the brokers and their vendors. Broadridge in their ‘Insight into the US Investor’ report provides context.

2.0 WHAT DO US RETAIL INVESTORS WANT?

The likelihood is the retail investor does not really know because they focus more on execution than due diligence, a theme the statistics support.

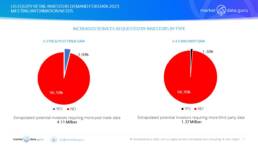

However the growth of third party tool providers is an indication investors are either unhappy with the additional services brokerage supply, or are looking for an independent source, perhaps both. For instance TradingView, a third party tool provider, has struck deals with brokers like Interactive Brokers and Saxo Bank to point trading towards them. The 2021 NASDAQ survey found 81.4% of respondents wanted to trade from a third party tool, see chart below, however this presents brokers with a dilemma, as it potentially removes one of the tethers tying brokers to clients. MDG’s research says depth and breadth of investment tools works well for full service brokers. Weakening the link is likely to make execution only brokers more competitive.

This narrative is partially supported by the same survey saying 51.5% of retail investors find their brokers insights and research insufficient.

At this point it appears most retail investors will remain loyal to their brokers yet are open to trading with their existing brokers via third party tools, while a number will shop around different brokers.

3.0 FOCUSED DIVERSITY

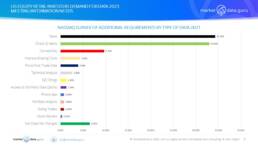

In their 2021 survey, NASDAQ survey found a diverse range of responses, yet there were two standout requirements accounting for 67.3% of demand, these were news and basic charts. The emphasis is placed on a higher demand for trading tools and execution capability over research and pre-trade insights. The rankings ties to the other findings of trends showing the increased retail importance in the US market with these headline points:

- Increasing market knowledge of the brokerage’s clients as traders

- Demand for real time news indicates that they are aware that news moves prices

- Visualisation means they will rely on the same sophisticated tools that institutional traders have had for many years

- Connectivity shows a demand for access to execution tools before the market moves

What the report did not cover was access to data. In the real world to make a timely investment, then real time streaming, or real time snapshot prices must be available, news must not be stale, and any trade must be executed without being caught up in systems that delay the process.

3.1 NEWS SERVICES

In the NASDAQ survey 34.3% of respondents stated they would like access to more news. The most popular choice for an enhanced requirement.

The retail brokers offering news incorporated into their research offerings with 4 distributing live stream TV, including Charles Schwab, E*Trade, Fidelity and IBKR. Access to television based news channels is relatively easily available on a subscription basis, and other providers include Bloomberg, CNBC, NASDAQ, and Stockcharts. Charles Schwab airs CNBC.

Partly driven by available income, but also generational, DIY broker clients rely on social media, like Reddit and You Tube as well as friends and family.

For the brokers its is cheaper to take a low cost press release news service then let their clients subscribe to a third party news service, watch television, or use social media, because the cost of providing a Dow Jones or Reuters at an entry level of US$100 per month is prohibitive. CNBC offers an extensive financial portal as well as delivering news service

3.2 ANALYTICS, CHARTS & ALERTS

In the NASDAQ survey 33% of respondents stated they would like access to more charting and related alerts. The second most popular choice for an enhanced requirement. In the Broadridge report only 7 brokers offer a stock alert service.

Third party analytics and chart providers offer a higher level of overall functionality than the brokers, notable exceptions being Charles Schwab, Firstrade, and IBKR (which has invested significantly in investment tools and analytics).

The arrival of companies like BarChart and Trading View are also changing the relationship between retail investors and their brokers, allowing them to trade off the charts themselves. Trading View has entered into agreements with multiple brokerages including IBKR and Saxo Bank. This is creating additional flow, not only within the US but globally and across multiple asset classes.

3.3 PRE & POST TRADE DATA

In the NASDAQ survey 3.9% of respondents stated they would like access to more pre-trade and post-trade data services.

The retail brokers offer this data as an inclusive service and the leading third provider of this data is Medved Trader whose clients include All Invest, Charles Schwab (via TD Ameritrade), E*Trade, Fidelity, IBKR, Robinhood Financial, Tradestation and Tradier.

Medved also allows clients to trade directly through to these brokers via their own applications. There are other providers of this data though these tend to be brokers offering additional services to create flow, for instance DRW.

3.4 THIRD PARTY DATA

In the NASDAQ survey 1.3% of respondents stated they would like access to a greater range of third party data including consensus earnings, reference data and SEC Filings.

It should be noted that brokers do make this data available, however, it is often white labelled or the retail investor is not aware of the attribution. Brokers do provide consensus earnings, fundamental data, and corporate actions as part of their research and valuations services. The differentiation between Brokers and the third party data providers is the latter offer additional services such as ‘Insider Transactions’, ‘Institutional Holdings’, ‘Director’s Dealings’, and ‘Events Diaries’. Aggregators can provide these services more cost effectively than brokers sourcing themselves.

