3.5 Hub-Busting & The Many Market Data Yellow Brick Roads

‘The Cloud’ really does look like being truly transformational in application, if not necessarily in concept. While an over-used and inevitably misused word it unlocks the doors to new and smaller players while reducing the reliance upon legacy systems.

‘The Cloud’ is what the airlines call a hub-buster, as it promises to bypass hubs and introduce direct market to market connectivity. If we continue with the air transport industry analogies the Hub-to Hub’s are dominated by the Very Large Aircraft types such as A380 and 747 while the secondary, and growing markets are built upon their smaller, yet more flexible, brothers the A350 and 787.

This direct market to market connectivity is built upon developing multiple ‘Market Data Yellow Brick Roads’ impacting choice and cost through introducing new-found flexibilities in access to, and operation of, market data and the provision of information.

Tailored solutions now become more accessible through a menu based à la carte selection of services as an alternative to existing buffet style aggregated solutions.

The immediate business impact is that this now dramatically levels the playing field for both financial institutions as well as market data vendors.

How? Previously, smaller financial institutions have lacked the resources to fund access to expensive market data services and associated infrastructure. Going forward, these smaller players can select from a ‘restaurant or supermarket menu’ while avoiding expensive investment in dedicated infrastructure.

These create relational changes on one side will put more dollar power in the hands of sources and providers of specialist, and proprietary data, and on the other, gives greater leverage to the consumers.

The vendors are undoubtedly surviving, and some will thrive, but it is hard to compete profitably in certain market segments when there are numerous avenues to get say the price of Ford Motors or the latest US$/GB£ rate.

This places greater emphasis on the dollar value of proprietary and unique data which can be licensed at a premium, such as the MSCI Index, an evaluated Bond Price, or hard to get illiquid instruments from a trusted source.

Inevitably this raises the worth of the market data inventory owned by unique sources, such as an Exchange, an Index Creator, Markit’s Red Codes, IDC’s evaluated price service.

As an electronic data point, multiple vendors can offer the same item, which increases the competition to deliver market data. The marginal pressure to compete lies with the aggregators whose previous reliance upon expensive proprietary infrastructure to deliver, thereby locking clients in, is now breaking down, thanks to new technology.

Previously exchanges and other sources lacked the global reach of a Bloomberg and Thomson Reuters who maintain offices from Tokyo to Timbuktu. These exchanges have had to rely on their vendors to deliver their prices creating a symbiotic relationship which is about to be weakened.

Crystal Balls.

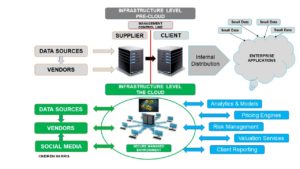

New technology and infrastructure is changing the inter-relational dynamics between suppliers, vendors, and consumers.

Gradually at first it is increasingly blurring the lines because one way flows become two way flows, then in turn evolve into multi-directional flows as the inter-connectivity develops in complexity.

Big Data will prove to be an increasingly important component of this ‘Cloud Web’ as the analytical tools and models which makes Big Data valuable can be utilised more efficiently and more effectively within a ‘The Cloud’ environment.

The graphic below looks at these changes from a high level, the reality there will be potentially an infinite number of Cloud Environments acting like a very sophisticated 3D Venn diagram.

- The Market Data Pie will get bigger, there will be more ‘yellow brick roads’, but there will be more players.

- The question becomes how far margins will be driven down, and where in this revenue pressure occurs. As can be seen in other industries nimbler entrants with a better cost base pressurises incumbents, just look at Ryanair in the airline industry.

- Technological disintermediation will result in changes to market data business relationships, with more direct source to consumer connectivity, i.e. ‘Hub-Busting’.

- Existing market data vendors are going to be squeezed from above and below.

- From above by the new entrants such as Google, Amazon, and Microsoft. They crave content for their financial services business, and will go around vendors direct to sources. They also bring far more resources and reach than even the biggest market data vendors.

- From below as sources leverage ‘The Cloud’ in turn to go direct to their end users.

- New technology is lowering barriers to delivery, in both cost and infrastructure terms.

- Market data Cloud nirvana is probably not achievable, so new technologies will co-exist with legacy infrastructure for some time, especially in large institutions, even if the relationship can only be described as uncomfortable.

To download the full Section 3 Report, please click here.