SEC Filings fall into this category and 9 leading brokers offer this service. Edgar Online, a subsidiary of Donnelly Financial Solutions is the market leader in this space to both the institutional and retail brokers.

3.5 PORTFOLIO ANALYSIS

In the NASDAQ survey 0.8% of respondents stated they would like access to more portfolio analysis tools. This is probably a case of the retail investors already being supplied the basic tools by their brokers which are fulfilling existing requirements adequately by supplying portfolio valuations.

Understanding each retail client’s overall position is one of the basic requirements of a broker, although several do not offer portfolio allocation models including All Invest, eToro, TradeStation, Tradier, and WeBull.

However, there is an argument retail investors, especially clients of DIY brokers focus primarily upon trading individual instruments and do not construct portfolio strategies which would leverage analytical tools to maximise investment returns, even when portfolio allocation models are being offered. Additionally, there are a plethora of free portfolio services that are available for instance well known examples include Google Finance and Yahoo Finance. This makes it difficult for third parties to develop fee paying services to cater for the retail investor market.

3.6 DO-IT-YOURSELF (DIY) APPLICATIONS

The DIY API segment is a relatively new market segment that is for now mostly an American phenomenon. Utilising the API code, investors can create their own application to access the US market.

There are a number of features common to these providers, including:

- Tiered pricing structure from entry level end of day data to 15 minute delayed then a real time feed

- Access to annual historical data increases by tier level

- All tiers get access to reference data, fundamental data, and corporate actions. Charting APIs are a recent free of charge addition

- Delayed data subscribers get traded prices, while real time data subscribers also get quotes

- Coverage is all US Exchanges and certain OTC venues, with currencies and cryptos as an add on. Users cannot choose individual exchanges, it is all the exchanges or none of the exchanges

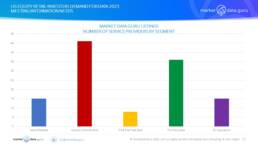

4.2 WHO ARE THE PROVIDERS?

MarketData.Guru lists 120 providers of services in 5 segments of companies based in North America catering to the US market, including

1.News & Releases

2.Analytics, Charts & Alerts

3.Pre & Post Trade Data

4.Third Party Services and

5.DIY Applications

Key Points

- This is not a complete listing as there are multiple press release businesses, analytics providers, third party data distributors and more DIY application developers coming online

- Many of these companies focus more on the professional market than the retail market, being margin driven

- Many companies provide services across multiple segments

- This listing excludes the plethora of financial information portals that exist

There are problems, for instance many of these market data vendors have yet to develop appropriate business and pricing models for the retail market because their existing structure was created for financial institutions willing and able to pay premiums.

4.0 FUTURE DEMAND

It is clear from recent research that retail investors are looking for additional services that influence when they are going to trade. This requirement means leading indicators, primarily,

1.News and commentary

2.Better charting with alerts

These are proactive data services the retail investor can trade off, and that is the key differentiator because other information like post trade and SEC filings are inherently passive. If brokerages rely on basic tools it will increase the trends towards:

1.Retail investors subscribing to third party analytics, charting, and alerts services like Barchart, Stockcharts, TradingView, and others which allow direct trading and connectivity from these providers to brokerages. This means the retail investor does not have to use the brokers own website or application. IBKR and Tradier have been actively adopting this strategy, other brokers are following, albeit reluctantly

2.The development of DIY APIs to create market data applications where the basic API has been developed by the provider who also gives access to real time market data, reference data, and direct trading connectivity, and the user can then individually customise the code.

At this point we argue neither will impact the majority of retail investor’s choice of brokerage, because it is driven by the actual trade execution facility. What it must do is make the brokerages think about what exactly should they be providing as market insights and analytical tools.

5.0 SUMMARY

Retail investors globally are underserved for their information needs. They are a growing force in the markets, increasingly sophisticated and willing to expand their horizon beyond stocks to more esoteric asset classes. This is creating a market which is highly cost sensitive, but at the same time far larger than the institutions at least numerically. It is a market many exchanges, traditional market data vendors, and facilitators are not properly engaging with.

This will open the doors to more entrepreneurial information providers willing to trade low margins for high volumes able to leverage lightweight cloud driven tech.

MarketData Guru believes this is a good time to embrace the retail investor.

Further Information:

Broadridge Insights on the US Investor 2021 https://www.broadridge.com/_assets/pdf/broadridge-insights-on-us-investor-data-study.pdf

NASDAQ Research 2021 US Equity Retail Investor Report https://www.nasdaq.com/articles/survey-on-the-2021-state-of-the-independent-retail-investor-2021-05-25

Market Data Guru Listings https://marketdata.guru/company-lists/

Keiren Harris 12 April 2023

www.marketdata.guru/data-compliance

Please contact info@marketdata.guru for a pdf copy of the article

For information on our consulting services please email knharris@marketdata.guru